How to Buy the Dip day trading? Small Account Long Strategy

Popular guide relevant with Forex Basics, Commodity Trading Systems, Learn Forex, Stochastic Indicator, and Day Trading Stochastic Settings, How to Buy the Dip day trading? Small Account Long Strategy.

Trade with me: https://humbledtrader.com

Stop buying penny stock breakout spikes. Buy the dip long set up is better for beginner traders with a small trading account.

🔽Time stamps:

1:35 Daily chart trading pattern best for dip buying

3:35 How to draw STRONG support and resistance lines to buy the dip

7:54 Using high short interest to your advantage when buying the bounce

Buy the dip, or buying the bounce is the best long strategy for day trading beginners to build their small account. The risk reward is much better than buying penny stock break outs. Here is what I look for when I’m picking stocks to buy the bounce.

1. Parabolic Daily chart pattern

This kind of daily chart pattern provides traders the best momentum and volume to the upside. Essentially you are buying the bounce on trends for a long continuation to the upside.

2. Drawing strong daily support and resistance levels

The strongest support and resistance lines are from the daily. I look to buy the dip intraday trading at support lines that are drawn from the daily chart. Same way the daily resistance levels will likely act as the top on intraday runners.

▶️How to draw support and resistance lines in day trading:

3. High short interest

Heavily shorted stocks with high short interest are likely to squeeze when momentum is shifting to the upside and the buying volume comes in.

▶️Best stock scanner for short interest:

http://bit.ly/2mYKie2

▶️Other delayed resources:

https://finviz.com/

http://shortsqueeze.com/

When to Buy Stocks Overnight

How to Trade PART TIME while Working a Full Time Job

How to Grow a Small Account in 2020 Day Trading

🖥️Recommended Trading Tools:

Benzinga Pro FREE 14 day trial (use code “HUMBLEDTRADER” to get 25% Off )

http://bit.ly/2KXeAqH

Trade Ideas Scanner (use code “HUMBLED15” to get 15% Off)

https://bit.ly/3rLAfp2

Cobra Trading (Best broker for shorting stocks, $30K min)

Get 25% off commissions, mention “Humbled Trader” at the time of account opening

https://bit.ly/3cGJHlR

🇨🇦Questrade Canada (get $50 FREE commission trades)

http://bit.ly/2GoeUMY

Webull Free Trading app (Get free stocks with $100 deposit)

http://bit.ly/2Lhtd9X

Get My Trading Station Set Up & Favorite Trading Books

https://www.amazon.com/shop/humbledtrader

📊Follow me on social for more updates:

IG @HumbledTrader

Twitter @HumbledTrader18

#daytrading #pennystocks #stocks

___

DISCLAIMER: I am not a financial adviser nor a CPA. These videos are for educational and entertainment purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments.

AFFILIATE DISCLOSURE: I only recommend products and services I truly believe in and use myself. Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. Commissions earned will be used towards growing this channel.

Humbled Trader FAM count: 49,000

Day Trading Stochastic Settings, How to Buy the Dip day trading? Small Account Long Strategy.

Cycles Can Leapfrog Your Trading Success

Utilizing an automatic system will assist you step up your portfolio or start creating an effective one. Trading is always short-term while investing is long term. Candlestick charts were developed by Japanese rice traders in the 16th century.

How to Buy the Dip day trading? Small Account Long Strategy, Watch trending full videos related to Day Trading Stochastic Settings.

Best Storm Of Trading

Forex swing trading is among the very best methods for novices to seek big gains. Regrettably, that’s what a lot of traders believe technical analysis is. Keep your stop well back up until the pattern is in movement.

Forex swing trading is easy to comprehend, only requires a simple system, its likewise amazing and enjoyable to do. Here we will take a look at how you can become an effective swing trader from house and pile up huge profits in around 30 minutes a day.

It is this if one ought to know anything about the stock market. It is ruled by emotions. Emotions are like springs, they extend and contract, both for just so long. BB’s step this like no other indication. A stock, especially commonly traded large caps, with all the fundamental research study in the world currently done, will only lie inactive for so long, and then they will move. The relocation after such inactive periods will generally remain in the direction of the total pattern. And the next Stochastic Trading relocation will likely be up as well if a stock is above it’s 200 day moving average then it is in an uptrend.

Tonight we are trading around 1.7330, our very first area of resistance is in the 1,7380 range, and a second region around 1.7420. Strong support exits From 1.7310 to 1.7280 levels.

Focus on long-term patterns – it’s these that yield the huge earnings, as they can last for years. Rewarding Stochastic Trading system never asks you to go versus the pattern. Patterns translate to big revenues for you. Going against the pattern suggests you are risking your cash unnecessarily.

Technical analysts attempt to find a pattern, and flight that trend up until the trend has confirmed a reversal. If a great business’s stock is in a downtrend according to its chart, a trader or financier using Technical Analysis will not Stochastic Trading buy the stock till its trend has reversed and it has been confirmed according to other essential technical signs.

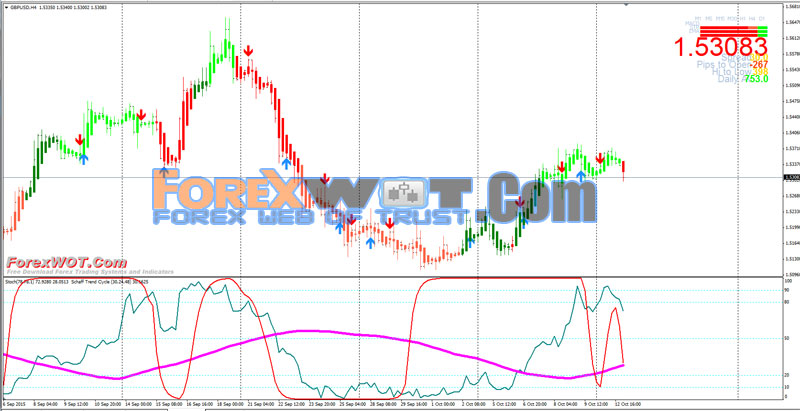

Inspect some momentum signs, to see how overbought momentum is and a fantastic one is the stochastic. We don’t have time to discuss it completely information here so look it up, its a visual indication and will only take 30 minutes or so to discover. Try to find it to end up being overbought and then. merely look for the stochastic lines to cross and turn down and get short.

Is it truly that easy? We think so. We were right recently on all our trades, (and we did even better in energies have a look at our reports) naturally we might have been wrong, but our entries were timed well and had close stops for danger control.

You can use the technique to create your own signal to trade FX from day to day. As a market moves upward toward a resistance, stochastic lines ought to generally punctuate. By waiting on a better cost they miss the relocation.

If you are looking best ever entertaining videos relevant with Day Trading Stochastic Settings, and Currency Trading, Market Cycles, Mechanical Forex Trading System you should list your email address in email subscription DB now.