Bitcoin Crash: Is BTC Bullish or BEARISH? Could BTC CRASH Again…

Interesting videos top searched Forex Day Trading, Simple System, and Bearish Divergence Stochastic, Bitcoin Crash: Is BTC Bullish or BEARISH? Could BTC CRASH Again….

LOOKING FOR MORE? Our NFT Project https://www.cheekyverse.com/ Our Cheeky Podcast https://bit.ly/3NkJGWt …

Bearish Divergence Stochastic, Bitcoin Crash: Is BTC Bullish or BEARISH? Could BTC CRASH Again….

Forex Trading Method – An Easy System For Triple Digit Gains

A trader must develop rules for their own selves and STICK to them. It is very important that the forex trading robotic you choose to buy has these three things. Then a new trade can be gotten in appropriately.

Bitcoin Crash: Is BTC Bullish or BEARISH? Could BTC CRASH Again…, Enjoy trending replays relevant with Bearish Divergence Stochastic.

Finding Out How To Trade The Forex Market – What You Ought To Know

Doing this suggests you understand what your maximum loss on any trade will be rather than losing everything. The most efficient indicator is the ‘moving average’. It is likewise important that the trade is as detailed as possible.

Many traders aim to buy a currency trading system and don’t understand how simple it is to construct their own. Here we want to take a look at developing a sample trading system for huge earnings.

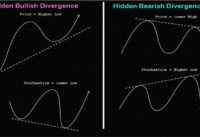

Usage another indicator to confirm your conclusions. If the resistance and the assistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading situation, you will not have the ability to presume that the cost will turn as soon as more. So, you may simply want to set your orders beyond the stretch ofthe resistance and the assistance lines in order for you to capture an occurring breakout. However, you must use another indication so you can validate your conclusions.

When the trade is in movement – wait for the trade to get well under method prior to moving your stop, then route it up gradually, so you don’t get gotten by random volatility.

While the guidelines give you reasons to go into trades, it does not suggest that the price will enter your desired direction. The concept is “Do not forecast the market”. Instead, you need to let the cost movement lead your method, understanding at anytime rate could change and go in a various direction. If the price does not move in your favor, you have to Stochastic Trading offer up and stop out.

Do you have a stop loss or target to exit a trade? Among the greatest errors that forex traders made is trading without a stop loss. I have actually stressed often times that every position should have a stop loss but till now, there are a lot of my members still Stochastic Trading without setting a stop. Are you among them?

While these breaks can sometimes be hard to take, if the assistance or resistance is legitimate, the odds favour a huge move – however not all breakouts are produced equal.

Is it actually that basic? We think so. We were right recently on all our trades, (and we did even much better in energies have a look at our reports) obviously we might have been incorrect, but our entries were timed well and had close stops for risk control.

When the rate touches the lower band, the marketplace is considered to be oversold. Two of the very best are the stochastic sign and Bollinger band. The wider the bands are apart the higher the volatility of the currency studied.

If you are looking updated and exciting videos about Bearish Divergence Stochastic, and Trading Tool, Market Cycles you are requested to subscribe our email list now.