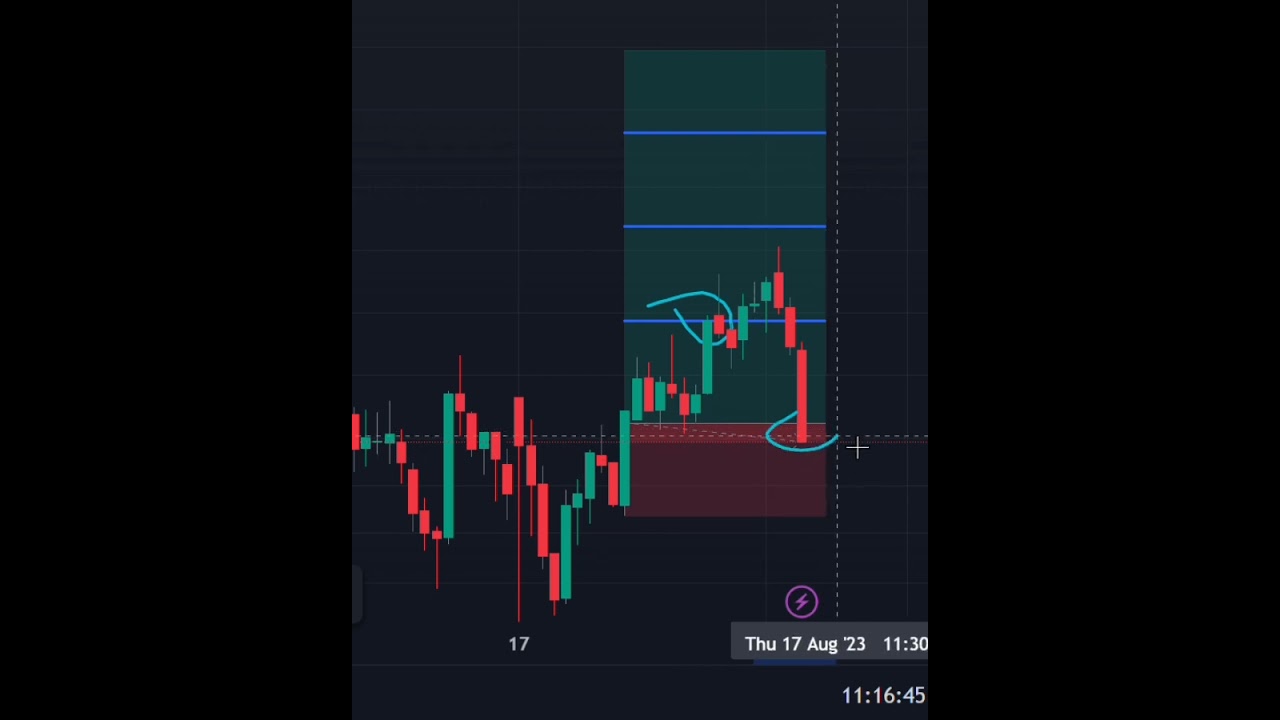

Banknifty analysis 17 August 2023 |#reliance #nifty #banknifty #nifty50 #shorts #viral

Latest YouTube videos top searched Swing Traders, How to Trade Support and Resistance, and What Is Stochastic Divergence, Banknifty analysis 17 August 2023 |#reliance #nifty #banknifty #nifty50 #shorts #viral.

Instagram =https://instagram.com/candle_traders?igshid=MzNlNGNkZWQ4Mg==

Top trading strategies for beginners.

How to analyze stock charts for trading success.

Best technical indicators for day trading.

Mastering options trading: A comprehensive guide.

Live trading session: Profits and losses.

Understanding candlestick patterns for profitable trading.

Trading psychology: Controlling emotions for consistent gains.

Swing trading strategies for volatile markets.

Candle trading.

Introduction to Nifty and Bank Nifty trading strategies.

Understanding technical analysis for Nifty and Bank Nifty.

How to trade Nifty and Bank Nifty options.

Strategies for day trading Nifty and Bank Nifty.

