Swing Trading Technical Indicators: What Are the Best and Most Accurate?

Interesting YouTube videos top searched Swing Trading Stocks, Learn How to Trade Options, Forex Trend Following, and What’s Swing Trading, Swing Trading Technical Indicators: What Are the Best and Most Accurate?.

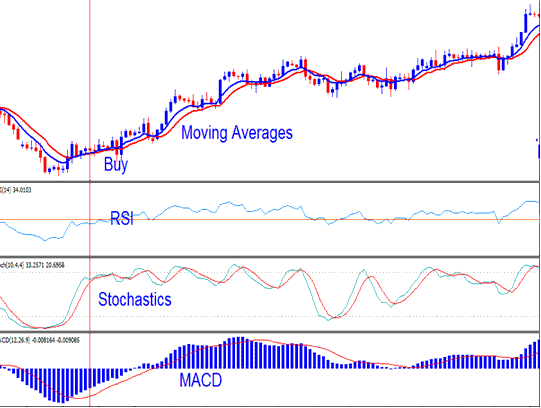

Swing trading indicators can be very helpful to use when trading because they show important technical support and resistance levels and trend changes. Take our free courses: https://bullishbears.com/

Join Our Trading Community & Receive:

• Trading Courses

• Trade Rooms

• Live Streaming

• Alerts

• Watch Lists

• Real Time Teaching

• Custom Built Discord

• Discord Bots & Trading Tools

Start Your Free Trial Here: https://bullishbears.com/stock-market-trading/

*All of our content and streams are for educational purposes only! Read Our Disclaimer: https://bullishbears.com/disclaimer/

#swingtradingindicators #swingtradeindicators #topswingtradingindicators

Blog Post: https://bullishbears.com/swing-trading-indicators/

Swing Trading Playlist: https://www.youtube.com/playlist?list=PLFsRFWsq5Eda9wRkJGCUnT07-MjdZMb06

What’s Swing Trading, Swing Trading Technical Indicators: What Are the Best and Most Accurate?.

Range Trading Winning Strategies

They do this by getting the ideal responses to these million dollar concerns.

Lots of people do not realize that the forex trading robotic software application will help manage charting.

Swing Trading Technical Indicators: What Are the Best and Most Accurate?, Get latest explained videos relevant with What’s Swing Trading.

Forex Trading Method – 3 Fundamental Steps For Forex Success

You might take one take a look at it and believe it is rubbish. What were these essential experts missing? More common signs include: stochastic, r.s.i, r.v.i, moving averages, candle light sticks, etc.

You can so this by utilizing the stochastic momentum sign (we have actually written regularly on this and it’s the finest indication to time any trade and if you are not farmiliar with it find out about it now) expect the stochastic lines to deny and cross with bearish divergence and go short.

Use another indicator to validate your conclusions. If the support and the resistancelines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading situation, you will not have the ability to presume that the price will turn again. So, you might just wish to set your orders beyond the stretch ofthe resistance and the assistance lines in order for you to catch an occurring breakout. However, you need to utilize another indicator so you can verify your conclusions.

Trade the odds and this means cost momentum ought to support your view and validate the trade prior to you get in. 2 excellent momentum indications are – the stochastic and the Relative Strength Index – look them up and utilize them.

Recognize when to exit: you should also specify the exit point in you forex Stochastic Trading system. If you use breakout on your system and entered a trade, you can keep an eye on if the cost exceeds the breakout point. , if it does it will turn into profits.. If it goes listed below don’t leave below the breakout level at the very same time. If it reaches after one day presuming you are working with weekly chart, you can wait for one day and exit.

This system is easy and you require to understand this truth – all the finest systems are. Forget expert Stochastic Trading systems, neural networks or lots if indicators – simple systems work best as they are robust and with fewer components to break in the face of brutal ever changing market conditions.

Technical Analysis is based on the Dow Theory. Dow theory in nutshell says that you can use the past rate action to predict the future rate action. These costs are supposed to include all the publicly offered details about that market.

I call swing trading “hit and run trading” which’s what your doing – getting high odds established, hitting them and then banking earnings, before the position can turn back on you. You will quickly be confident sufficient to applly it for long term currency trading success if you learn and practice the above method for a week or so.

In summary – they are leading signs, to gauge the strength and momentum of cost. Currency trading is a method of earning money but it also depends on the luck aspect. They are put side by side (tiled vertically).

If you are searching best ever exciting comparisons relevant with What’s Swing Trading, and Techncial Analysis, E Mini Trading you should subscribe our subscribers database now.