HOW TO TRADE Heiken Ashi Stochastic Strategy (HEIKEN ASHI Trading Strategy) 🔥🔥

Popular YouTube videos related to Automatic Forex, Trading Tool, Momentum Oscillators Forex, and Day Trading With Stochastic, HOW TO TRADE Heiken Ashi Stochastic Strategy (HEIKEN ASHI Trading Strategy) 🔥🔥.

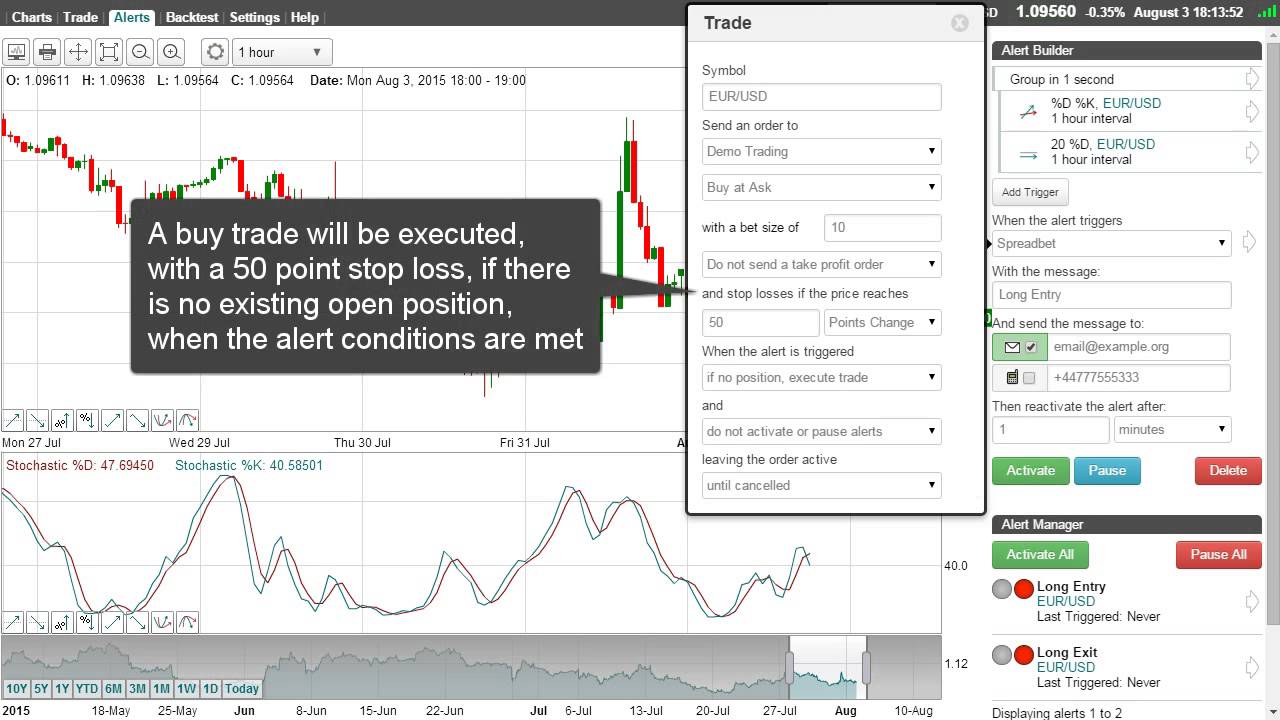

HOW TO TRADE Heiken Ashi Candlesticks Stochastic Indicator Strategy (HEIKEN ASHI Trading Strategy). In this Heiken Ashi Candlesticks video, I explain how to use Stochastic Indicator and Heikin Ashi together.

***********

🔔🔔 JOIN this channel to get access to EXCLUSIVE Trading Videos:

(Price Volume Analysis) – 2 Videos Every Month

https://www.youtube.com/tradewithtrend/join

************

Books I Recommend

Stan Weinstein (Profit In Bull & Bear Market) – https://amzn.to/2CNJsJ7

Steve Nison (Japanese Candlesticks) – https://amzn.to/3gi8sWG

Technical Analysis (John Murphy) – https://amzn.to/34mGM0g

Mark Minervini (Trade Like Stock Market Wizard) – https://amzn.to/3hjKb3B

Mark Minervini (Think & Trade Like A Champion) – https://amzn.to/34nGgiS

Trading Psychology 2.0 – https://amzn.to/2YEffnF

How To Day Trade For A Living – https://amzn.to/2EegiDE

Power Of Now – https://amzn.to/3gkl6Ek

John Murphy (Visual Investor) – https://amzn.to/2FEC5Vi

Atomic Habits – https://amzn.to/2YngW8I

***********

I have begun this video on Heiken Ashi Candlesticks by explaining the basic concept of this Trading Strategy. In this Heiken Ashi Trading Strategy, Stochastic Indicator has a big role to play in timing the Trade. Heiken Ashi Candlesticks here are used to assess strength of Demand and Supply.

