Stochastics RSI

Popular clips highly rated Stochastic System, Daily Timeframe Strategy, Forex Online Trading, Currency Trading Method, and Bearish Divergence Stochastic, Stochastics RSI.

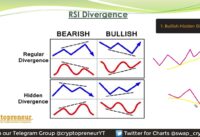

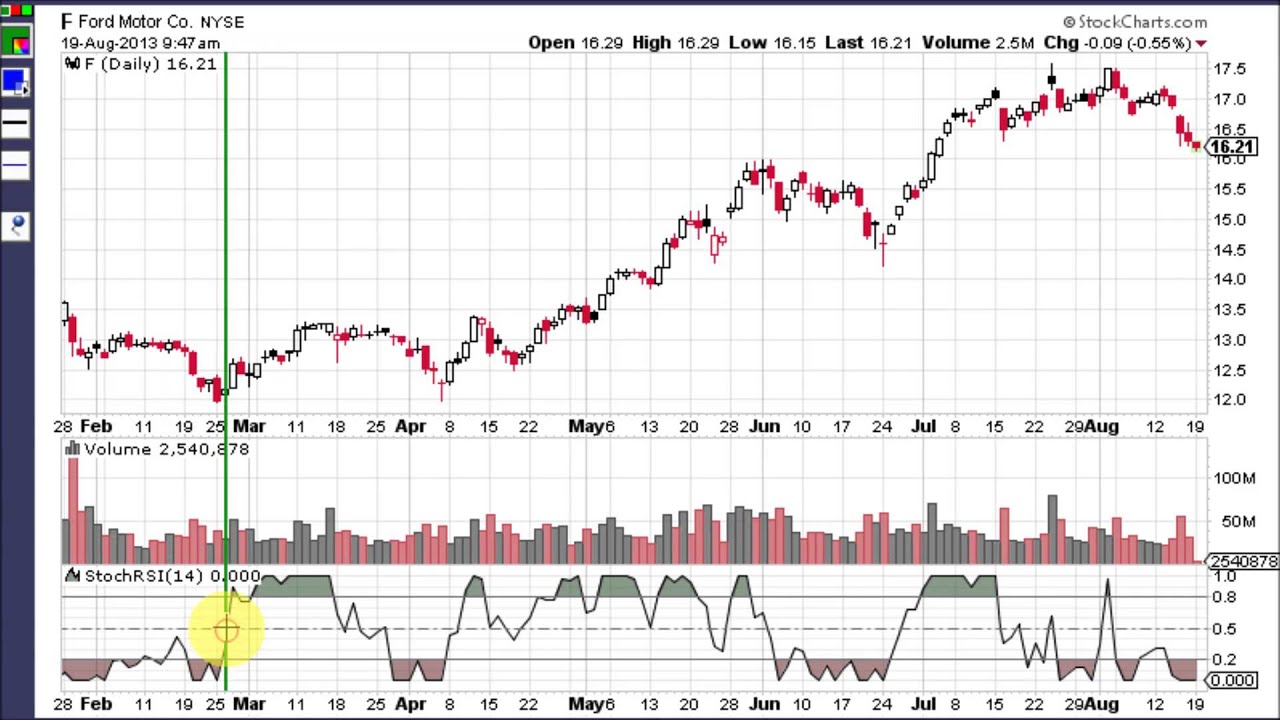

This lesson describes StochRSI, and shows how it’s used on a few chart examples.

Learn to trade Like a Pro – Join the StockGoodies Community – It’s Free!

Join HERE – http://www.stockgoodies.com

Bearish Divergence Stochastic, Stochastics RSI.

Valuable Ideas On How To Stand Out At Stock Trading

Feelings resemble springs, they stretch and contract, both for just so long. Forex swing trading is among the very best ways for amateurs to seek big gains. The external bands can be used for contrary positions or to bank earnings.

Stochastics RSI, Watch most shared reviews relevant with Bearish Divergence Stochastic.

How To Use Fibonacci In Forex

You’ll observe that when a stock cost hits the lower Bollinger Band, it usually tends to increase again. This can reveal a trader about where to get in and about where to get out. Use another indication to confirm your conclusions.

Here we are going to take a look at how to use forex charts with a live example in the markets and how you can use them to discover high odds possibility trades and the chance we are going to look at is in dollar yen.

Rate surges constantly take place and they always fall back and the goal of the swing trader is – to sell the spike and make a fast earnings. Now we will take a look at an easy currency swing Stochastic Trading method you can use right now and if you use it properly, it can make you triple digit gains.

You then require to see if the chances are on your side with the breakout so you check rate momentum. There are great deals of momentum indications to help you time your move and get the velocity of rate on your side. The ones you choose are a matter of individual preference however I like the ADX, RSI and stochastic. , if my momentum estimation adds up I go with the break..

Identify when to leave: you should likewise specify the exit point in you forex Stochastic Trading system. You can monitor if the cost goes above the breakout point if you use breakout on your system and got in a trade. , if it does it will turn into revenues.. , if it goes below don’t exit listed below the breakout level at the very same time.. You can await one day and exit if it reaches after one day presuming you are dealing with weekly chart.

The challenging part about forex Stochastic Trading is not so much getting an approach – but having self-confidence in it and trading it with discipline. , if you do not trade with discipline you will lose and you must have confidence to get discipline..

Check some momentum indications, to see how overbought momentum is and an excellent one is the stochastic. We don’t have time to discuss it completely detail here so look it up, its a visual sign and will only take thirty minutes or so to find out. Try to find it to end up being overbought and then. merely view for the stochastic lines to turn and cross down and get short.

This forex trading method highlights how concentrating on a bearish market can benefit a currency that is overbought. Whether this strategy is right or wrong, it provides an excellent risk-reward trade off and is well based on its brief position in forex trading.

Forex trading is everything about purchasing and selling of foreign currencies. Today we are going to take a look at the US Dollar V British Pound and Japanese Yen. Look at support and resistance levels and pivot points.

If you are searching best ever engaging comparisons related to Bearish Divergence Stochastic, and Momentum Trading, Automatic Forex you are requested to subscribe in subscribers database for free.