How to Use Price Action Trading Indicators to Confirm Your Trading Signals

Interesting guide top searched Automatic Forex, Trading Tool, Momentum Oscillators Forex, and Best Stochastic Settings For 5 Minute Chart, How to Use Price Action Trading Indicators to Confirm Your Trading Signals.

Trade with the leading broker in the world and unlock exclusive benefits by clicking on the link: https://www.icmarkets.com/?camp=43804

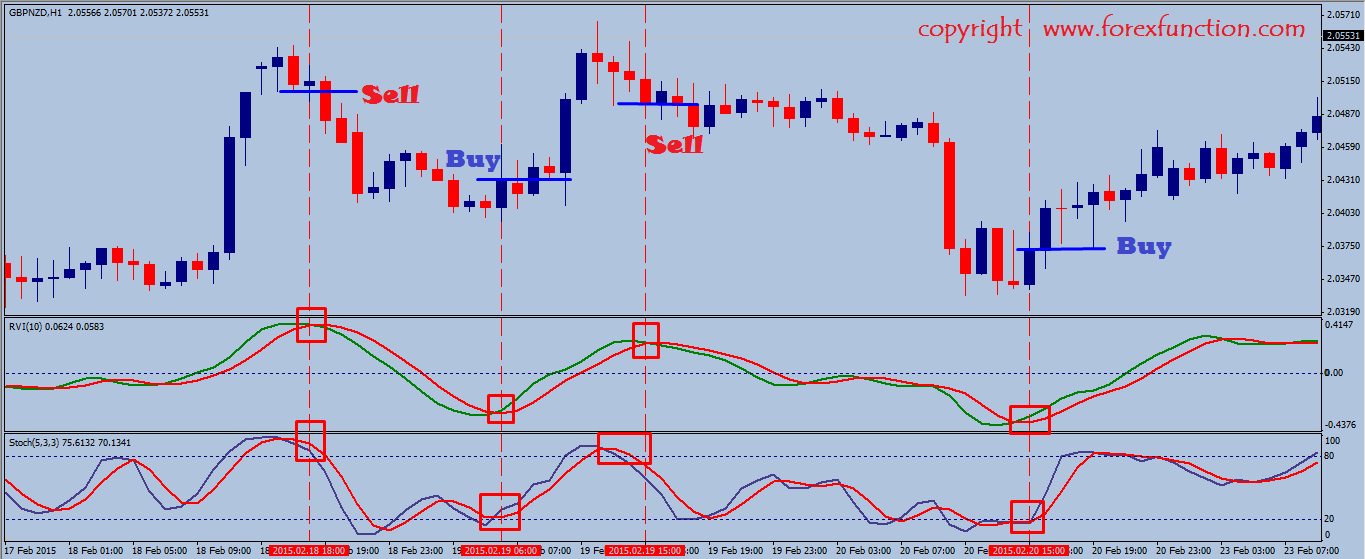

Price action trading indicators are technical analysis tools that can be used to confirm your trading signals. They can help you identify trends, support and resistance levels, and potential breakouts.

How to use price action trading indicators to confirm your trading signals:

1. Choose the right indicators. There are many different price action trading indicators available, so it’s important to choose the ones that work best for you and your trading style. Some popular price action trading indicators include:

**Japanese candlesticks: Candlestick charts are a popular way to visualize price action. They show the open, high, low, and close prices for a given period of time. Candlestick patterns can be used to identify trend reversals, breakouts, and other important market signals.

**Pivot points: Pivot points are calculated using the previous day’s open, high, low, and close prices. They can be used to identify support and resistance levels, as well as potential breakout targets.

**Moving averages: Moving averages are calculated by averaging the closing prices over a certain period of time. They can be used to identify trends and potential breakouts.

2. Use multiple indicators together. No single price action trading indicator is perfect. It’s best to use multiple indicators together to get a more complete picture of the market.

3. Consider the context. Price action trading indicators are most effective when used in conjunction with other forms of technical analysis, such as chart patterns and trend analysis. It’s also important to consider the fundamental factors affecting the market when making trading decisions.

Here are some examples of how to use price action trading indicators to confirm your trading signals:

**Identifying trend reversals: You can use candlestick patterns, such as hammer and engulfing patterns, to identify potential trend reversals. You can also use moving averages to confirm a trend reversal. For example, if a stock price crosses above its 50-day moving average after a downtrend, this could signal a bullish reversal.

**Identifying support and resistance levels: Pivot points and moving averages can be used to identify support and resistance levels. For example, if a stock price bounces off a pivot point several times, this could indicate that the pivot point is acting as a support level.

