92% Success Rate With “No-Brainer” Swing Trading Patterns – MasterTrader.com

https://www.youtube.com/watch?v=-eEDWiCa4gI

Latest overview relevant with Win at Forex, Best Forex Trading, and What’s Swing Trading, 92% Success Rate With “No-Brainer” Swing Trading Patterns – MasterTrader.com.

Would you like to see some of Master Trader’s top trading patterns which set up recently allowing us to reap huge gains in our three trading and investing advisory letters last week?

We finally got our bearish crack in the overbought markets since the incredible retracement off the December lows. Our market internals gave us the “heads up,” and the M-Tops in the Index ETFs gave us the green light to short.

Both new and seasoned subscribers have been pleasantly pleased with our recent weekly income trades, closing 11 of 12 for winners last week using Master Trader Technical Strategies (MTS).

There were many “no-brainer” compelling swing trading patterns (stocks and options) with Multiple Time Frame (MTF) alignment.

Successful trading is all about finding high-probability setups, properly entering and managing them, and then having the discipline and patience to follow your trading plan.

We have been doing that for decades in trading our own accounts and in educating thousands of investors and traders.

The Weekly Options Trader focuses solely on selling options and credit spreads expiring in 10 days or less around compelling patterns to generate weekly income. These trades are easy to find, enter and manage for any type of trader or investor.

Learn how Master Trader Technical Strategies – MTS and MTS with Options Strategies can make consistent money.

To Access the Options Credit Spread Program that puts you on the Master Trader Income Path, see https://mastertrader.com/trading-credit-spreads-for-income/

Click Here to Learn The Master Trader Swing Trading Strategies to profits over a few days to weeks. https://mastertrader.com/swing-trading-strategies-for-the-master-trader/

CLICK HERE For a free 3-day complimentary access to the Master Trader Green Room

In the Master Trader Green Room, we trade stocks, options, and ETFs in real-time.

Learn how we scan pre-market compelling Gap Trades and discuss a “plan of attack” to profit.

Our comprehensive Master Trader All-Inclusive Advisory Market Edge Membership includes the Master Trader Advisory Swing and Options Trader — plus much more – in providing ongoing, invaluable trading information for active investors and traders. Check out what the amazing package includes. https://mastertrader.com/master-trader-market-edge-membership/#start-membership

Master Trader Weekly Lessons for Investors and Traders will build your investing and trading knowledge and confidence to profit in all markets! Each lesson can change your financial future — only $11.97/month! https://mastertrader.com/master-trader-weekly-lessons-investors-traders/

Master Trader and You Building Your Financial Future Together!

What’s Swing Trading, 92% Success Rate With “No-Brainer” Swing Trading Patterns – MasterTrader.com.

