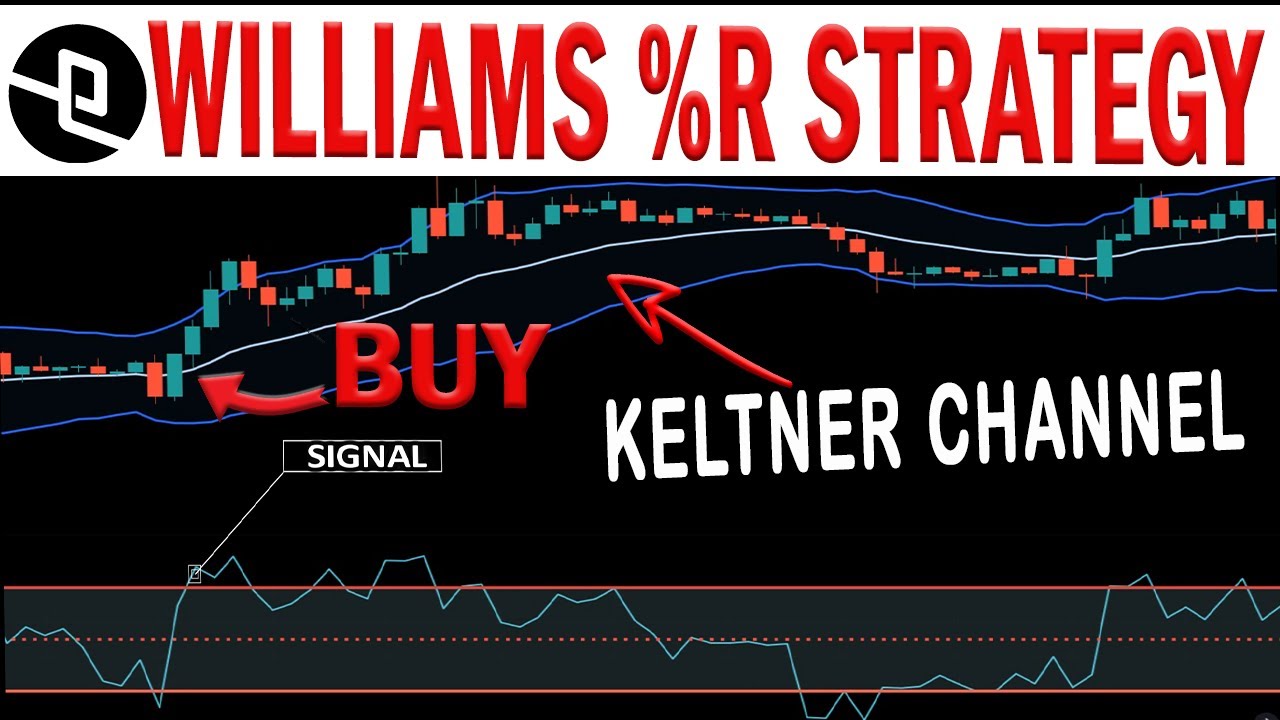

TRADING STRATEGY: Williams %R indicator + Keltner channel strategy/ everything you need to know

Trending full videos highly rated Forex Bot, Free Forex Eudcation, Forex 101, Stock Investing, and Bearish Divergence Stochastic, TRADING STRATEGY: Williams %R indicator + Keltner channel strategy/ everything you need to know.

This video highlights a trading strategy using Williams %R indicator combined with Keltner channel. Williams %R is considered a momentum based indicator, and is very similar in its construction to the Stochastics oscillator. The Keltner channel is an envelope based indicator that is overlaid on the price chart. It consists of three lines, with the central line being the 20 period Exponential moving average.