**Identifying potential breakouts: You can use candlestick patterns, such as pin bars and breakaways, to identify potential breakouts. You can also use moving averages and support and resistance levels to confirm a breakout. For example, if a stock price breaks out above its 50-day moving average after a consolidation period, this could signal a bullish breakout.

It’s important to remember that no price action trading indicator is perfect. All indicators have their limitations, and they can sometimes produce false signals. It’s important to use price action trading indicators in conjunction with other forms of technical analysis and risk management to make informed trading decisions.

#stockmarket #forextrading #cryptocurrencytrading #financialmarkets #investing #tradingtips #tradingeducation #daytrading #swingtrading #technicalanalysis

#SmartMoneyIndicator #BreakoutIndicator #DayTradingIndicator #BuySellSignal #MarketStructureBreak #OrderBlocks #Forextrading #Livetrading #Intradaytrading #BankNiftyoptiontrading #Nifty50 #Howtogrowatradingaccount #Daytrading #Tradingstrategies #Tradingtips #Tradinglessons #Tradingpsychology #Tradingforbeginners #Stockmarket #Investing #Finance #Money #Tradinglifestyle #Tradingcommunity #Learn2trade #Tradewise #Profitabletrading #Tradingcoach #Tradingsignals #tradingcourse

Indicator Download Link:- on my telegram channel ( https://t.me/poweroftradingofficial1 )

How to Install Indicator In MT4 ( Step by Step ) – https://youtu.be/ztcYw9Q_LTg

Business Contact Email : poweroftrading7@gmail.com

Twitter : https://twitter.com/PowerOfTrading2?s=09

Facebook : https://www.facebook.com/power.oftrading.12

Instagram : https://www.instagram.com/poweroftrading7/

Indicator Download Link:- on my telegram channel ( https://t.me/poweroftradingofficial1 )

Subscribe Our Channel To Received crypto And Forex or stock market Profitable Indicators And Strategy (FULL FREE )

I Hope This Indicator Brings Success For You.

Thanks For Watching Video …….

Best Stochastic Settings For 5 Minute Chart, How to Use Price Action Trading Indicators to Confirm Your Trading Signals.

Online Forex Trading – This Basic Reality Could Make You Substantial Profits

There are lots of fake breakouts though and therefore you wish to trade breakouts on the current trend.

In swing trading, a trader tries to ride a trend in the market as long as it lasts.

How to Use Price Action Trading Indicators to Confirm Your Trading Signals, Explore more explained videos related to Best Stochastic Settings For 5 Minute Chart.

Ideal Storm Of Trading

The most effective indication is the ‘moving average’. The move after such dormant durations will nearly constantly be in the instructions of the general trend. There are no easy forex methods for that situation.

Numerous traders aim to purchase a currency trading system and don’t recognize how easy it is to build their own. Here we want to take a look at constructing a sample trading system for substantial profits.

You’ll notice that when a stock cost hits the lower Bollinger Band, it usually tends to rise again. Utilizing the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even better image. Keep in mind, whatever stock symbol you choose from on the NASDAQ 100, you ought to look for any news on it before you trade it as any unfavorable news could impact the stock no matter what the Nasdaq efficiency is like.

Because easy systems are more robust than complex ones in the ruthless world of trading and have fewer aspects to break. All the leading traders use essentially easy currency trading systems and you should to.

, if you look at the weekly chart you can plainly Stochastic Trading see resistance to the dollar at 114.. We likewise have a yen trade that is up with lower highs from the July in a strong pattern the mid Bollinger band will act as resistance or assistance, in this case it serves as resistance and is just above the 114.00 level. Momentum is up at present – will the resistance hold its time to take a look at the everyday chart.

You can spend around 30 minutes a day, trading in this manner with your forex Stochastic Trading strategy and then go and do something else. You just require to inspect the rates one or two times a day which’s it.

The technical analysis should also be identified by the Forex trader. This is to anticipate the future pattern of the rate. Common indications utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indications can be utilized in combination and not just one. This is to confirm that the rate pattern is true.

In this short article is a trading strategy revealed that is based on the Bolling Bands and the stochastic signs. The technique is easy to utilize and might be used by day traders that wish to trade short trades like 10 or 30 minute trades.

A trader might take note on other charts however this will be the main location of concern. Nevertheless, most of the time the marketplace isn’t trending. It is a clear sign that the BP currency is over bought.

If you are finding updated and entertaining reviews relevant with Best Stochastic Settings For 5 Minute Chart, and Stock Market Trend, Currency Swing Trading dont forget to subscribe for a valuable complementary news alert service for free.