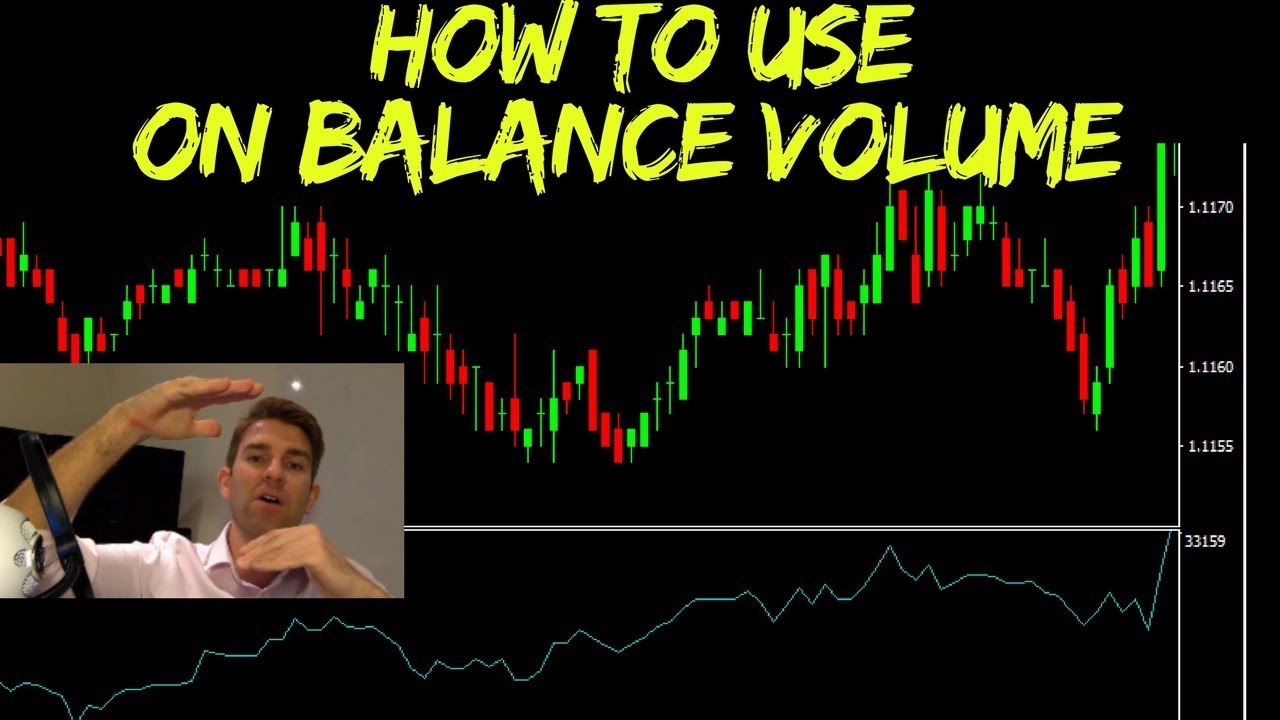

On Balance Volume: What It Is and How to Use It 🙌

Interesting guide highly rated Forex Professional System Trading, Ranging Market, Forex Day Trading Signals, Forex Market, and Trading Stochastic Divergence, On Balance Volume: What It Is and How to Use It 🙌.

The On Balance Volume indicator (OBV) http://www.financial-spread-betting.com/course/on-balance-volume.html PLEASE LIKE AND SHARE THIS VIDEO SO WE CAN DO MORE! The OBV is utilized in technical analysis to measure buying and selling pressure. On-Balance Volume is a summary of volume in an uptrend against the downtrend. If the market closes higher than the prior’s day close the volume on that is added to the indicator. If the next day we have an ‘up day’ again the volume of that day is again added to that indicator. If we have a down day then that day’s volume is taken away from the current indicator value. The OBV value is subsequently plotted as a line for interpretation. On Balance volume is normally utilized to confirm or spot prevailing price trends and/or to anticipate price movements after divergence. Divergences between On Balance Volume and price may indicate the price may be approaching a reversal. Using trend lines can also help in identifying divergences and trading opportunities as they come up.

Trading Stochastic Divergence, On Balance Volume: What It Is and How to Use It 🙌.

Forex Trading – Swing Trading In 3 Basic Steps For Big Profits

Trading is always brief term while investing is long term. Also trade on the period where major markets are open. The idea is “Do not forecast the marketplace”.

The charts reveal that the market is moving up once again.

On Balance Volume: What It Is and How to Use It 🙌, Watch more updated videos about Trading Stochastic Divergence.

Variety Trading Secrets

Now I’m not going to get into the information regarding why cycles exist and how they belong to cost action. The support level is a level the cost can not go below it for a big period.

Here we are going to look at two trading opportunities last week we banked a fantastic profit in the British Pound. Today we are going to look at the United States Dollar V British Pound and Japanese Yen.

Versions are very important. Prior to you buy any forex robotic, you need to ensure that it is current. How can you do this? Look over the sellers site Stochastic Trading and examine the version variety of the software being sold. Also, examine the copyright at the bottom of the page to see how typically the page is upgraded. If not updates are being made, then it’s buyer beware.

You require less discipline than trend following, due to the fact that you don’t need to hold positions for weeks on end which can be hard. Instead, your losses and profits come rapidly and you get a lot of action.

A vital starting point suffices cash to survive the preliminary stages. If you have enough money you have the time to find out and enhance your Stochastic Trading till you are earning money. How much money is required depends on how many agreements you wish to trade. For instance to trade 1 $100,000 dollar agreement you need between $1000 and $1500 as margin.

The key to utilizing this easy system is not just to search for overbought markets however markets are extremely Stochastic Trading overbought – the more a market is overbought, the larger the move down will be, so be selective in your trades.

To see how overbought the currency is you can utilize some momentum signs which will offer you this details. We don’t have time to discuss them here but there all easy to apply and learn. We like the MACD, the stochastic and the RSI but there are a lot more, just pick a couple you like and use them.

Yes and it will constantly make cash as long as markets trend breakouts will happen and if you are selective on the ones you pick and verify the relocations, you could take pleasure in magnificent currency trading success.

They do this by getting the ideal responses to these million dollar concerns. Forex traders make cash by speculating market movements. When prices hit target take your earnings in and wait on the next established.

If you are searching more exciting videos related to Trading Stochastic Divergence, and Stock Trading Strategy, Simple Forex Trading Strategy, Forextrading Strategy, Currency Trading please list your email address for newsletter for free.