Reliance analysis18 August 2023|#reliance #nifty #banknifty #nifty50 #shorts #viral

Interesting high defination online streaming top searched Forex Trend Following, Forex Effectively, Swing Trading Software, Forex Online, and What Is Stochastic Divergence, Reliance analysis18 August 2023|#reliance #nifty #banknifty #nifty50 #shorts #viral.

Instagram =https://instagram.com/candle_traders?igshid=MzNlNGNkZWQ4Mg==

Top trading strategies for beginners.

How to analyze stock charts for trading success.

Best technical indicators for day trading.

Mastering options trading: A comprehensive guide.

Live trading session: Profits and losses.

Understanding candlestick patterns for profitable trading.

Trading psychology: Controlling emotions for consistent gains.

Swing trading strategies for volatile markets.

Candle trading.

Introduction to Nifty and Bank Nifty trading strategies.

Understanding technical analysis for Nifty and Bank Nifty.

How to trade Nifty and Bank Nifty options.

Strategies for day trading Nifty and Bank Nifty.

Nifty and Bank Nifty futures trading explained.

How to read Nifty and Bank Nifty charts for trading.

100 % accuracy

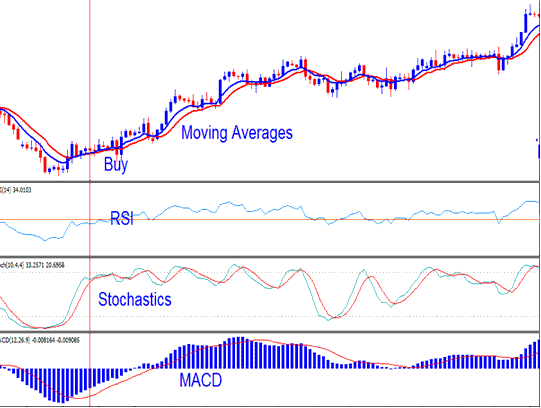

Trading Nifty and Bank Nifty using moving averages.

Candlestick patterns for Nifty and Bank Nifty trading.

Fibonacci retracement in Nifty and Bank Nifty trading.

Bollinger Bands strategy for Nifty and Bank Nifty.

MACD indicator for Nifty and Bank Nifty trading.

RSI indicator strategy for Nifty and Bank Nifty.

Volume analysis in Nifty and Bank Nifty trading.

Support and resistance levels in Nifty and Bank Nifty.

Breakout trading strategies for Nifty and Bank Nifty.

Intraday trading techniques for Nifty and Bank Nifty.

Swing trading strategies for Nifty and Bank Nifty.

Options strategies for Nifty and Bank Nifty.

Hedging techniques in Nifty and Bank Nifty trading.

Risk management in Nifty and Bank Nifty trading.

Position sizing for Nifty and Bank Nifty trades.

Stop-loss and target placement in Nifty and Bank Nifty trading.

Gap trading in Nifty and Bank Nifty.

Seasonal patterns in Nifty and Bank Nifty.

Option chain analysis for Nifty and Bank Nifty.

Trading psychology for Nifty and Bank Nifty.

Algorithmic trading in Nifty and Bank Nifty.

Backtesting strategies for Nifty and Bank Nifty.

Trading Nifty and Bank Nifty with moving average crossovers.

Breakout trading strategies for Bank Nifty.

Intraday scalping strategies for Nifty and Bank Nifty.

Options selling strategies for Nifty and Bank Nifty.

Hedging with options in Nifty and Bank Nifty.

High-frequency trading in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with price action.

Trading ranges in Nifty and Bank Nifty.

Trading with market profile in Nifty and Bank Nifty.

Market breadth analysis for Nifty and Bank Nifty.

Swing trading strategies for Bank Nifty.

Intraday momentum trading in Nifty and Bank Nifty.

Option buying strategies for Nifty and Bank Nifty.

Trend reversal patterns in Nifty and Bank Nifty.

Trading divergence in Nifty and Bank Nifty.

Option Greeks and their impact on Nifty and Bank Nifty trades.

Price and volume analysis in Nifty and Bank Nifty.

Swing trading with Fibonacci retracement in Nifty and Bank Nifty.

Breakout pullback trading strategy for Bank Nifty.

Intraday trading with VWAP in Nifty and Bank Nifty.

Options straddle and strangle strategies for Nifty and Bank Nifty.

Delta hedging in Nifty and Bank Nifty options.

Market-making strategies in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with Ichimoku Cloud.

Intraday volume profile analysis for Nifty and Bank Nifty.

Order flow analysis in Nifty and Bank Nifty trading.

Option writing strategies for Nifty and Bank Nifty.

Swing trading with RSI divergence in Nifty and Bank Nifty.

Day trading using VWAP deviation in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with Heikin Ashi charts.

Intraday breakout trading strategy for Bank Nifty.

