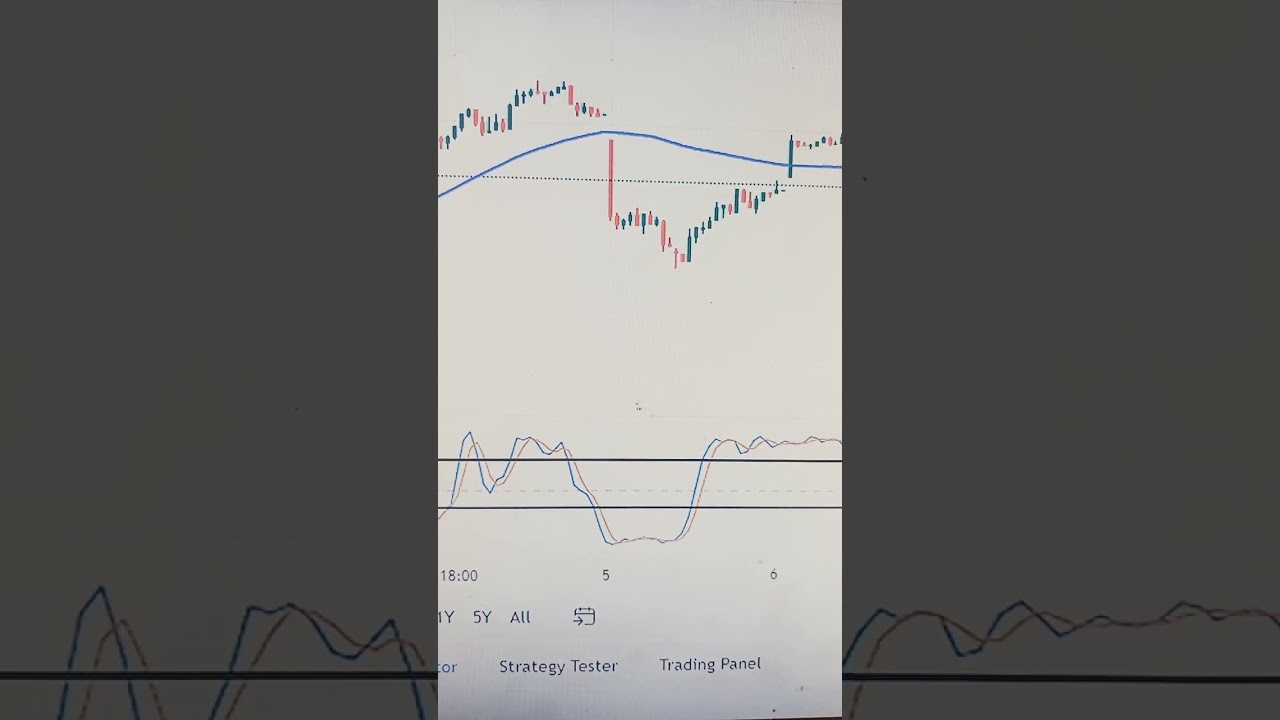

Moving Average (66)+ Stochastic (14,2,3) Best profitable strategy

Interesting full videos top searched Forex Day Trading, Forex Trading Ideas, and Stochastic Scalping Strategy, Moving Average (66)+ Stochastic (14,2,3) Best profitable strategy.

Stochastic Scalping Strategy, Moving Average (66)+ Stochastic (14,2,3) Best profitable strategy.

Forex Swing Trading For Beginners

You might take one look at it and believe it is rubbish. Using an automated system will assist you step up your portfolio or begin developing an effective one. This everyday charts strategy can make you 100-500 pips per trade.

Moving Average (66)+ Stochastic (14,2,3) Best profitable strategy, Play trending explained videos relevant with Stochastic Scalping Strategy.

Forex Charting Errors – Make These Errors And You Will Lose

Now, the slope of a trendline can inform you a lot about the strength of a trend. These are: financial analysis and technical analysis. Strong assistance exits From 1.7310 to 1.7280 levels. They will “bring the stocks in” to change their position.

Pattern trading is certainly my favorite kind of trading. When the market patterns, you can make a heap of money in simply a very brief time. Nevertheless, the majority of the time the market isn’t trending. Sometimes it merely ranges backward and forward. Does this mean you need to simply stroll away? Hardly! You can earn money in a ranging market, and here is how.

Use another indicator to validate your conclusions. If the resistance and the supportlines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading circumstance, you will not be able to presume that the cost will turn once again. So, you might just desire to set your orders beyond the stretch ofthe support and the resistance lines in order for you to capture a happening breakout. Nevertheless, you should utilize another indicator so you can verify your conclusions.

The very first indicate make is if you like action and wish to trade all the time don’t keep reading – this is everything about trading very high chances trades for big revenues not trading for enjoyable or messing about for a couple of pips.

Stochastic Trading The swing trader purchases into fear and sells into greed, so lets take a look at how the effective swing trader does this and take a look at a bullish trend as an example.

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise should try to find floors and ceilings in a stock chart. This can reveal a trader about where to get in and about where to get out. I say “about” since it is quite hard to guess an “specific” bottom or an “specific” top. That is why locking in earnings is so so vital. , if you don’t lock in earnings you are really running the threat of making a worthless trade.. Some traders end up being truly greedy and it only injures them.

How do you draw trendlines? In an up pattern, connect two lower highs with a line. That’s it! And in a drop, connect 2 greater lows with a straight line. Now, the slope of a trendline can inform you a lot about the strength of a trend. For instance, a high trendline reveals extreme bullish mindset of the purchasers.

In this article is a trading strategy revealed that is based upon the Bolling Bands and the stochastic signs. The technique is easy to use and might be utilized by day traders that want to trade brief trades like 10 or 30 minute trades.

This system is basic and you need to comprehend this reality – all the very best systems are. Develop a trading system that works for you based on your testing results. Absolutely nothing could be further from the truth!

If you are looking updated and entertaining comparisons relevant with Stochastic Scalping Strategy, and Market Timing, Best Forex Tradsing Strategies dont forget to signup our a valuable complementary news alert service for free.

![Stochastic Oscillator Indikator Forex Paling Akurat Semua Trader [RAHASIA SETTING] Stochastic Oscillator Indikator Forex Paling Akurat Semua Trader [RAHASIA SETTING]](https://Stochastictrader.com/wp-content/uploads/1706719048_Stochastic-Oscillator-Indikator-Forex-Paling-Akurat-Semua-Trader-RAHASIA-SETTING-200x137.jpg)