Nifty and Bank Nifty futures trading explained.

How to read Nifty and Bank Nifty charts for trading.

100 % accuracy

Trading Nifty and Bank Nifty using moving averages.

Candlestick patterns for Nifty and Bank Nifty trading.

Fibonacci retracement in Nifty and Bank Nifty trading.

Bollinger Bands strategy for Nifty and Bank Nifty.

MACD indicator for Nifty and Bank Nifty trading.

RSI indicator strategy for Nifty and Bank Nifty.

Volume analysis in Nifty and Bank Nifty trading.

Support and resistance levels in Nifty and Bank Nifty.

Breakout trading strategies for Nifty and Bank Nifty.

Intraday trading techniques for Nifty and Bank Nifty.

Swing trading strategies for Nifty and Bank Nifty.

Options strategies for Nifty and Bank Nifty.

Hedging techniques in Nifty and Bank Nifty trading.

Risk management in Nifty and Bank Nifty trading.

Position sizing for Nifty and Bank Nifty trades.

Stop-loss and target placement in Nifty and Bank Nifty trading.

Gap trading in Nifty and Bank Nifty.

Seasonal patterns in Nifty and Bank Nifty.

Option chain analysis for Nifty and Bank Nifty.

Trading psychology for Nifty and Bank Nifty.

Algorithmic trading in Nifty and Bank Nifty.

Backtesting strategies for Nifty and Bank Nifty.

Trading Nifty and Bank Nifty with moving average crossovers.

Breakout trading strategies for Bank Nifty.

Intraday scalping strategies for Nifty and Bank Nifty.

Options selling strategies for Nifty and Bank Nifty.

Hedging with options in Nifty and Bank Nifty.

High-frequency trading in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with price action.

Trading ranges in Nifty and Bank Nifty.

Trading with market profile in Nifty and Bank Nifty.

Market breadth analysis for Nifty and Bank Nifty.

Swing trading strategies for Bank Nifty.

Intraday momentum trading in Nifty and Bank Nifty.

Option buying strategies for Nifty and Bank Nifty.

Trend reversal patterns in Nifty and Bank Nifty.

Trading divergence in Nifty and Bank Nifty.

Option Greeks and their impact on Nifty and Bank Nifty trades.

Price and volume analysis in Nifty and Bank Nifty.

Swing trading with Fibonacci retracement in Nifty and Bank Nifty.

Breakout pullback trading strategy for Bank Nifty.

Intraday trading with VWAP in Nifty and Bank Nifty.

Options straddle and strangle strategies for Nifty and Bank Nifty.

Delta hedging in Nifty and Bank Nifty options.

Market-making strategies in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with Ichimoku Cloud.

Intraday volume profile analysis for Nifty and Bank Nifty.

Order flow analysis in Nifty and Bank Nifty trading.

Option writing strategies for Nifty and Bank Nifty.

Swing trading with RSI divergence in Nifty and Bank Nifty.

Day trading using VWAP deviation in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with Heikin Ashi charts.

Intraday breakout trading strategy for Bank Nifty.

Options hedging strategies for Nifty and Bank Nifty.

Range breakout trading in Nifty and Bank Nifty.

Volume-weighted average price (VWAP) trading in Nifty and Bank Nifty.

Delta-neutral strategies for Nifty and Bank Nifty options.

Arbitrage opportunities in Nifty and Bank Nifty.

Nifty and Bank Nifty trading using the ATR indicator.

Intraday pullback trading in Nifty and Bank Nifty.

Scalping with pivot points in Nifty and Bank Nifty.

Trading with the Parabolic SAR indicator in Nifty and Bank Nifty.

Moving average convergence divergence (MACD) trading in Nifty and Bank Nifty.

Intraday range trading in Nifty and Bank Nifty.

Options iron condor strategy for Nifty and Bank Nifty.

Volume-based trading strategies for Nifty and Bank Nifty.

Swing trading with the Average True Range (ATR) in Nifty and Bank Nifty.

Intraday mean reversion trading in Nifty and Bank Nifty.

