Mastering Stochastic Oscillator: Part 2 – Candlestick Patterns and Divergence Spotting

Top high defination online streaming highly rated Swing Trading Ranges, Forex Traading System, Trading Rules, and Best Stochastic Setting For Divergence, Mastering Stochastic Oscillator: Part 2 – Candlestick Patterns and Divergence Spotting.

Welcome back to the second part of our in-depth series on mastering the Stochastic Oscillator. In this episode, we take your understanding of this powerful indicator to the next level by exploring two essential techniques: using it in conjunction with candlestick patterns and spotting divergences for more accurate trading signals.

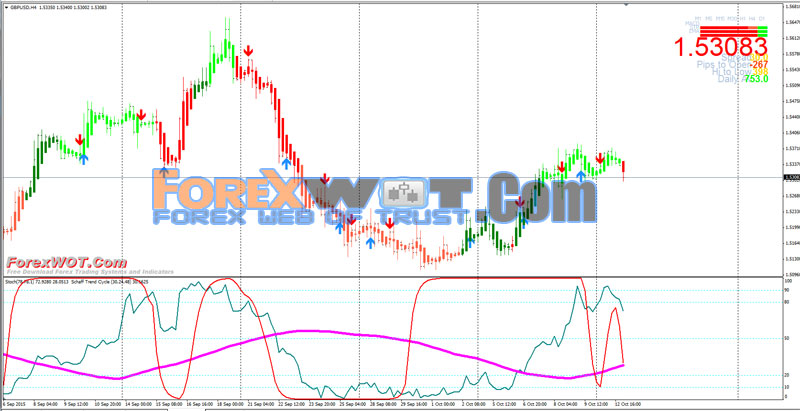

Discover how to combine the Stochastic Oscillator with popular candlestick patterns to validate trade setups and enhance your confidence in making trading decisions. We’ll cover how to identify bullish and bearish reversal patterns in harmony with the Stochastic Oscillator’s signals, allowing you to pinpoint potential trend changes with precision.

Furthermore, we delve into the art of spotting divergences with the Stochastic Oscillator, a key technique utilized by seasoned traders. Learn how to identify bullish and bearish divergences between price action and the Stochastic Oscillator, providing invaluable insights into potential trend reversals.

Throughout the video, we showcase real-life examples to illustrate the application of these methods in different market conditions. By the end of this episode, you’ll have a well-rounded knowledge of how to leverage the Stochastic Oscillator alongside candlestick patterns and spot divergences, empowering you to make more informed and effective trading decisions.

Subscribe now and join us in this immersive learning experience as we unveil the advanced techniques of using the Stochastic Oscillator with candlestick patterns and divergence spotting. Elevate your trading skills and gain a competitive edge in the financial markets. Don’t miss this opportunity to become a more confident and successful trader in Part 2 of our Stochastic Oscillator series!

🍀I Give You 250$ 🍀GIFT for investments https://www.liteforex.com/promo/codes/?code=INVITE_718238115&uid=718238115

📌To stay in touch and check my trades you go here 📌 https://my.liteforex.com/traders/info?id=745117&uid=148570395

• what is Stochastic indicator and how Stochastic works in forex and stock market

• how to use and how to read Stochastic oscillator (how to buy and sell using Stochastic indicator)

• how to interpret Stochastic when trading stocks (Stochastic explained for beginners)

• how does Stochastic indicator work in forex and how to correctly trade with Stochastic indicator

• how to use Stochastic indicator to spot divergences and how does Stochastic divergences work

• how to take long and short positions with Stochastic oscillator

• which are the best Stochastic settings and parameters for day trading

• what are Stochastic crossovers and what are the best signals offered by Stochastic lines (%K and %D)

• simple and effective Stochastic trading strategies for day trading/swing trading or scalping the Forex and stock market

#stochasticindicator #stochastictradingstrategy #forex #forexdemoaccountmt4 #raynerteo #stochasticindicatorsettings #forextradingdemoaccount #stochasticindicatorscalping #howtousestochasticindicator #stochasticrsitradingstrategy #priceactiontrading #intradaytrading #stochastic #stockmarket #exponentialmovingaverage #intradaytradingstrategies #stocks #stochasticsignals #livetrading #stockmarketlive #forextradinglive #intradaytradinglive

Best Stochastic Setting For Divergence, Mastering Stochastic Oscillator: Part 2 – Candlestick Patterns and Divergence Spotting.

How To Use Fibonacci In Forex

Using an automated system will help you step up your portfolio or begin producing a successful one. Trading is constantly short-term while investing is long term. Candlestick charts were invented by Japanese rice traders in the 16th century.

Mastering Stochastic Oscillator: Part 2 – Candlestick Patterns and Divergence Spotting, Get popular full length videos about Best Stochastic Setting For Divergence.

Forex Suggestions For Novices – How To Generate Income When There Is No Trend

You might take one take a look at it and think it is rubbish. What were these basic experts missing out on? More typical indications include: stochastic, r.s.i, r.v.i, moving averages, candle sticks, and so on.

Forex swing trading is easy to comprehend, just needs an easy system, its also amazing and fun to do. Here we will take a look at how you can end up being an effective swing trader from house and stack up huge profits in around 30 minutes a day.

Excellent ones to look at are Relative Strength Index (RSI) Stochastic Trading, Typical Directional Motion (ADX) – There are others – but these are an excellent place to begin.

The 2nd sign is the pivot point analysis. This analysis strategy depends on identifying various levels on the chart. There are three levels that serve as resistance levels and other three that function as support levels. The resistance level is a level the rate can not exceed it for a large period. The support level is a level the price can not go below it for a big duration.

OK now, not all breakouts are produced equal and you want the ones where the chances are highest. You’re looking for Stochastic Trading support and resistance which traders discover crucial and you can typically see these levels in the news.

It is essential to find a forex robotic that features a 100% money back assurance. , if there is a cash back guarantee this indicates that it is one of the best forex Stochastic Trading robots out there..

How do you draw trendlines? In an up pattern, link 2 lower highs with a line. That’s it! And in a downtrend, connect 2 higher lows with a straight line. Now, the slope of a trendline can inform you a lot about the strength of a pattern. For instance, a high trendline shows extreme bullish attitude of the purchasers.

Energy markets are unstable and can make any trader appearance silly but they provide some fantastic revenue opportunities at present which traders can benefit from.

The 60 min chart uses up about 1/3 of my screen space and the 5 min 2/3 of the screen area. For that reason if there is a chance for you to do a counter trend trade remember DO NOT take that trade.

If you are finding best ever engaging comparisons relevant with Best Stochastic Setting For Divergence, and Forex Trading Strategies, Forex Trading Advice, Forex Day Trading Signals dont forget to join in email alerts service totally free.