I Tested MACD Crossover Trading Strategy Indicator for X500 Times – QUANT Analysis Results Were…

New replays about Forex Online Trading, Learn Currency Trading Online, Large Cap Stocks, Best Forex Trading, and Macd Crossover Strategy, I Tested MACD Crossover Trading Strategy Indicator for X500 Times – QUANT Analysis Results Were….

Greetings Trading fans, welcome to the BacktestMachine – a quantitative researcher’s analysis of trading systems.

In this video we’re going to use quantitative data analysis to find out if a simple MACD Crossover system can be profitable.

The quick answer is: Yes it can!

http://www.backtestmachine.com/data_08_19_2020.html

(Above is a direct link to a cumulative Excel spreadsheet with entries, exits and results of 500 trades @ 100 share lots of SPY ($30,000+), QQQ, GLD for 8 month period (December 3, 2019 through August 19, 2020). Both real and simulated trades.)

But how do we build this system? Once it’s built, how do we test it? And how many trades will it take to determine this? What kind of accuracy can we expect, and how much profit are we talking about?

Fortunately, I have done the legwork out of tireless research and years of trading, systems design and systems backtesting and this particular system is one that we can build upon or use outright.

The trades used in this study consist of real positions as well as simulated ones ($30,000 and higher SPY positions were taken at 100 shares per trade).

First off, there are thousands of indicators out there, why are we looking at the MACD?

For the uninitiated, the MACD’s technical definition is:

“Developed by Gerald Appel in the late seventies, the Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA.”

It is a popular indicator not just put into play by retail traders, but by institutional traders alike.

While it is possible to tweak, overlap, and supplement the MACD with an infinite array of indicators, we are going to strip down the MACD to its purest form and use the simplest of trading strategies for this indicator,

Namely, the MACD Crossover.

In this system, a buy signal is initiated when the MACD turns up and crosses above the signal line. Conversely, a sell signal occurs when the MACD turns down and crosses below the signal line.

This is the most rudimentary of MACD systems, but, we will see, even a simple system can be enough to profit from financial systems if executed mechanically, or, without emotion.

For more details about this system, including its exact settings, please feel free to email me at

backtestmachine@gmail.com

We will focus on three giant ETFs, namely the SPY, QQQ, and GLD.

By doing so, we gain the liquidity desired if we were to scale upwards with the system, and also get exposure to a multitude of equities at one time.

For this study, we are using 100 share lots and use a 30 minute time frame.

This time frame is one that is heavily watched across many market participants.

Both real positions and simulated positions were made throughout the study.

When going back from December of 2019, we are going to find out that our Simple MACD Crossover system would trigger 500 times.

So, what were the results?

For starters, there was one trade on the SPY that would net over $2200.00!

Let’s watch the video to drill down into the individual stock’s results over 500 trades.

keywords: backtestmachine, backtest, backtest machine, backtesting, trading strategies, trading strategy, stock trading system, trading systems, stock market, macd, macd cross, macd crossover, macd indicator, stock trading, daytrading, spy, sp500, market analysis, stock market analysis, stock charts, chart, indicators, stock indicators, trading indicators, technical analysis, breakout indicator, breakout tool, trading tool, spy technical analysis, ta, spy technical analysis, important levels, support levels, resistance levels, breakouts, breakout, breakout stocks, stocks breaking out, price action, trading today, stocks for today, hot stocks, moving stocks, trending stocks, cannabis stocks, tech stocks, fang stocks, faang stocks

Music:

http://www.bensound.com/royalty-free-music

You can feel free to email me at:

BacktestMachine@gmail.com

Macd Crossover Strategy, I Tested MACD Crossover Trading Strategy Indicator for X500 Times – QUANT Analysis Results Were….

Ideal Storm Of Trading

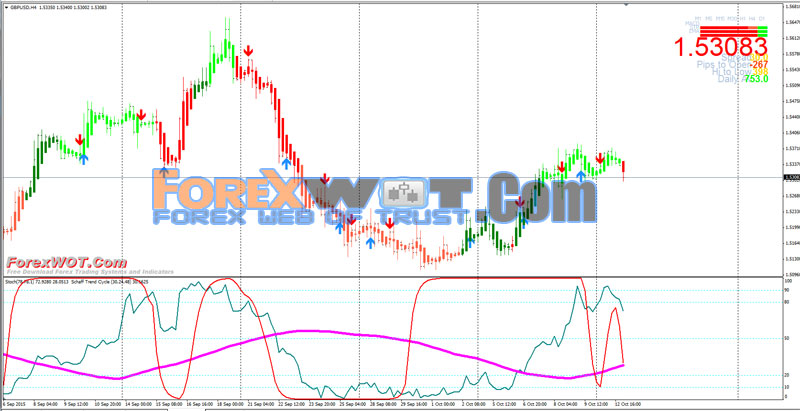

The application is, as always, price and time. So how do we appreciate the pattern when day trading? It is a clear sign that the BP currency is over bought.

This is real frequently and can end up being really discouraging.

I Tested MACD Crossover Trading Strategy Indicator for X500 Times – QUANT Analysis Results Were…, Find new full length videos about Macd Crossover Strategy.

Forex Swing Trading Method – A Simple One For Substantial Gains Anybody Can Use

Here we desire to take a look at developing a sample trading system for substantial revenues. These trendlines are considered to be really crucial TA tool. A trader must establish rules for their own selves and STICK to them.

The Stochastic Oscillator is an overbought/oversold sign established by Dr. George Lane. The stochastic is a typical indication that is incorporated into every charting software including MetaStock.

Rate increases constantly occur and they always fall back and the objective of the swing trader is – to sell the spike and make a fast earnings. Now we will take a look at a basic currency swing Stochastic Trading technique you can utilize right now and if you utilize it correctly, it can make you triple digit gains.

Them significant problem for most traders who utilize forex technical analysis or forex charts is they have no understanding of how to handle volatility from a entry, or stop point of view.

Recognize when to leave: you should likewise specify the exit point in you forex Stochastic Trading system. If you use breakout on your system and entered a trade, you can monitor if the cost goes above the breakout point. If it does it will develop into profits. If it goes below do not leave listed below the breakout level at the exact same time. You can wait on one day and exit if it reaches after one day assuming you are working with weekly chart.

Stochastic Trading If the break occurs you go with it, you require to have the state of mind that. Sure, you have missed out on the very first little revenue however history shows there is generally plenty more to follow.

Technical Analysis is based upon the Dow Theory. Dow theory in nutshell states that you can utilize the past rate action to predict the future cost action. These costs are supposed to integrate all the publicly readily available details about that market.

Energy markets are unpredictable and can make any trader look dumb but they use some wonderful earnings opportunities at present which traders can make the most of.

They are the nearby you can get to trading in genuine time with all the pressure of potential losses. If one must know anything about the stock exchange, it is this. It is ruled by feelings.

If you are looking best ever exciting videos about Macd Crossover Strategy, and Online Currency Trading, Commodity Trading Systems, Unpredictable Market you are requested to signup our email alerts service now.