Breakout pullback continuation trading strategy in Nifty and Bank Nifty.

Trading with the Relative Strength Index (RSI) in Nifty and Bank Nifty.

Intraday gap trading strategy for Nifty and Bank Nifty.

Swing trading with the Moving Average Convergence Divergence (MACD) in Nifty and Bank Nifty.

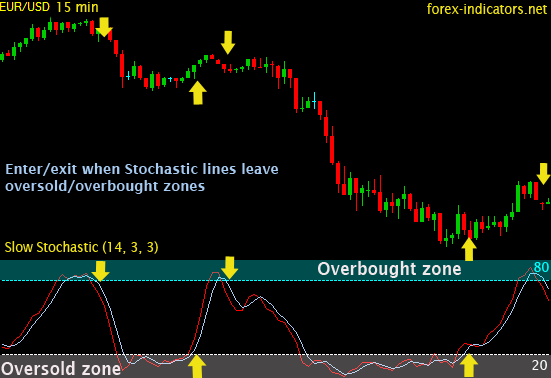

Scalping with the Stochastic Oscillator in Nifty and Bank Nifty

Options calendar spread strategy for Nifty and Bank Nifty

Breakout pullback trend reversal trading strategy in Nifty and Bank Nifty

Intraday momentum breakout trading strategy for Nifty and Bank Nifty

What Is Stochastic Divergence, Banknifty analysis 17 August 2023 |#reliance #nifty #banknifty #nifty50 #shorts #viral.

Complimentary Forex Trading Strategy

What is does is connect a series of points together forming a line. They are put side by side (tiled vertically). Using the SMA line in the middle of the Bollinger Bands offers us an even much better photo.

Banknifty analysis 17 August 2023 |#reliance #nifty #banknifty #nifty50 #shorts #viral, Watch new videos about What Is Stochastic Divergence.

Cycles Can Leapfrog Your Trading Success

It reveals you the crossovers of bearish and bullish divergence of oversold and overbought levels. The beauty of cycle analysis is that we can often pinpoint possible tops and bottoms well ahead of time.

Although forex trading isn’t a complicated process procedurally, there are things you need to learn about the marketplace to avoid making financially agonizing mistakes. Never get in the forex trading market until you are armed with understanding of the marketplace, how it acts and why the pros trade the method they do. This preparation might suggest the difference between excellent revenue and excellent loss.

Trade the chances and this indicates cost momentum need to support your view and verify the trade before you enter. Two fantastic momentum indications are – the Stochastic Trading and the Relative Strength Index – look them up and use them.

The reality is you don’t have actually to be daunted with the concept of day trading. The beauty of day trading is that you do not need to have a Masters degree in Organization from Harvard to earn money doing this. Effective day traders consist of a lot of “Typical Joes” like you and me. There are lots of effective day traders out there who had a truly bumpy ride simply finishing high school.

Resistance is the location of the chart where the cost stops increasing. No brand-new highs have been met in the last few Stochastic Trading sessions and the rate remains in a sideways direction.

If the assistance Stochastic Trading and resistance lines are assembling, a breakout is likely. In this case you can not assume that the cost will always turn. You might choose to set orders outside the series of the assembling lines to capture a breakout when it takes place. However again, examine your conclusions against a minimum of one other sign.

How do you draw trendlines? In an up trend, connect 2 lower highs with a line. That’s it! And in a downtrend, link two higher lows with a straight line. Now, the slope of a trendline can tell you a lot about the strength of a pattern. For example, a steep trendline reveals severe bullish mindset of the buyers.

This is a simple Forex trading method which is sensible, east to find out and is an ageless way to make money. You can easily find out a swing trading method in a week or to and then, your all set to achieve trading success in less than an hour a day and earn yourself some excellent Forex earnings.

I use the moving averages to define exit points in the list below method. In summary – they are leading indications, to evaluate the strength and momentum of price. It is among the simplest tools utilized in TA.

If you are looking instant exciting comparisons relevant with What Is Stochastic Divergence, and Learn Forex Trading, Forex Traading System please signup in email alerts service for free.