👌 This Pocket Option Strategy Is PERFECT FOR BEGINNERS | About Stochastic Indicator

Popular full videos top searched How to Trade Support and Resistance, Forex Trading Course, Stock Signals, and Using Stochastics For Day Trading, 👌 This Pocket Option Strategy Is PERFECT FOR BEGINNERS | About Stochastic Indicator.

✅ FREE SIGNALS in my Telegram: https://tg.binary-school.com/bs_yt_tg?vid=xYIs4F_65a0

✅ Platform: https://po.binary-school.com/bs_yt_po?vid=xYIs4F_65a0

✅ Instagram: https://instagram.com/mia_tradingschool

Hey guys! Welcome to the Trading School channel. I’m Mia, and today I’ve got something cool to share with you. So, some of you have been following my videos for a while but haven’t taken the plunge into trading yet. I get messages from you saying you’re interested in trying out Pocket Option trading but are worried about wasting time. Totally get it! I was once in your shoes, hesitant to start trading. But hey, it’s normal to feel that way. With a reliable Pocket Option strategy, you can minimize the risks. And the Pocket Option trading strategy I’ll be showing you today is top-notch. The Stochastic Oscillator is a popular trading indicator used to analyze momentum in the market. It helps traders identify potential trend reversals by comparing the closing price of an asset to its price range over a specified period.

Check out my earlier videos:

Hey students, just a quick reminder about my Telegram channel. I share Pocket Option signals there every day, and it’s totally free for you to join!

You can check out reviews of my work here: https://t.me/BINARYSCHOOLREWIEWS

Disclaimer: Keep in mind that in binary options trading the result is never guaranteed. Only you are responsible for your actions. The Pocket Option platform is not responsible for your results. Make sure that the Pocket Option is legal in your country before you start trading.

⏳ Timestamps:

00:00 – Welcome Back to Trading School

00:10 – Introduction

00:32 – Free Daily Pocket Option Signals

01:44 – Setting Up Pocket Option Trading Strategy

03:13 – Round One of Live Trading

04:26 – Round Two of Pocket Option Live Trading

06:14 – Round Three of Pocket Option Trading

07:33 – Round Four of Pocket Option Live Trading

08:55 – Pocket Option Withdrawal

09:36 – Conclusion

stochastic

stochastic indicator

stochastic oscillator

stochastic trading strategy

stochastic strategy

stochastic indicator strategy

stochastic rsi

stochastic oscillator trading strategy

stochastic indicator explained

how to use stochastic indicator

#stochastics #stochastic #stochasticoscillator #pocketoptiontrading #binaryoptionsstrategy #pocketoptioncopytrading #binaryoptions #pocketoption #pocketoptionsocialtrading #pocketoptionsignals

Using Stochastics For Day Trading, 👌 This Pocket Option Strategy Is PERFECT FOR BEGINNERS | About Stochastic Indicator.

Live Trading – Volatility Provides Huge Chance In Yen And Euro

This is to predict the future trend of the cost. The wider the bands are apart the higher the volatility of the currency studied. When they do concentrate on the long term and do not nab early.

👌 This Pocket Option Strategy Is PERFECT FOR BEGINNERS | About Stochastic Indicator, Play more updated videos related to Using Stochastics For Day Trading.

5 Pointers For Easy Forex Trading In A Changing Market

They do this by getting the right answers to these million dollar concerns. We do not have time to describe them here however there all easy to discover and apply. It is likewise essential that the trade is as detailed as possible.

Here we are going to look at currency trading basics from the perspective of getting a currency trading system for earnings. The one confined is simple to comprehend and will allow you to seek huge gains.

