Tradingview Strategy Algorithmic Trading – Perfect Momentum Strategy – How To Use The Stochastics

Popular replays relevant with Range Trading, Trend Detection in Forex Trading, Best Forex Tradsing Strategies, and How To Use Stochastics For Day Trading, Tradingview Strategy Algorithmic Trading – Perfect Momentum Strategy – How To Use The Stochastics.

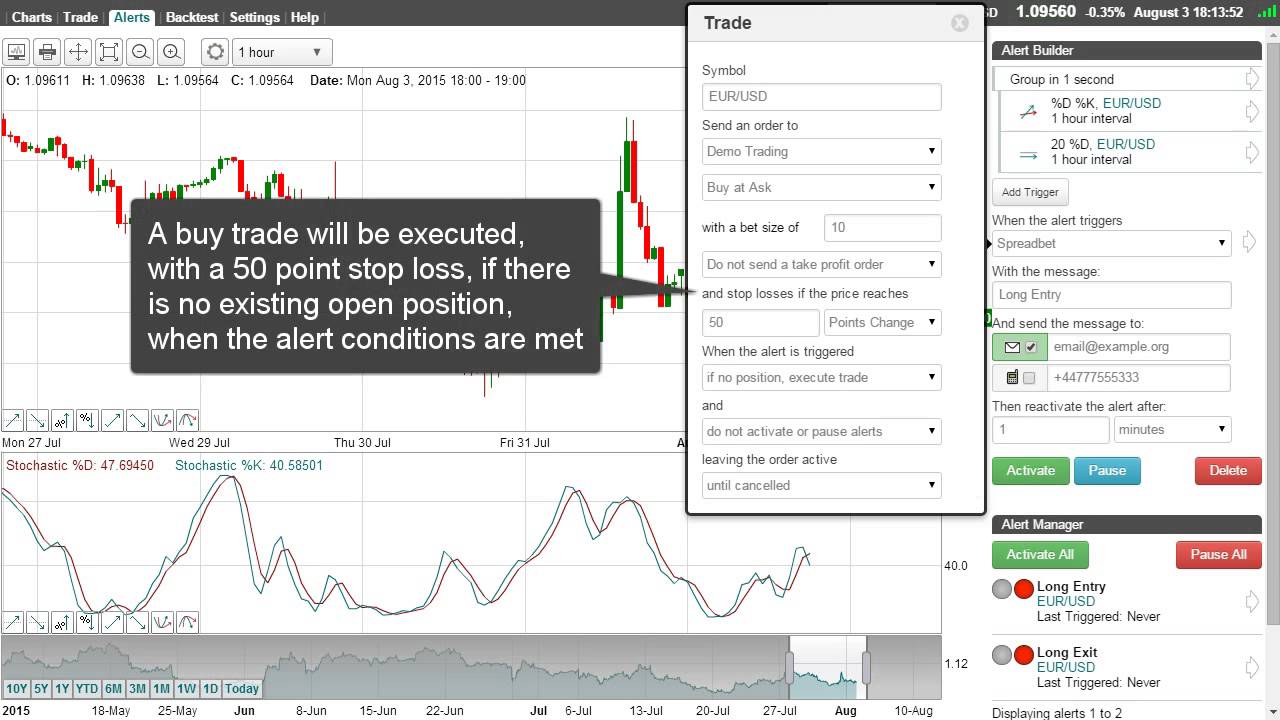

A detailed Tradingview Strategy overview on how to use the The Stochastics and backtesting date options Settings in The Perfect Momentum Strategy. Use for tradingview automated trading.

Use up to 6 different stochastics each looking at different timeframes to capture the perfect entries and exits using pure momentum.

At Zen Trading Strategies – www.zentradingstrategies.com – we cover the following: tradingview indicators to automate your tradingview strategy, tradingview alerts for tradingview automated trading, tradingview buy sell indicators, a tradingview indicators tutorial, and everything algorithmic trading.

The Tradingview Perfect Momentum Strategy Script can be found at: https://www.zentradingstrategies.com/tradingview-strategies-indicators/

Get a completely free 7 day trial of any of our tradingview strategies at:

https://www.zentradingstrategies.com/tradingview-strategies-indicators/

How To Use Stochastics For Day Trading, Tradingview Strategy Algorithmic Trading – Perfect Momentum Strategy – How To Use The Stochastics.

Who Desires To Be A Forex Trading Millionaire?

You stand there with 15 pips and now the marketplace is up 60. You then require to see if the chances are on your side with the breakout so you inspect price momentum. This strategy is easy and it is not made complex in any way.

Tradingview Strategy Algorithmic Trading – Perfect Momentum Strategy – How To Use The Stochastics, Get more reviews about How To Use Stochastics For Day Trading.

Forex Trading – Swing Trading In 3 Simple Steps For Big Profits

This analysis technique depends on determining various levels on the chart. This means, to name a few things, only investing what you can afford to lose. Never have a substantial stop loss unless you are doing swing trading.

Here we are going to look at currency trading basics from the standpoint of getting a currency trading system for earnings. The one confined is easy to understand and will enable you to seek big gains.

When I initially began to start to trade the forex market, I can keep in mind. I was under the wrongful impression (like a great deal of other brand-new traders) that I had no choice. I was going to HAVE TO trade with indications if I was going to trade the market. So, like many others I begun to utilize Stochastic Trading.

Them significant issue for the majority of traders who use forex technical analysis or forex charts is they have no understanding of how to handle volatility from a entry, or stop perspective.

Focus on long-term patterns – it’s these that yield the big earnings, as they can last for several years. Lucrative Stochastic Trading system never ever asks you to break the trend. Patterns translate to big earnings for you. Going against the trend indicates you are risking your money unnecessarily.

Simplicity. A Forex Stochastic Trading system that achieves success is likewise easy. Get too made complex with a lot of rules, and you’ll just be bogged down. Basic systems work far better than complex ones do, and you’ll have a better possibility of success in the Forex market, in spite of its quick rate.

How do you draw trendlines? In an up trend, connect 2 lower highs with a line. That’s it! And in a downtrend, link 2 greater lows with a straight line. Now, the slope of a trendline can tell you a lot about the strength of a trend. For instance, a steep trendline reveals severe bullish mindset of the purchasers.

It takes perseverance and discipline to wait for the best breakouts and after that a lot more discipline to follow them – you require self-confidence and iron discipline – but you can have these if you wish to and soon be stacking up triple digit profits.

You’ll discover that when a stock rate hits the lower Bollinger Band, it normally tends to rise once again. The Stochastic Oscillator is an overbought/oversold indicator developed by Dr. Let’s discuss this Day-to-day Timeframe Technique.

If you are finding more engaging reviews related to How To Use Stochastics For Day Trading, and Trading Support and Resistance, Technical Analysis Tool, Options Trading, Forex Swing Trading Strategy dont forget to subscribe in email list totally free.