Options hedging strategies for Nifty and Bank Nifty.

Range breakout trading in Nifty and Bank Nifty.

Volume-weighted average price (VWAP) trading in Nifty and Bank Nifty.

Delta-neutral strategies for Nifty and Bank Nifty options.

Arbitrage opportunities in Nifty and Bank Nifty.

Nifty and Bank Nifty trading using the ATR indicator.

Intraday pullback trading in Nifty and Bank Nifty.

Scalping with pivot points in Nifty and Bank Nifty.

Trading with the Parabolic SAR indicator in Nifty and Bank Nifty.

Moving average convergence divergence (MACD) trading in Nifty and Bank Nifty.

Intraday range trading in Nifty and Bank Nifty.

Options iron condor strategy for Nifty and Bank Nifty.

Volume-based trading strategies for Nifty and Bank Nifty.

Swing trading with the Average True Range (ATR) in Nifty and Bank Nifty.

Intraday mean reversion trading in Nifty and Bank Nifty.

Breakout pullback continuation trading strategy in Nifty and Bank Nifty.

Trading with the Relative Strength Index (RSI) in Nifty and Bank Nifty.

Intraday gap trading strategy for Nifty and Bank Nifty.

Swing trading with the Moving Average Convergence Divergence (MACD) in Nifty and Bank Nifty.

Scalping with the Stochastic Oscillator in Nifty and Bank Nifty

Options calendar spread strategy for Nifty and Bank Nifty

Breakout pullback trend reversal trading strategy in Nifty and Bank Nifty

Intraday momentum breakout trading strategy for Nifty and Bank Nifty

What Is Stochastic Divergence, Reliance analysis18 August 2023|#reliance #nifty #banknifty #nifty50 #shorts #viral.

Range Trading Winning Strategies

Two moving average indicators should be made use of one quick and another slow. They are the nearest you can get to trading in real time with all the pressure of possible losses. Absolutely nothing could be further from the fact!

Reliance analysis18 August 2023|#reliance #nifty #banknifty #nifty50 #shorts #viral, Get top updated videos about What Is Stochastic Divergence.

Online Forex Trading – A Basic Effective Technique Making Huge Profits

One reason this takes place is that the marketplace makers and professional often take the opposite side of your trade. The support level is a level the price can not go listed below it for a large duration.

The Stochastic Oscillator is an overbought/oversold indication established by Dr. George Lane. The stochastic is a common indicator that is integrated into every charting software application including MetaStock.

If you buy and sell these breaks, you can participate and stick with every major trend. Breakout Stochastic Trading is a basic, tested way to earn money – however most traders can’t do it and the reason is simple.

His primary approaches include the Dedication of Traders Index, which reads like a stochastic and the second is Major & Minor Signals, which are based upon a static jump or decrease in the previously mentioned index. His work and research study are very first class and parallel his character as an individual. Nevertheless, for any approach to work, it needs to be something the trader is comfy with.

No issue you state. Next time when you see the earnings, you are going to click out which is what you do. You were in a long position, a red candle light appears and you click out. Whoops. The marketplace continues in your instructions. You stand there with 15 pips and now the marketplace is up 60. Annoyed, you decide you are going to either let the trade play out to your Stochastic Trading revenue target or let your stop get set off. You do your homework. You enter the trade. Boom. Stopped out. Bruised, damaged and deflated.

MACD Crossover. After you have investigated a stocks chart to see if the stock is trending, you ought to now have a look at its MACD graph. MACD-stands for Moving Average Convergence-Divergence. This graph has 2 lines, the crossing of the two lines is a signal of a new pattern. The 2 lines include a quick line and a sluggish line. Where the crossover happens informs you if there is Stochastic Trading a pattern. The fast line needs to cross above the slow line, or above the 0 line. The higher it ascends above the 0 line the stronger the uptrend. The lower it comes down listed below the 0 line the more powerful the drop. A trader or investor wishes to catch stocks that are trending huge time, that is how it is possible to make good money!

If you wish to earn money forget “buying low and offering high” – you will miss all the huge relocations. Instead aim to “buy high and sell greater” and for this you need to comprehend breakouts. Breakouts are simply breaks of crucial support or resistance levels on a forex chart. Most traders can’t buy these breaks.

The above technique is very simple but all the best systems and strategies are. If you swing trade extremes, you will get a couple of great signals a week and this will suffice, to make you big gains in around 30 minutes a day. There is no much better technique than currency swing trading if you desire a fantastic way to make big revenues.

A trader might focus on other charts however this will be the main location of concern. Nevertheless, the majority of the time the market isn’t trending. It is a clear indication that the BP currency is over purchased.

If you are finding updated and entertaining reviews relevant with What Is Stochastic Divergence, and Trend Detection in Forex Trading, Forex Ambush Review dont forget to list your email address our email list now.