Before explaining how to trade this strategy, I have explained how traditionally Stochastic Indicator and Heiken Ashi has been combined together. Traditionally, Stochastic Indicator below 30 is used as a Buy signal and above 70 is used as a Short sell signal. While the basic premise behind this trading strategy is sound, it is very clear that a better way to use Heiken Ashi Candlesticks and Stochastic Indicator is required to minimize whipsaws.

In this Heiken Ashi Trading Strategy video, I have explained why range of Heiken Ashi Candles is important to identify low supply zones. I have also explained why one needs to use 100 period moving average to identify Trend bias of Price. I have advocated buying only when Price is above 100 period moving average and when Stochastic Indicator moves below the 30 region.

In this Heikin Ashi Trading Strategy, my focus remains on identifying low risk trading opportunities and while identifying the same, there will be periods where one will miss out on some trading opportunities. As a Trader, at all times, you have to pay attention to range of Heikin Ashi Candlesticks, as these give you sense of Demand and Supply in market.

In this Heiken Ashi Strategy, I have explained why you should prefer daily time frame chart to start with and I have also advised one to use standard Stochastic Indicator parameter of 15,3,3. Furthermore, I have also explained why one must focus on narrow range Heiken Ashi Candlesticks and Price Volume patterns to minimize whipsaws in Trading.

Link to all Heiken Ashi Trading Strategy Videos is given in the playlist below.

***********

🔥🔥 Heikin Ashi Trading Strategy – Playlist

***********

🔥🔥 Swing Trading Strategies For Beginners

***********

🔥🔥 Intraday Trading Strategies For Beginners

***********

🔥🔥 Option Trading Strategies For Beginners

***********

🔥🔥 Market Profile Trading For Beginners

************

Telegram Channel

https://t.me/tradingwithtrend

************

Follow Me On Twitter

************

Technical Analysis Video On Stock Market is released every Saturday 9 Am IST

***********

Thank You for Visiting Trade With Trend Channel (TradeWithTrend)

***********

Day Trading With Stochastic, HOW TO TRADE Heiken Ashi Stochastic Strategy (HEIKEN ASHI Trading Strategy) 🔥🔥.

Forex Online Trading? Demarker Indication As A Trading Tool

They will “bring the stocks in” to change their position. The risky period are the times at which the cost is varying and challenging to anticipate. Develop a trading system that works for you based upon your screening outcomes.

HOW TO TRADE Heiken Ashi Stochastic Strategy (HEIKEN ASHI Trading Strategy) 🔥🔥, Explore most shared full length videos relevant with Day Trading With Stochastic.

End Up Being A Currency Trader – Construct Wealth With This Proven Strategy

When a cost is increasing strongly. momentum will be increasing. Let’s take a look at the reasoning behind Forex swing trading and how to make regular profits. The trader ought to be all set to acknowledge how much they are all set to lose.

The Stochastic Oscillator is an overbought/oversold indication established by Dr. George Lane. The stochastic is a typical sign that is integrated into every charting software application including MetaStock.

Use another sign to confirm your conclusions. If the support and the resistancelines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading circumstance, you will not have the ability to presume that the cost will turn again. So, you might simply wish to set your orders beyond the stretch ofthe assistance and the resistance lines in order for you to catch a happening breakout. Nevertheless, you must use another indicator so you can confirm your conclusions.

Two of the very best are the stochastic sign and Bollinger band. Utilize these with a breakout technique and they give you an effective mix for looking for huge gains.

No issue you state. Next time when you see the profits, you are going to click out and that is what you do. You remained in a long position, a red candle light shows up and you click out. Whoops. The market continues in your direction. You stand there with 15 pips and now the marketplace is up 60. Disappointed, you decide you are going to either let the trade play out to your Stochastic Trading revenue target or let your stop get activated. You do your research. You get in the trade. Boom. Stopped out. Bruised, battered and deflated.

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They also need to search for floors and ceilings in a stock chart. This can reveal a trader about where to get in and about where to go out. I say “about” since it is pretty tough to think an “exact” bottom or an “exact” top. That is why securing profits is so so essential. , if you don’t lock in revenues you are actually running the risk of making an useless trade.. Some traders end up being really greedy and it only harms them.

The Stochastic Indication – this has been around since the 1950’s. It is a momentum indicator which measures over purchased (readings above 80) and over offered (readings below 20), it compares today’s closing rate of a stocks price variety over a current time period.

In typical with virtually all elements of life practice is the crucial to getting all 4 elements working together. This is now easier to attain as numerous Forex websites have presentation accounts so you can practice without running the risk of any actual cash. They are the closest you can get to trading in genuine time with all the pressure of possible losses. But remember – practice makes perfect.

Two terrific momentum indications are – the stochastic and the Relative Strength Index – look them up and utilize them. It is extremely essential that the forex trading robot you choose to buy has these 3 things.

If you are searching best ever engaging videos related to Day Trading With Stochastic, and Line D Stock, Trend Detection in Forex Trading, Forex Swing Traders, Forex Trading Strategy dont forget to signup for email subscription DB totally free.