OK Trader Forex Live #13 MACD & Stochastic

New complete video top searched Currency Trading Tutorial, Online Forex Trading, Trading Rules, and Macd And Stochastic A Double-cross Strategy, OK Trader Forex Live #13 MACD & Stochastic.

Macd And Stochastic A Double-cross Strategy, OK Trader Forex Live #13 MACD & Stochastic.

4 Pointers To Successfully Trade Forex In An Unpredictable Market

There are lots of fake breakouts though and therefore you want to trade breakouts on the present pattern.

In swing trading, a trader tries to ride a trend in the market as long as it lasts.

OK Trader Forex Live #13 MACD & Stochastic, Find interesting videos related to Macd And Stochastic A Double-cross Strategy.

Totally Free Forex Trading Strategy

This depends on how frequently one refers the trade charts. When the guidelines are met, whatever it is, the trader can leave the trading or go into. But all is not lost if the traders make guidelines for themselves and follow them.

Here we are going to look at how to use forex charts with a live example in the markets and how you can use them to discover high chances probability trades and the chance we are going to look at is in dollar yen.

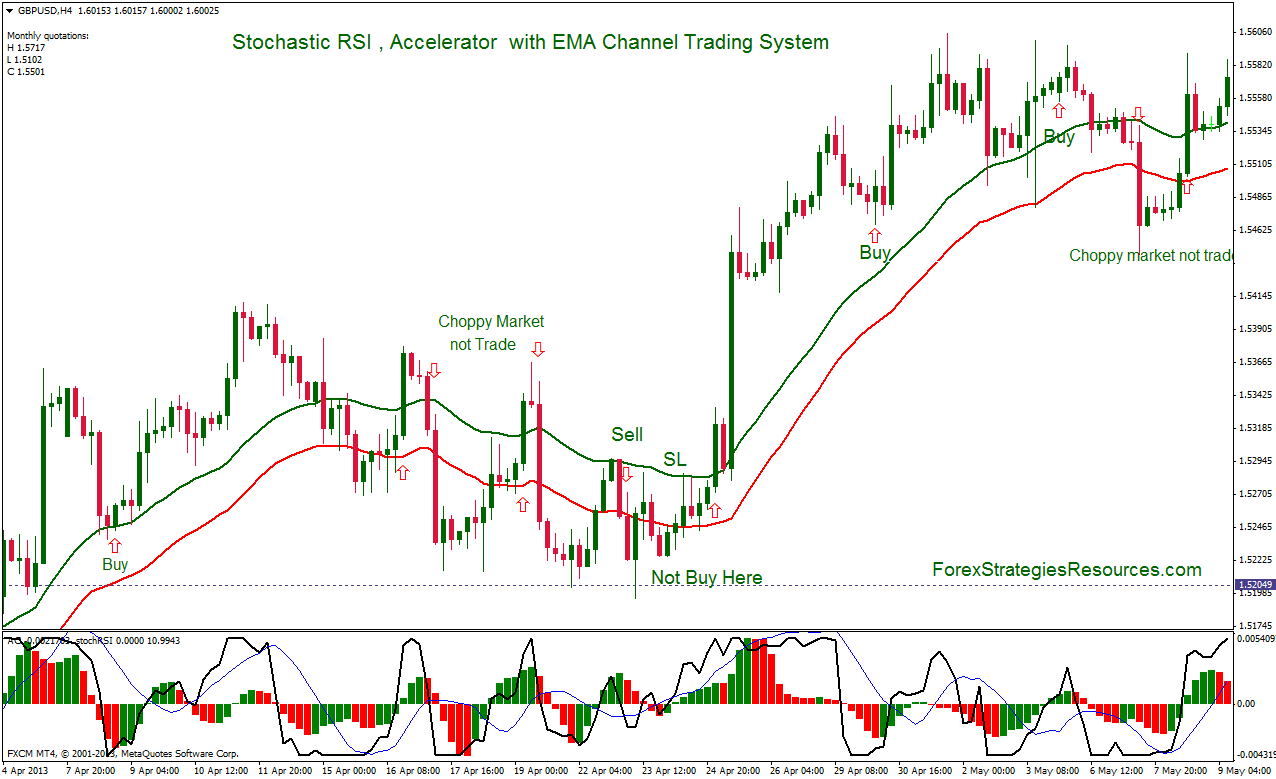

You’ll see that when a stock price strikes the lower Bollinger Band, it usually tends to rise again. Using the SMA line in the middle of the Bollinger Bands offers Stochastic Trading us an even much better picture. Keep in mind, whatever stock sign you pick from on the NASDAQ 100, you need to look for any news on it prior to you trade it as any unfavorable news might impact the stock no matter what the Nasdaq performance is like.

You then need to see if the chances are on your side with the breakout so you check rate momentum. There are great deals of momentum indications to help you time your move and get the velocity of rate in your corner. The ones you select refer personal choice however I like the ADX, RSI and stochastic. If my momentum estimation includes up I go with the break.

These are the long term financial investments that you do not rush into. This is where you take your time evaluating Stochastic Trading an excellent area with resistance and support to make a substantial slide in earnings.

Stochastic Trading If the break happens you go with it, you need to have the state of mind that. Sure, you have actually missed the very first bit of earnings however history shows there is usually plenty more to follow.

The technical analysis needs to also be determined by the Forex trader. This is to predict the future trend of the price. Common signs used are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indications can be used in mix and not just one. This is to verify that the cost trend is real.

In common with practically all elements of life practice is the essential to getting all 4 aspects collaborating. This is now easier to achieve as many Forex websites have demonstration accounts so you can practice without running the risk of any actual money. They are the nearest you can get to trading in real time with all the pressure of potential losses. However remember – practice makes best.

Also, check the copyright at the bottom of the page to see how often the page is upgraded. I highly recommend you get at least a megabyte or more of memory. This depends on how frequently one refers the trade charts.

If you are searching updated and engaging reviews related to Macd And Stochastic A Double-cross Strategy, and Learn Forex Trading, Forex Traading System please subscribe in email list now.