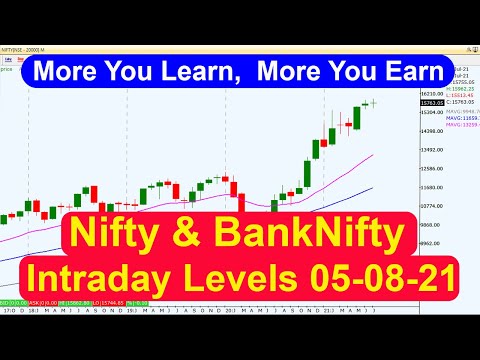

Nifty and Banknifty Intraday Trading Levels 05 08 21 RSI Bearish Divergence All Time High

Popular high defination online streaming about Forex Basics, Commodity Trading Systems, Learn Forex, Stochastic Indicator, and Bearish Divergence Stochastic, Nifty and Banknifty Intraday Trading Levels 05 08 21 RSI Bearish Divergence All Time High.

MEGA Offer : “ZERODHA” , “UPSTOX” , “5Paisa” OPEN any one of the below Trading & Demat account under our Partner Referral …

Bearish Divergence Stochastic, Nifty and Banknifty Intraday Trading Levels 05 08 21 RSI Bearish Divergence All Time High.

Forex Pattern Analysis – How To Identify When The Very Best Time Is To Sell

The buzzword today in trading is “signs, indications, indications”. This is to verify that the rate pattern is real. The final band in the Forex trading method is the entry and exit points.

Nifty and Banknifty Intraday Trading Levels 05 08 21 RSI Bearish Divergence All Time High, Watch top replays relevant with Bearish Divergence Stochastic.

Forex Trend Following – 2 Pointers To Milk The Big Patterns For Bigger Profits

A basic product trading system like the above, traded with discipline is all you require. Although, it is not precisely sure-fire, you can still get a good upper hand by utilizing it. The concept is “Do not anticipate the market”.

The Stochastic Oscillator is an overbought/oversold indicator developed by Dr. George Lane. The stochastic is a typical sign that is integrated into every charting software application including MetaStock.

Some these “high leaflets” come out the high tech sector, that includes the Web stocks and semiconductors. Other “high leaflets” originated from the biotech stocks, which have actually increased volatility from such news as FDA approvals. Since Stochastic Trading there are fewer of them than on the NASDAQ that trade like a home on fire on the ideal news, after a while you will acknowledge the signs.

Checking is a process and it is advisable to check various tools throughout the years. The objective in testing the tools is to find the best trading tool the trader feels comfortable with in various market situation however likewise to enhance trading skills and profit margin.

It should increase the revenues and cut the losses: when you see a trend and use the system you developed Stochastic Trading , it needs to continue opening the offer if the profits going high and close the offer if the losses going on.

Many traders make the mistake of thinking they can use the swing trade strategy daily, however this is not a good concept and you can lose equity rapidly. When the market is simply right for swing trading, instead reserve forex swing trading for days. So, how do you understand when the marketplace is right? See for resistance or support that has been held a number of times like when the chart is low or high. Look and view the momentum for when costs swing highly towards either the resistance or the support, while this is happening look for confirmation that the momentum will turn. This confirmation is important and if the momentum of the rate is beginning to subside and a turn is likely, then the odds remain in excellent favor of a swing Stochastic Trading environment.

If you wish to earn money forget “purchasing low and offering high” – you will miss all the huge moves. Rather seek to “buy high and offer higher” and for this you need to understand breakouts. Breakouts are merely breaks of crucial assistance or resistance levels on a forex chart. Many traders can’t buy these breaks.

In typical with virtually all elements of life practice is the crucial to getting all 4 elements interacting. This is now much easier to attain as lots of Forex websites have demonstration accounts so you can practice without running the risk of any real cash. They are the nearest you can get to trading in genuine time with all the pressure of possible losses. But keep in mind – practice makes best.

Forex trading can be learned by anybody and easy forex trading systems are best. It is this if one need to understand anything about the stock market. It is ruled by feelings. When evaluating a stock’s chart, moving averages are vital.

If you are looking updated and entertaining comparisons about Bearish Divergence Stochastic, and Technical Analysis Trading Strategies, Trading 4x Online you are requested to join in email alerts service for free.