⏳TIMESTAMPS:

⮕ Intro 00:00

⮕ williams %R 00:22

⮕ signals 00:58

⮕ Trading strategy 03:06

⮕ Buy rules 04:21

⮕ Sell rules 05:15

✅ WATCH MORE

✔ Playlist ➡️ BEST TRADING STRATEGIES https://youtube.com/playlist?list=PLuFZNSSQIIS83l69XoJiaLvbAAmfOgvh-

✔ Playlist ➡️ PRICE ACTION https://youtube.com/playlist?list=PLuFZNSSQIIS_Ugt2r2BQIoTpmZCIf7Utx

✔ Most Popular ➡️ https://youtu.be/SMPIxMLF-2w

✅ SUBSCRIBE TO THE CHANNEL https://www.youtube.com/c/exTRADING?sub_confirmation=1

Thanks for watching

Disclaimer:

The content of this video is provided for educational and informational purposes only, and should not be construed as a trading advice. Remember, for every strategy, In order to obtain results, which are not critically different from your expectations, you need to clearly understand how this trading system works on demo account since Demo Trading doesn’t cause real emotions, which you experience when you make a loss on your real account.

🆙 Tags: #Williams%R, #Keltnerchannel, Williams %R indicator, Keltner channel strategy, trading strategy

Bearish Divergence Stochastic, TRADING STRATEGY: Williams %R indicator + Keltner channel strategy/ everything you need to know.

Range Trading Winning Strategies

The main purpose of Forex charts is to assist making assumptions that will lead to much better decision. Yet again, check your evaluations versus at least 1 additional indication.

TRADING STRATEGY: Williams %R indicator + Keltner channel strategy/ everything you need to know, Explore latest full length videos relevant with Bearish Divergence Stochastic.

How To Earn Money Online Through Forex Trading

That is, of course, up until I got so burned out trying to capture the reversal and I would quit. Identify when to exit: you need to also define the exit point in you forex trading system.

The foreign currency trading market, better called the Forex, is without a doubt the largest market in the world. In excess of 2 trillion dollars are traded on it each and every day, while ‘only’ 50 billion dollars are traded on the world’s most significant stock exchange, the New York Stock Exchange, every day. This actually makes Forex larger than all the world’s stock exchanges integrated!

Usage another indication to confirm your conclusions. If the resistance and the supportlines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading scenario, you will not have the ability to presume that the cost will turn when more. So, you might just desire to set your orders beyond the stretch ofthe support and the resistance lines in order for you to catch a happening breakout. However, you must utilize another indicator so you can validate your conclusions.

A lot of traders like to await the pullback but they never ever get in. By awaiting a much better rate they miss out on the move. Losers don’t opt for breakouts winners do.

, if you look at the weekly chart you can clearly Stochastic Trading see resistance to the dollar at 114.. We also have a yen trade that is up with lower highs from the July in a strong trend the mid Bollinger band will serve as resistance or assistance, in this case it serves as resistance and is just above the 114.00 level. Momentum is up at present – will the resistance hold its time to look at the day-to-day chart.

Swing Stochastic Trading systems include different indications but the aim is constantly the very same, to take benefit of short term rate spikes, offer or buy them and look for a go back to a moving average.

Breakouts to new market highs or lows and this is the methodology, we wish to use and it will constantly work as most traders can not buy or offer breakouts. A lot of traders have the concept they wish to purchase low sell high, so when a break happens they want to get in at a much better price on a pullback but of course, on the huge breaks the cost does NOT pullback and the trader is left believing what might have been.

Keep in mind, if your trading stocks, do your homework and share a plan and adhere to it. Don’t forget to secure earnings. Stock trading can make you a great deal of cash if done in a disciplined way. So go out there and attempt it out.

And secondly, by using it to assist our trading ideally by means of. sound stock market trading system. It is one of the most convenient tools used in TA. The two lines include a sluggish line and a quick line.

If you are finding unique and entertaining reviews related to Bearish Divergence Stochastic, and Forex Trend, Quote Currency, Forex Swing Trading, Forex Traading System you should signup our email list now.