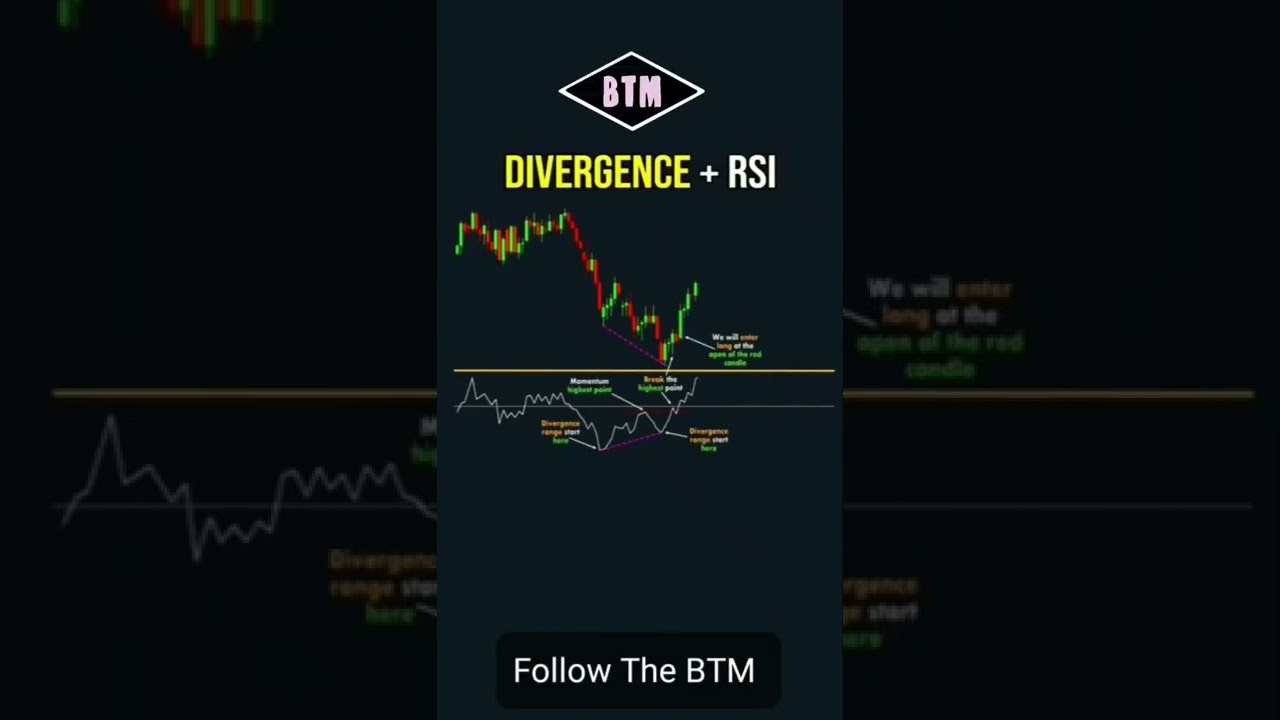

RSI Indicator Explaining The Bullish And Bearish Hidden Divergence

Top clips related to Forex Online Trading, Learn Currency Trading Online, Large Cap Stocks, Best Forex Trading, and Hidden Divergence Stochastic, RSI Indicator Explaining The Bullish And Bearish Hidden Divergence.

Hidden Divergence Stochastic, RSI Indicator Explaining The Bullish And Bearish Hidden Divergence.

The Benefits Of Using Technical Analysis In Forex Trading

In some cases, either one or both the assistance and resistance are slanting. I will cover the short term trading first up. Dow theory in nutshell states that you can utilize the previous price action to anticipate the future cost action.

RSI Indicator Explaining The Bullish And Bearish Hidden Divergence, Enjoy top updated videos relevant with Hidden Divergence Stochastic.

British Pound – Shorting Chance Bears Poised To Take Currency Lower?

Those lines might have crossed 3 or 4 times before only to revert back. Here we are going to take a look at two trading chances last week we banked a terrific profit in the British Pound.

Here we are going to look at how to use forex charts with a live example in the markets and how you can utilize them to discover high chances likelihood trades and the chance we are going to take a look at is in dollar yen.

Trade the chances and this implies rate momentum should support your view and confirm the trade before you enter. 2 terrific momentum indications are – the Stochastic Trading and the Relative Strength Index – look them up and use them.

The 2nd sign is the pivot point analysis. This analysis technique depends upon identifying numerous levels on the graph. There are 3 levels that function as resistance levels and other three that function as support levels. The resistance level is a level the rate can not exceed it for a big duration. The assistance level is a level the cost can not go below it for a large duration.

Keep in mind, you will never cost the precise top because no one knows the marketplace for particular. You should keep your winning trades longer. Nevertheless, if your technical signs break you, and the patterns start to stop working, that’s when you should offer your stock and take Stochastic Trading earnings.

Throughout my career in the forex industry, mentor thousands of traders how to profit, I’ve always suggested to start with a trend following technique to Stochastic Trading currencies. I do the same thing with my current customers. Naturally, I’m going to share a pattern following method with you.

When a price is rising highly. momentum will be rising. What you need to search for is a divergence of momentum from rate i.e. prices continue to increase while momentum is declining. This is referred to as divergence and trading it, is one of the best currency trading strategies of all, as it’s cautioning you the trend is about to reverse and prices will fall.

Is it truly that simple? We think so. We were right recently on all our trades, (and we did even better in energies take a look at our reports) obviously we could have been incorrect, but our entries were timed well and had close stops for danger control.

There are lots of effective day traders out there who had an actually difficult time simply graduating high school. That is why securing earnings is so so important. Breaking the trend indicates you are risking your cash needlessly.

If you are finding instant exciting comparisons related to Hidden Divergence Stochastic, and Forex Trading Advice, Forex Day Trading, Trend Line please list your email address in email subscription DB totally free.