Stochastic Oscillator: When to Buy or Sell a Stock

Latest complete video top searched Trading Tool, Stock Market Trading, Currency Trading Tutorial, Simple Forex Trading, and Stochastic Oscillator, Stochastic Oscillator: When to Buy or Sell a Stock.

In this short video we’ll talk about a very useful technical indicator to use in the Stock Market or Forex. If you have a brokerage account and have already in mind a stock to buy or sell, the stochastic oscillator can help you decide when to do it.

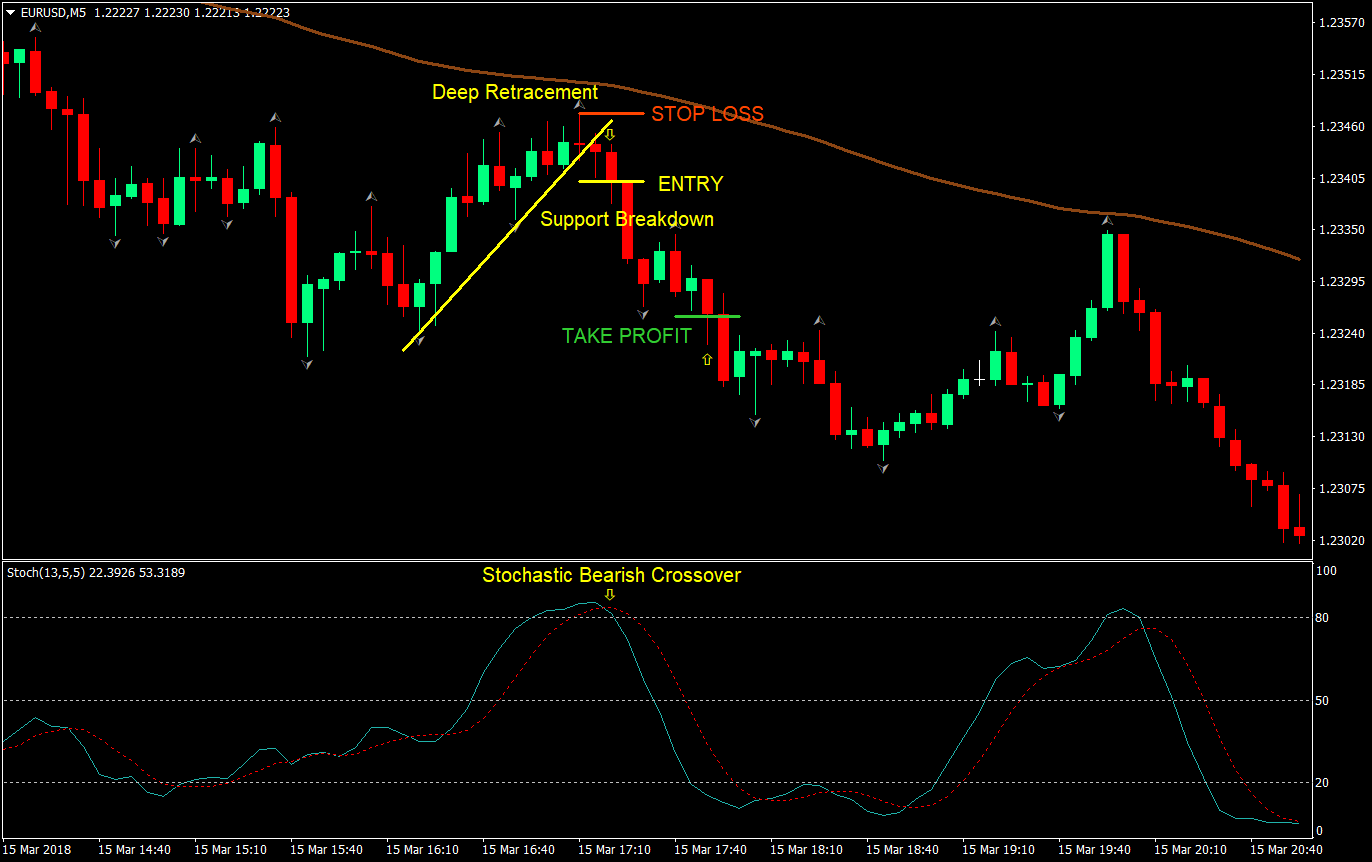

Just like the RSI, the Stochastic Oscillator is a very reputable indicator. Ideal to use when the market is moving sideways or is showing a choppy trend.

In my opinion, the more technical tools we know, the better. Even though we can never be certain about what the stock market will do, we can certainly minimize risk and maximize our profits in the stock market by having several analysis tools supporting our decision to buy, sell or simply stay away from a stock until the right moment arrives.

Don’t forget to check my other videos, hit like and subscribe!

Stochastic Oscillator, Stochastic Oscillator: When to Buy or Sell a Stock.

Forex Trading Strategy – 3 Basic Steps For Forex Success

Trading is constantly short-term while investing is long term. Likewise trade on the duration where significant markets are open. The concept is “Do not forecast the marketplace”.

The charts show that the marketplace is going up once again.

Stochastic Oscillator: When to Buy or Sell a Stock, Search most shared complete videos relevant with Stochastic Oscillator.

Forex-Ology Streamlined – 5 Unorthodox Actions Of A Winning Forex Strategy

The two lines consist of a slow line and a quick line. This holds true frequently and can end up being extremely frustrating. It is essential to discover a forex robot that features a 100% money back assurance.

Let’s take a look at Fibonacci first of all. This 750 year old “natural order” of numbers reflects the birth of bunnies in a field, the variety of rinds on a pineapple, the sequence of sunflower seeds. So how do we apply it to forex trading?

These are the long term investments that you do not hurry Stochastic Trading into. This is where you take your time evaluating a great spot with resistance and support to make a big slide in revenue.

Search for divergences, it informs you that the rate is going to reverse. If price makes a new high and at the same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the cost makes a new low while the stochastic makes greater low.

It needs to go up the revenues and cut the losses: when you see a trend and use the system you developed Stochastic Trading , it should continue opening the offer if the profits going high and seal the deal if the losses going on.

Throughout my career in the forex market, teaching countless traders how to profit, I’ve always recommended to begin with a trend following approach to Stochastic Trading currencies. I do the exact same thing with my present customers. Naturally, I’m going to share a pattern following technique with you.

The Stochastic Indication – this has been around given that the 1950’s. It is a momentum sign which determines over bought (readings above 80) and over sold (readings listed below 20), it compares today’s closing cost of a stocks price variety over a current amount of time.

Await the indications to signal the bears are taking control, through the stochastic and RSI and remember the bulls just take charge above January’s highs.

Do not expect t be a millionaire over night, because that’s simply not reasonable. No one can anticipate where the market will go. You can use the mid band to purchase or sell back to in strong patterns as it represents worth.

If you are looking most entertaining comparisons related to Stochastic Oscillator, and Online Forex, Online Forex Training please subscribe in newsletter for free.