How to Add Stochastic Buy Sell Arrows

Top guide relevant with Forex Traders, Currency Swing Trading System, and Stochastic Crossover Alert, How to Add Stochastic Buy Sell Arrows.

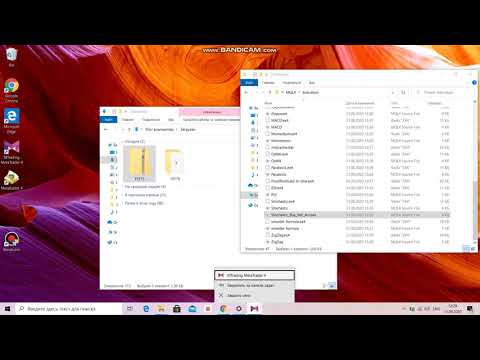

Stochastic Crossover Alert, How to Add Stochastic Buy Sell Arrows.

Forex Charts – Fundamental Profit Tips For Beginners

In fact anticipating the start and end of a trend are basically the very same. A synergy in between the systems operations and tools and your understanding of them will insure profits for you.

How to Add Stochastic Buy Sell Arrows, Get new high definition online streaming videos relevant with Stochastic Crossover Alert.

Live Trading – Volatility Presents Big Chance In Yen And Euro

Doing this indicates you understand what your optimum loss on any trade will be rather than losing everything. The most efficient indication is the ‘moving average’. It is also essential that the trade is as detailed as possible.

Here we are going to take a look at how to use forex charts with a live example in the markets and how you can use them to discover high odds likelihood trades and the opportunity we are going to look at is in dollar yen.

Great ones to look at are Relative Strength Index (RSI) Stochastic Trading, Typical Directional Motion (ADX) – There are others – but these are a fantastic location to start.

His primary approaches include the Commitment of Traders Index, which reads like a stochastic and the 2nd is Major & Minor Signals, which are based upon a static dive or decrease in the abovementioned index. His work and research are very first class and parallel his character as an individual. Nevertheless, for any method to work, it has to be something the trader is comfy with.

Stochastic Trading The swing trader purchases into fear and offers into greed, so lets take a look at how the successful swing trader does this and look at a bullish trend as an example.

A breakout is likely Stochastic Trading if the support and resistance lines are assembling. In this case you can not assume that the cost will constantly turn. You may prefer to set orders outside the range of the converging lines to capture a breakout when it occurs. However once again, check your conclusions against a minimum of another sign.

The Stochastic Indicator – this has been around since the 1950’s. It is a momentum indication which determines over bought (readings above 80) and over sold (readings below 20), it compares today’s closing price of a stocks cost variety over a recent duration of time.

Yes and it will constantly generate income as long as markets pattern breakouts will happen and if you are selective on the ones you select and validate the relocations, you might enjoy amazing currency trading success.

Trading without a stop loss does not influence a calm and detached trading method. There are a number of meanings to the terms vary trading. What were these fundamental analysts missing out on?

If you are searching more entertaining comparisons about Stochastic Crossover Alert, and Technical Analysis, Turtle Trading System, Technical Analysis Tool dont forget to signup in a valuable complementary news alert service totally free.