NZD/USD Price Analysis: Surrenders early gains, forms negative RSI divergence on 1H chart

Latest vids highly rated Swing Trading Ranges, Forex Traading System, Trading Rules, and Divergence In Stochastic, NZD/USD Price Analysis: Surrenders early gains, forms negative RSI divergence on 1H chart.

NZD #USD Price Analysis Surrenders early gains, forms negative RSI divergence on 1H chart

http://ntvforex.com/news/?id=338546. . 6 minutes ago . By Omkar Godbole #NZD #USD hourly chart shows a bearish divergence of key indicators. A violation of support at 0.6715 could invite stronger selling pressure. #NZD #USD is trading near 0.6732 at press time, representing a 0.11% decline on the day. The pair reached a high of 0.6752 during the early Asian session. That level was last seen on Dec. 31, 2019. The pullback from 0.6752 has confirmed a bearish divergence of the relative strength index on the hourly chart. Similarly, the slow stochastic indicator has also diverged in favor of the bears. As such, the former resistance turned support at 0.6715 July 31 high could be put to the test soon. Acceptance under that level would shift the focus to the ascending 5 day simple moving average SMA , currently at 0.6655. The overall trend would remain bullish while the pair is held above the daily chart …

Divergence In Stochastic, NZD/USD Price Analysis: Surrenders early gains, forms negative RSI divergence on 1H chart.

Swing Trading In Basic Steps For Big Forex Profits

This preparation could imply the difference between fantastic revenue and fantastic loss. Do not listen to traders who attempt and inform you trading product systems needs to be made complex, it does not.

NZD/USD Price Analysis: Surrenders early gains, forms negative RSI divergence on 1H chart, Get more explained videos related to Divergence In Stochastic.

Forex Swing Trading – The Perfect Methodology For Newbies To Seek Huge Gains

Trade the odds and this suggests cost momentum ought to support your view and verify the trade before you get in. Nevertheless, if for some factor, the software application doesn’t work for you it’s good assurance to have.

Here I am going to show you a simple tested method which is a proven way to generate income in forex trading and will continue to work. Let’s look at the method and how it works.

Once the move is well in progress, start to route your stop however hold it outside of everyday volatility (if you do not comprehend Stochastic Trading standard variance of cost make it part of your forex education now), this means tracking right back – when the relocation turns, you are going to offer back some profit, that’s ok.If you caught just 60% of every major trending move you would be really abundant! If it’s a big relocation you will have plenty in the bank and you can’t forecast where costs go so don’t attempt.

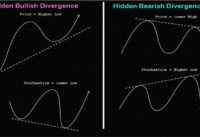

Search for divergences, it tells you that the cost is going to reverse. If price makes a brand-new high and at the same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a new low while the stochastic makes greater low.

OK now, not all breakouts are produced equivalent and you want the ones where the odds are highest. You’re trying to find Stochastic Trading assistance and resistance which traders find important and you can typically see these levels in the news.

Simpleness. A Forex Stochastic Trading system that is successful is also simple. Get too made complex with too numerous rules, and you’ll merely be slowed down. Basic systems work better than complex ones do, and you’ll have a better chance of success in the Forex market, in spite of its fast rate.

If the rate action of the market has moved sideways the trend line (18 bars) remains in holding pattern, no action should be taken. you need to be on the sidelines waiting on a breakout to one side or another.

If the price goes to a greater pivot level (which can be assistance or resistance) and the stochastic is low or high for a big time, then a turnaround will take place. Then a brand-new trade can be gotten in appropriately. Therefore, in this forex trading method, w wait till the marketplace saturate to low or high and then sell or purchase depending upon the scenario.

Now I’m not going to get into the details regarding why cycles exist and how they belong to rate action. There are many phony breakouts though and therefore you desire to trade breakouts on the existing pattern.

If you are finding more exciting reviews related to Divergence In Stochastic, and Forex Softwares, Technical Indicators, Forex Trading Education please join our email alerts service now.