Simple Forex Strategy | How to use the Stochastic Oscillator Indicator

Popular replays related to Effectively Trade Forex, Simple Forex Trading Strategy, Unpredictable Market, and How To Use Stochastic Oscillator, Simple Forex Strategy | How to use the Stochastic Oscillator Indicator.

Hello, and welcome.

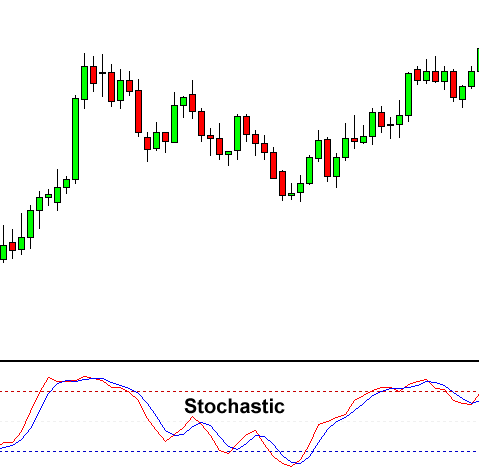

In this video, I will be showing you how to use a very simple strategy with an indicator called The stochastic oscillator.

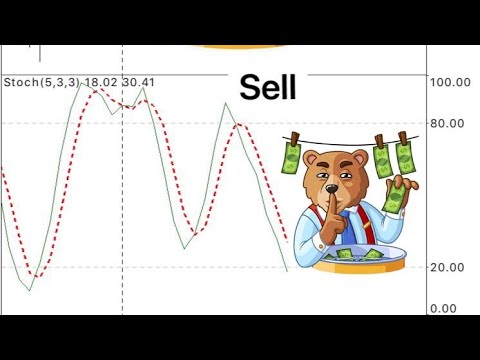

It is very important to use the indicator for overbought and oversold conditions.

Click on the link below to get started with any of my recommended brokers:

https://multibankfx.com/account/live-account?ibNum=333509074

https://www.rally.trade/?utm_source=introducingbroker-792982

How To Use Stochastic Oscillator, Simple Forex Strategy | How to use the Stochastic Oscillator Indicator.

Forex Charts Can Lead To Big Profits

They will “bring the stocks in” to adjust their position. The only thumb-down in this company is that it is highly risky. You then need to see if the chances are on your side with the breakout so you inspect price momentum.

Simple Forex Strategy | How to use the Stochastic Oscillator Indicator, Play new reviews related to How To Use Stochastic Oscillator.

The Very Best Forex Trading System For Newbies Keeps You Busy – Not Bored

Breaking the trend suggests you are risking your cash needlessly. Candlestick charts were invented by Japanese rice traders in the 16th century. You can utilize the technique to generate your own signal to trade FX from day to day.

There is a distinction in between trading and investing. Trading is constantly brief term while investing is long term. The time horizon in trading can be as brief as a couple of minutes to a few days to a few weeks. Whereas in investing, the time horizon can be months to years. Many individuals day trade or swing trade stocks, currencies, futures, choices, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the same day making a quick profit. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, an investor is least pressed about the brief term swings in the market. She or he has a long term time horizon like a couple of months to even a few years. This very long time horizon matches their financial investment and monetary objectives!

Some these “high leaflets” come out the high tech sector, which consists of the Web stocks and semiconductors. Other “high flyers” come from the biotech stocks, which have increased volatility from such news as FDA approvals. Since Stochastic Trading there are less of them than on the NASDAQ that trade like a house on fire on the best news, after a while you will recognize the signs.

The first indicate make is if you like action and want to trade all the time do not keep reading – this is everything about trading very high chances trades for huge profits not trading for fun or messing about for a few pips.

Just as essential as you will comprehend the logic that this forex Stochastic Trading technique is based upon, you will have the discipline to trade it, even when you take a couple of losses as you understand your trade will come.

Many traders make the error of thinking they can utilize the swing trade strategy daily, but this is not an excellent concept and you can lose equity quickly. Rather reserve forex swing trading for days when the market is ideal for swing trading. So, how do you understand when the market is right? When the chart is high or low, watch for resistance or assistance that has been held a number of times like. Look and see the momentum for when prices swing highly toward either the assistance or the resistance, while this is taking place expect confirmation that the momentum will turn. This confirmation is critical and if the momentum of the rate is starting to wane and a turn is likely, then the odds are in excellent favor of a swing Stochastic Trading environment.

2 of the best are the stochastic indicator and Bollinger band. Utilize these with a breakout technique and they provide you a powerful mix for seeking big gains.

I call swing trading “hit and run trading” which’s what your doing – getting high odds established, striking them and after that banking revenues, prior to the position can turn back on you. If you learn and practice the above technique for a week approximately, you will soon be confident adequate to applly it for long term currency trading success.

It works even in volatile market conditions. The traders most favored currency sets are the EURUSD, USDJYP and GPBUSD. Recognize when to exit: you should likewise specify the exit point in you forex trading system.

If you are looking best ever entertaining comparisons related to How To Use Stochastic Oscillator, and Range Trading Winning, Successful Trading you are requested to list your email address our email subscription DB now.