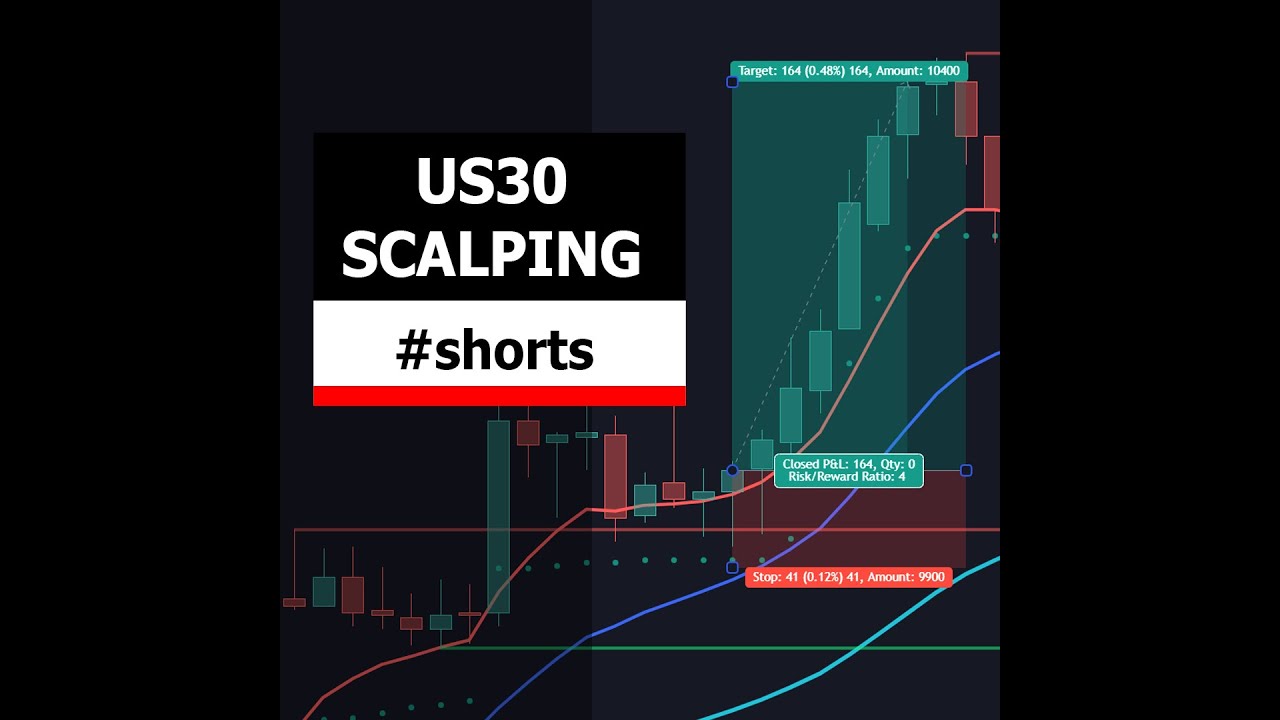

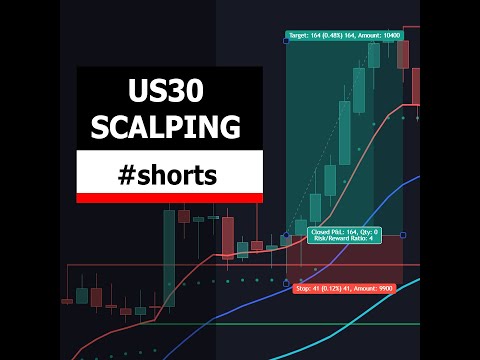

Stochastics RSI & EMA Forex Scalping Strategy #shorts

Trending videos highly rated Trading Forex Online, Forex Strategy, and Hidden Divergence Stochastic, Stochastics RSI & EMA Forex Scalping Strategy #shorts.

In this #shorts video I show a scalping #forex and stocks (indices) strategy on the 5 min chart (onr US 30). The inidcators I use is my 4-EMA trend (for EMA and ATR volatility stoploss), then the Stochastics & RSi indicator and the Higher High Lower Low strategy indicator.

You can find my TradingView indicators on this page:

https://www.tradingview.com/u/trading-guide/#published-scripts

Production Music courtesy of Epidemic Sound: http://www.epidemicsound.com

—

The information in this video is no financial advice.

Trading in the financial markets is risky and you

should not risk capital that you can’t afford to lose.

I do not guarantee any success of shown methods and

I do not accept any liabilities in this regard or for any

loss or damage arising from or in connection with

any of the information in this video.

Hidden Divergence Stochastic, Stochastics RSI & EMA Forex Scalping Strategy #shorts.

Currency Trading System – An Ageless Easy Method To Make Substantial Gains

These are the long term investments that you do not hurry into. The upper and lower limitation needs to be clear in the trade. Trading is constantly short term while investing is long term.

Stochastics RSI & EMA Forex Scalping Strategy #shorts, Enjoy top updated videos related to Hidden Divergence Stochastic.

3 Things You Need To Learn About Range Trading

The very first point is the technique to be followed while the second pint is the trading time. Flatter the assistance and resistance, stronger will be your conviction that the variety is genuine.

The Stochastic Oscillator is an overbought/oversold indicator established by Dr. George Lane. The stochastic is a common indication that is integrated into every charting software application including MetaStock.

Price surges always take place and they constantly fall back and the goal of the swing trader is – to sell the spike and make a quick earnings. Now we will look at a basic currency swing Stochastic Trading technique you can use today and if you use it properly, it can make you triple digit gains.

His main methodologies involve the Commitment of Traders Index, which reads like a stochastic and the 2nd is Major & Minor Signals, which are based on a fixed dive or decline in the abovementioned index. His work and research are very first class and parallel his character as an individual. However, for any methodology to work, it needs to be something the trader is comfy with.

While the guidelines offer you reasons to get in trades, it does not indicate that the cost will enter your desired direction. The idea is “Do not forecast the market”. Rather, you need to let the cost motion lead your method, knowing at anytime price might go and alter in a different direction. If the price does not move in your favor, you need to Stochastic Trading give up and stop out.

Technical analysts attempt to identify a pattern, and ride that pattern till the pattern has confirmed a reversal. If a good company’s stock is in a drop according to its chart, a trader or investor using Technical Analysis will not Stochastic Trading purchase the stock until its trend has actually reversed and it has actually been validated according to other crucial technical signs.

Technical Analysis is based on the Dow Theory. Dow theory in nutshell states that you can use the past cost action to forecast the future cost action. These costs are supposed to integrate all the publicly readily available info about that market.

If the rate goes to a greater pivot level (which can be support or resistance) and the stochastic is high or low for a big time, then a reversal will occur. Then a new trade can be gotten in accordingly. Therefore, in this forex trading method, w wait till the market fill to high or low and after that sell or buy depending upon the situation.

The more flat these 2 levels are, possibilities of a rewarding range trading will be higher. Path your stop up gradually and beyond normal volatility, so you do not get bumped out of the trend to quickly.

If you are finding unique and entertaining reviews relevant with Hidden Divergence Stochastic, and Forex Trading Course, Currency Trading Education you are requested to subscribe for subscribers database for free.