What is Hidden Divergence? – Technical Analysis Guide

Best videos about Trade Without Indicators, Forex Tip Trading, and Divergence In Stochastic, What is Hidden Divergence? – Technical Analysis Guide.

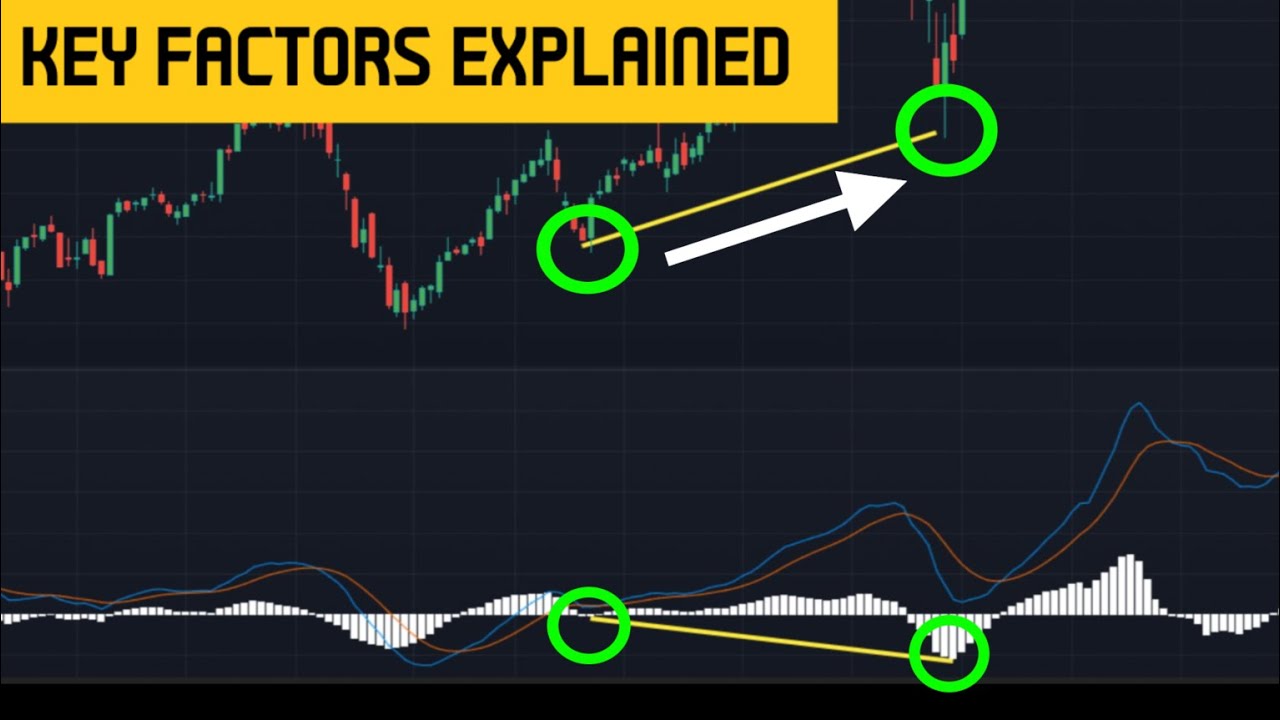

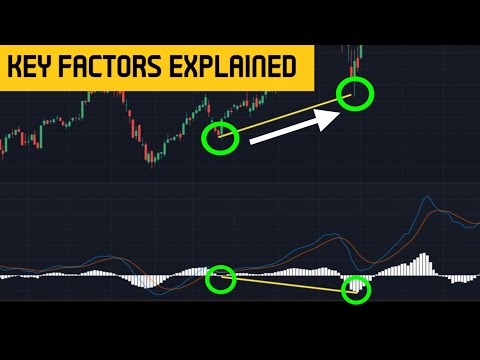

Part 1: What is hidden divergence

Part 2: Hidden Divergence with price action

✅ Subscribe: https://www.youtube.com/channel/UCpgmb87fXUqu8U6XZ1DivUQ?sub_confirmation=1

Check out the website for more content on this topic: https://www.subjectinvesting.com

Timestamps:

0:00 – Intro

0:40 – What is hidden divergence

0:50 – Hidden bullish divergence example

1:10 – Hidden bearish divergence example

2:40 – Hidden divergence proximity tip

Divergence In Stochastic, What is Hidden Divergence? – Technical Analysis Guide.

5 Steps To Trading Success Using Technical Analysis

This is how the market works and your system should obey this law. In an up trend, connect two lower highs with a line. As stated above, it should be easy to relieve the usage of it.

What is Hidden Divergence? – Technical Analysis Guide, Search popular reviews relevant with Divergence In Stochastic.

Simple Systems For Trading Forex

A good trader not only thinks about the heights of profits however also considers the threat involved. Sometimes it simply ranges backward and forward. In other words, forget those complicated Forex trading systems.

There is a difference between trading and investing. Trading is always short term while investing is long term. The time horizon in trading can be as brief as a couple of minutes to a couple of days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Many people day trade or swing trade stocks, currencies, futures, options, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the exact same day making a quick earnings. In swing trading, a trader tries to ride a pattern in the market as long as it lasts. On the other hand, an investor is least pressed about the short-term swings in the market. She or he has a long term time horizon like a few months to even a couple of years. This very long time horizon matches their investment and financial objectives!

You’ll see that when a stock price strikes the lower Bollinger Band, it typically tends to increase once again. Utilizing the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even much better picture. Remember, whatever stock symbol you choose from on the NASDAQ 100, you must look for any news on it prior to you trade it as any unfavorable news might affect the stock no matter what the Nasdaq efficiency is like.

You then require to see if the odds are on your side with the breakout so you inspect rate momentum. There are lots of momentum indicators to assist you time your move and get the velocity of rate on your side. The ones you pick are a matter of personal choice however I like the ADX, RSI and stochastic. If my momentum calculation accumulates I opt for the break.

Focus on long-lasting trends – it’s these that yield the huge earnings, as they can last for several years. Rewarding Stochastic Trading system never ever asks you to break the trend. Patterns equate to big earnings for you. Breaking the pattern indicates you are risking your cash needlessly.

Numerous traders make the error of thinking they can use the swing trade technique daily, however this is not a great idea and you can lose equity rapidly. Rather reserve forex swing trading for days when the marketplace is perfect for swing trading. So, how do you understand when the marketplace is right? Enjoy for resistance or support that has actually been held several times like when the chart is high or low. Enjoy the momentum and look for when rates swing strongly towards either the resistance or the assistance, while this is occurring look for verification that the momentum will turn. This verification is important and if the momentum of the rate is starting to wane and a turn is likely, then the odds remain in great favor of a swing Stochastic Trading environment.

But do not believe it’s going to be a breeze either. Don’t anticipate t be a millionaire overnight, because that’s simply not reasonable. You do require to put in the time to find out about technical analysis. By technical analysis, I do not mean tossing a couple of stochastic indicators on your charts, and have them tell you what to do. Sadly, that’s what a great deal of traders believe technical analysis is.

Position the trade at a stop loss of approximately 35 pips and you ought to use any of these two strategies for the function of making earnings. The very first is apply a good danger to a rewarding ratio of 1:2 while the next is to make use of support and resistance.

The lower it descends below the 0 line the stronger the sag. If the support and the resistance lines are touching, then, there is likely to have a breakout. Let’s discuss this Daily Timeframe Method.

If you are finding best ever engaging videos relevant with Divergence In Stochastic, and Ranging Market, Trend Line, Simple Forex Trading Strategy, Daily Timeframe Strategy you should list your email address for email alerts service for free.