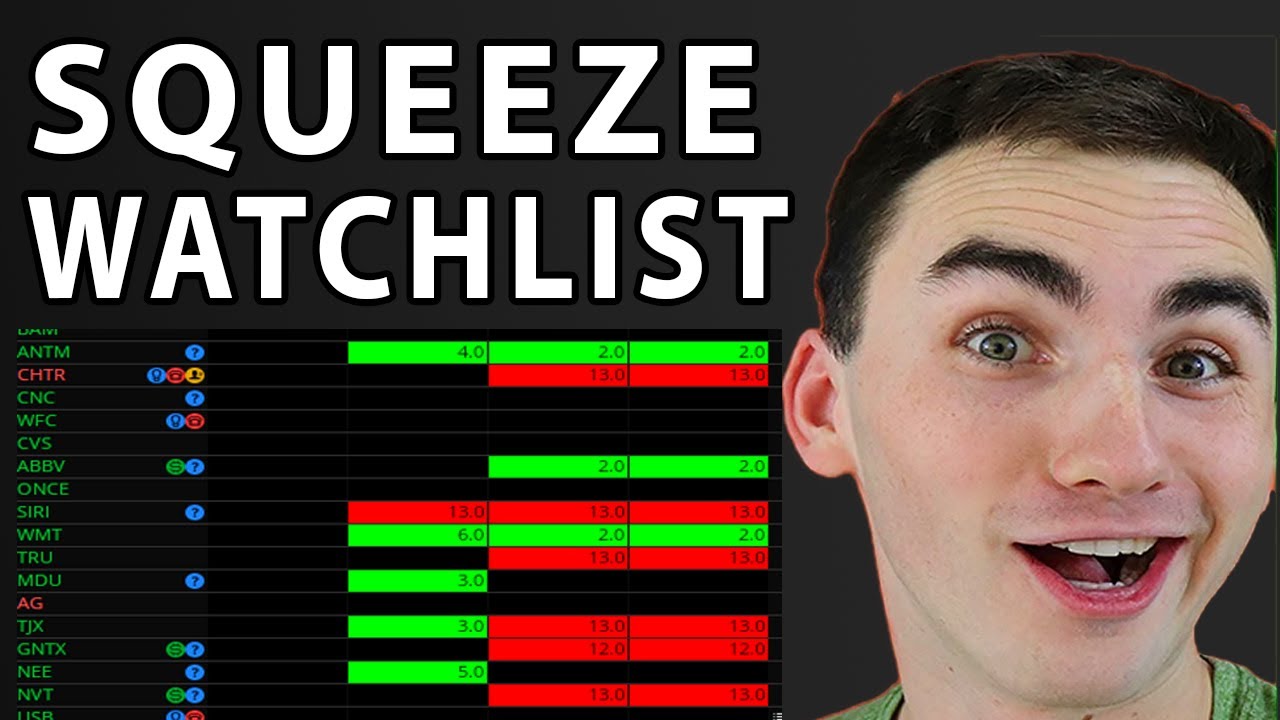

Setup the TTM Squeeze Watchlist in Thinkorswim – Thinkorswim Tutorial

Latest YouTube videos highly rated Online Currency Trading, Range Trading, Short Swing Trading, and Best Stochastic Settings For 1 Minute Chart, Setup the TTM Squeeze Watchlist in Thinkorswim – Thinkorswim Tutorial.

📈Squeeze Pro Discount: http://bit.ly/SqueezeProSystem-RC

Here is the link to the script 👉 http://bit.ly/WatchlistScript

DISCLAIMER: This video is for entertainment purposes only. Trade based on what you know and understand not what someone else says.

#Ttmsqueeze #Squeezeindicator #Rileycoleman

About This Video: In this video Riley goes over how to create a watchlist that will show when stocks are in a squeeze without you having to scan them all the time. This is a quick and easy way to use the ttm squeeze indicator for your trading.

Best Stochastic Settings For 1 Minute Chart, Setup the TTM Squeeze Watchlist in Thinkorswim – Thinkorswim Tutorial.

Earn Money Fast – Easy Trading Pointers To Build Genuine Wealth

So if you want to swing trade varieties, you can use the ADX (Average Directional Index) oscillator. These are the long term financial investments that you do not hurry into. You stand there with 15 pips and now the market is up 60.

Setup the TTM Squeeze Watchlist in Thinkorswim – Thinkorswim Tutorial, Watch popular full videos about Best Stochastic Settings For 1 Minute Chart.

Find Out Currency Trading – A Basic Strategy For Big Profits

Many people do not realize that the forex trading robot software will help deal with charting. The software application the traders utilize at the online trading platforms is more easy to use than it was years back.

The Stochastic Oscillator is an overbought/oversold indicator developed by Dr. George Lane. The stochastic is a common indicator that is integrated into every charting software including MetaStock.

You need to have the state of mind that if the break occurs you Stochastic Trading go with it. Sure, you have actually missed out on the very first bit of earnings however history reveals there is generally plenty more to follow.

Many traders like to wait on the pullback however they never ever get in. By waiting on a better price they miss the move. Losers don’t go with breakouts winners do.

Focus on long-term trends – it’s these that yield the big earnings, as they can last for many years. Rewarding Stochastic Trading system never asks you to break the trend. Trends translate to big earnings for you. Going versus the pattern implies you are risking your cash needlessly.

If you caught just 50% of every major pattern, you would be extremely rich; accept short term dips versus Stochastic Trading you and keep your eyes on the larger long term prize.

Technical Analysis is based upon the Dow Theory. Dow theory in nutshell states that you can utilize the previous rate action to anticipate the future cost action. These rates are expected to incorporate all the publicly readily available details about that market.

Await the indicators to signify the bears are taking control, via the stochastic and RSI and keep in mind the bulls only take charge above January’s highs.

The 60 minutes chart takes up about 1/3 of my screen area and the 5 minutes 2/3 of the screen area. Therefore if there is a chance for you to do a counter pattern trade remember DO NOT take that trade.

If you are looking more engaging reviews related to Best Stochastic Settings For 1 Minute Chart, and Forex Trading Strategies, Forex Trading Advice, Forex Day Trading Signals please subscribe in a valuable complementary news alert service totally free.