Oscillator Workbench + Delta Volume Channels Indicator Trading Strategy

New un-edited videos about Online Forex Trading, Daily Charts Forex Strategy, and Day Trading Stochastic Settings, Oscillator Workbench + Delta Volume Channels Indicator Trading Strategy.

Trade with World Top Broker And Enjoy Exclusive Benefits. https://fxdailyreport.com/top-forex-brokers/

FXDailyReport.com – Oscillator Workbench + Delta Volume Channels Indicator Trading Strategy

Use Full Links Bellow

Forex Trading Education and Tutorials :

Chart Patterns Education :

Testing Forex Strategy :

Official website and useful links! ► https://fxdailyreport.com/

Subscribe to our channel: https://www.youtube.com/channel/UCXRfIMqmyR21RNI4x2Woi1Q?sub_confirmation=1

Keywords Ignore these:

forex trading,forex basics,forex,forex guides,forex tutorial,metatrader,ctrader,ecn,metatrader 4,mt4,mt5,metatrader 5,tradingview,#supportandresistance,#fx,#forex,support resistance,crypto trading,gold trading,commidity trading,forex market,Trading Strategies,fxdailyreport.com,RSI,Relative Strength Index,100 Pips a Day,Pullback Strategy,bollinger bands Strategy,SuperTrend Indicator,Scalping Strategy,crypto currency,Super Trend Indicator, Price Action,

Day Trading Stochastic Settings, Oscillator Workbench + Delta Volume Channels Indicator Trading Strategy.

Forex Trading – How To Catch The Mega Patterns For Big Profits!

Typical indications utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Sometimes, either one or both the support and resistance are inclining. Those lines might have crossed 3 or 4 times before only to revert back.

Oscillator Workbench + Delta Volume Channels Indicator Trading Strategy, Get most shared updated videos related to Day Trading Stochastic Settings.

Who Desires To Be A Forex Trading Millionaire?

There are several meanings to the terms range trading. The ones you select refer personal choice but I like the ADX, RSI and stochastic. However how to anticipate that the existing trend is ending or will end?

Here we are going to look at currency trading basics from the perspective of getting a currency trading system for revenues. The one confined is simple to understand and will enable you to seek substantial gains.

When I initially started to begin to trade the forex market, I can remember. I was under the wrongful impression (like a great deal of other new traders) that I had no option. If I was going to trade the market, I was going to NEED TO trade with indications. So, like numerous others I started to utilize Stochastic Trading.

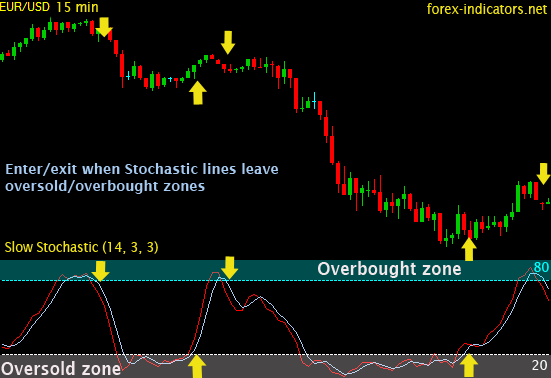

Search for divergences, it tells you that the rate is going to reverse. If price makes a new high and at the very same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a new low while the stochastic makes greater low.

Now I’m not going to get into the information regarding why cycles exist and how they relate to price action. There is much composed on this to fill all your peaceful nights in checking out for decades. If you spend just a bit of time enjoying a MACD or Stochastic Trading sign on a cost chart, you ought to currently be convinced that cycles are at work behind the scenes. Simply see as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ebb and circulation of price action.

In summary – they are leading signs, to assess the strength and momentum of rate. You want momentum to support any break before executing your Stochastic Trading signal as the odds of continuation of the trend are higher.

If the price action of the market has actually moved sideways the trend line (18 bars) is in holding pattern, no action must be taken. you need to be on the sidelines awaiting a breakout to one side or another.

In this short article is a trading method revealed that is based upon the Bolling Bands and the stochastic signs. The technique is simple to use and might be used by day traders that want to trade short trades like 10 or thirty minutes trades.

The lower it descends below the 0 line the stronger the sag. If the support and the resistance lines are touching, then, there is likely to have a breakout. Let’s discuss this Everyday Timeframe Method.

If you are looking best ever engaging reviews related to Day Trading Stochastic Settings, and Range Trading Winning, Forex Traading System you are requested to list your email address our subscribers database now.