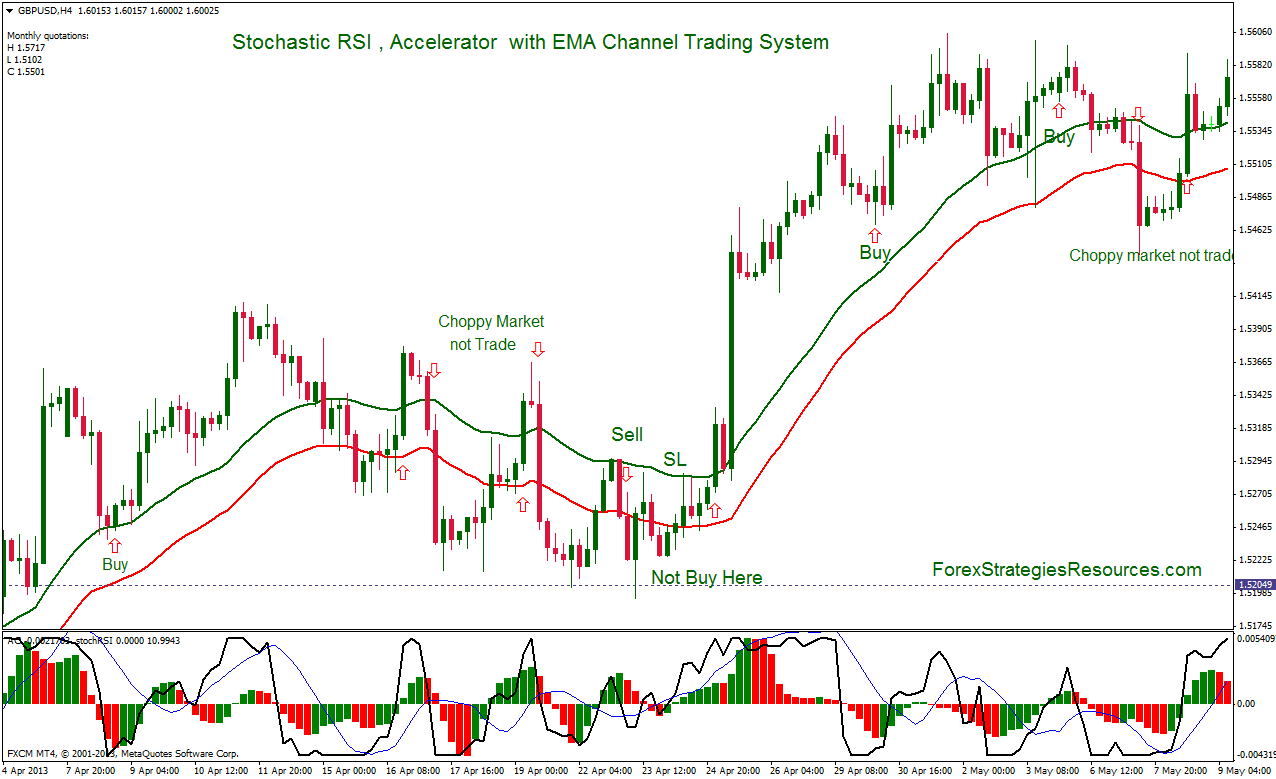

You can get in on and stay with every major pattern if you purchase and sell these breaks. Breakout Stochastic Trading is a simple, tested method to make cash – but most traders can’t do it and the factor is simple.

Them major issue for many traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop point of view.

Identify when to leave: you must likewise specify the exit point in you forex Stochastic Trading system. You can monitor if the cost goes above the breakout point if you use breakout on your system and entered a trade. , if it does it will turn into profits.. If it goes below don’t exit below the breakout level at the very same time. You can wait on one day and exit if it reaches after one day presuming you are working with weekly chart.

Lots of traders make the mistake of thinking they can use the swing trade method daily, however this is not an excellent idea and you can lose equity rapidly. When the market is just right for swing trading, instead reserve forex swing trading for days. So, how do you understand when the marketplace is right? When the chart is high or low, enjoy for resistance or support that has actually been held a number of times like. Look and watch the momentum for when rates swing highly towards either the assistance or the resistance, while this is happening watch for confirmation that the momentum will turn. This confirmation is critical and if the momentum of the rate is starting to subside and a turn is likely, then the chances remain in great favor of a swing Stochastic Trading environment.

Keep your stop well back till the pattern is in movement. Path your stop up gradually and beyond normal volatility, so you do not get bumped out of the pattern to soon.

Energy markets are unpredictable and can make any trader look dumb however they use some great profit opportunities at present which traders can benefit from.

Likewise trade on the duration where major markets are open. Evaluating is a procedure and it is suggested to check various tools during the years. In an up trend, connect two lower highs with a line.

If you are searching rare and exciting reviews related to Using Stochastics For Day Trading, and Stock Prices, Thinslice Trading please signup for email list now.