Forex Trading Education – The Most Basic Approach To Make Huge Profits

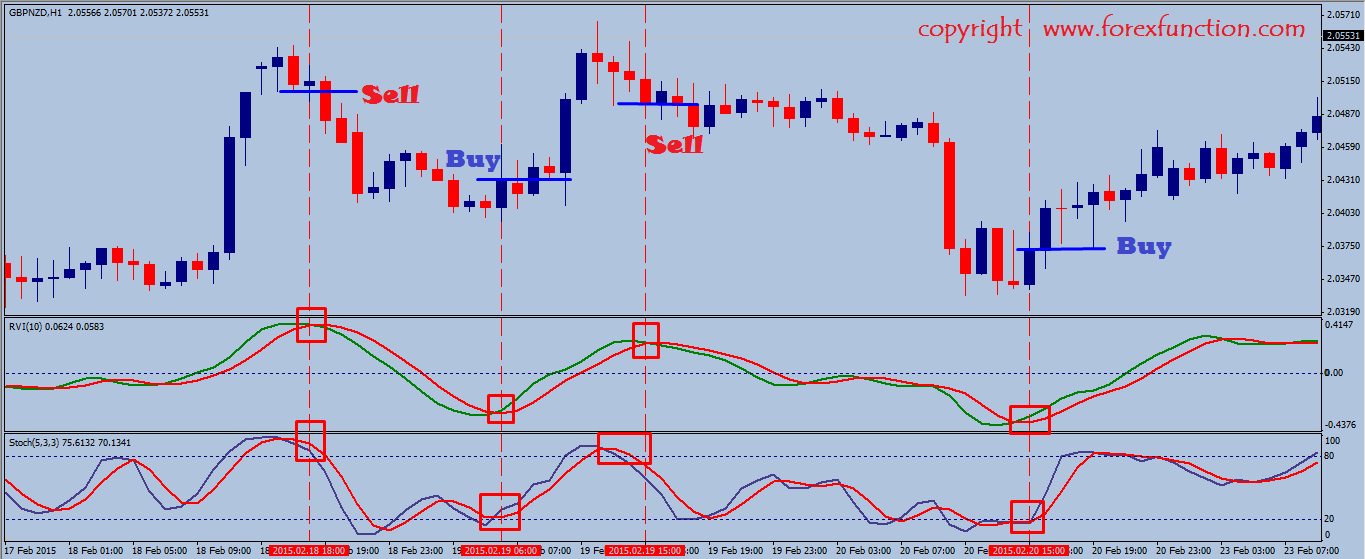

The first point is the method to be followed while the second pint is the trading time. Breakouts are simply breaks of crucial support or resistance levels on a forex chart. The Stochastic – is a really powerful trade indication.

92% Success Rate With “No-Brainer” Swing Trading Patterns – MasterTrader.com, Explore top replays relevant with What’s Swing Trading.

How To Utilize Stochastics To Discover Awesome Forex Trades

Doing this indicates you understand what your maximum loss on any trade will be instead of losing whatever. The most effective sign is the ‘moving average’. It is also essential that the trade is as detailed as possible.

Today many traders buy commodity trading systems and spent money on pricey software application when really all they require is to do a little bit of research study on the web and construct their own.

Some these “high flyers” come out the high tech sector, which includes the Web stocks and semiconductors. Other “high leaflets” come from the biotech stocks, which have increased volatility from such news as FDA approvals. After a while you will acknowledge the symbols Stochastic Trading due to the fact that there are less of them than on the NASDAQ that trade like a house on fire on the best news.

The fact is you do not have to be intimidated with the concept of day trading. The appeal of day trading is that you don’t need to have a Masters degree in Service from Harvard to make cash doing this. Effective day traders consist of a great deal of “Typical Joes” like you and me. There are lots of effective day traders out there who had a truly bumpy ride just graduating high school.

So, here are some helpful suggestions to successfully trade foreign currency exchange in an unforeseeable market. Sure enough, you can apply these pointers while utilizing a demonstration account. After all, using a demonstration account will enable you to practice forex Stochastic Trading and make you prepared for the real thing.

A few of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise ought to try to find floorings and ceilings in a stock chart. This can reveal a trader about where to get in and about where to get out. I say “about” since it is pretty difficult to think an “precise” bottom or an “precise” top. That is why locking in earnings is so so essential. If you don’t secure revenues you are actually risking of making a worthless trade. Some traders end up being actually greedy and it only hurts them.

Breakouts are probable if the resistance and assistance lines converge. In this instance, you may not assume that costs will return always. You may prefer orders outside the converging line range to acquire a breakout as it happens. Yet once again, check your assessments versus a minimum of 1 additional sign.

Energy markets are unstable and can make any trader look dumb however they provide some wonderful earnings chances at present which traders can make the most of.

This figures out whether the time frame required is hourly, everyday or annual. The more flat these two levels are, chances of a profitable range trading will be higher. This is to forecast the future pattern of the cost.

If you are finding more exciting reviews related to What’s Swing Trading, and Forex Indicators, Forex Trend you should signup for email subscription DB totally free.