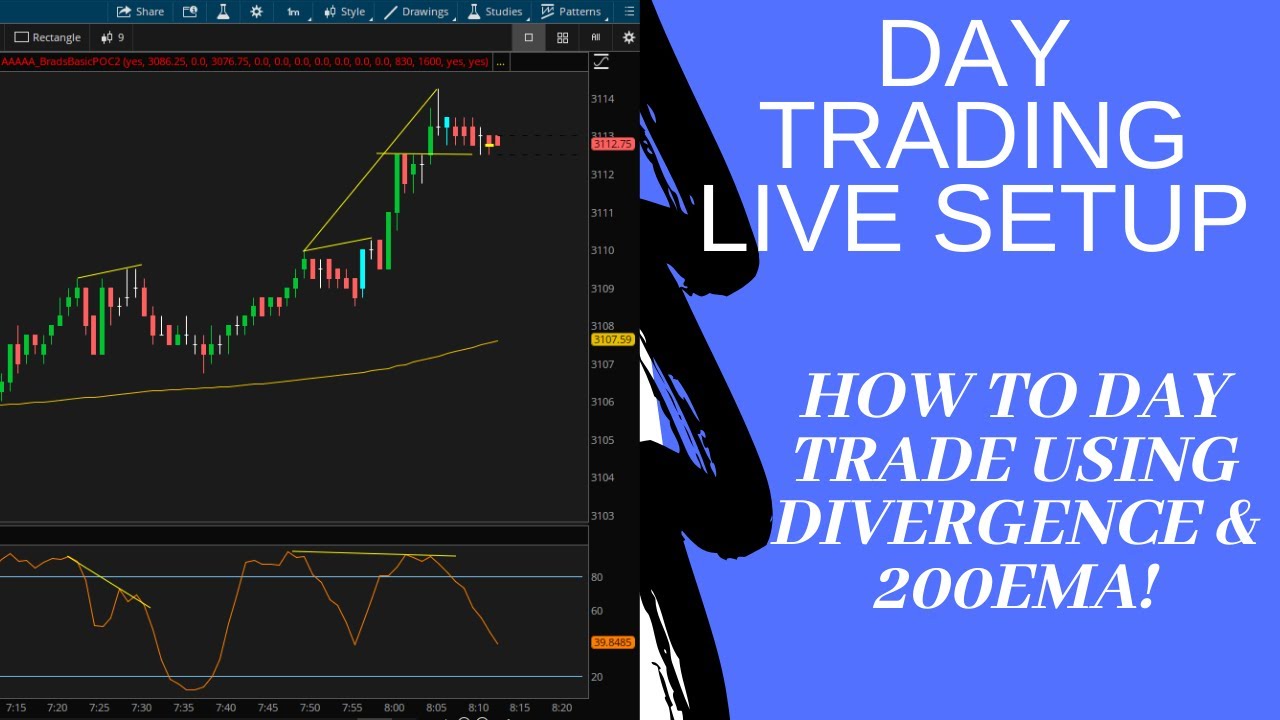

Day Trading S&P Emini Futures With Divergence & 200EMA In Real Time!

Best guide top searched Forex Bot, Free Forex Eudcation, Forex 101, Stock Investing, and Divergence In Stochastic, Day Trading S&P Emini Futures With Divergence & 200EMA In Real Time!.

In Today’s Free DayTradingFearless Raw & Uncut Trading Finance Education Video: I do a live in the market trade setup using divergence and yes I had a losing trade but I also had a winning trade. I show you both the good and bad trades.

Here is a link to my Thinkorswim 1 min chart with the stochastic. Here is the chart: http://tos.mx/lKUAqbD

My Patreon Page To See My Trading Portfolio & Private Educational Videos:

https://www.patreon.com/daytradingfearless

My Website: http://www.DayTradingFearless.com

BookMap Free Trial To See Order Flow In Your Trading:

https://tinyurl.com/y9a4fbb3

Recommended Trading Books on Amazon:

Day Trading – How to Day Trade for a Living – http://amzn.to/2vJXZQD

Swing Trading – Trading in the Zone: (Mark Douglas) http://amzn.to/2vqND5t

Using Fibonacci & Elliott Wave (Todd Gordon) http://amzn.to/2vqUADo

Affiliate Disclaimer: This video and description contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission. This helps support the channel and allows us to continue to make videos like this. Thank you for the support!

Risk Disclosure: Futures and Forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets.hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets.

Divergence In Stochastic, Day Trading S&P Emini Futures With Divergence & 200EMA In Real Time!.

Forex Trading System – Reputable Trading Ways

The Stochastic Oscillator is an overbought/oversold indicator developed by Dr.

The above approach is very easy and can be discovered by anyone and is a classic method to make big Forex gains.

Day Trading S&P Emini Futures With Divergence & 200EMA In Real Time!, Watch latest explained videos related to Divergence In Stochastic.

Thinking Of Getting A Forex Trading Robotic? 3 Concepts To Get It Right

It appears that we now just put value on intricacy or what we typically label as “advanced”. It is important to look for verification that the cost momentum will turn. Do you have a stop loss or target to leave a trade?

Forex swing trading is simple to comprehend, just needs a basic system, its also amazing and fun to do. Here we will take a look at how you can end up being a successful swing trader from house and pile up huge profits in around thirty minutes a day.

Good ones to look at are Relative Strength Index (RSI) Stochastic Trading, Typical Directional Motion (ADX) – There are others – but these are a terrific location to start.

His primary methodologies include the Dedication of Traders Index, which reads like a stochastic and the second is Major & Minor Signals, which are based on a static jump or decline in the previously mentioned index. His work and research are very first class and parallel his character as an individual. Nevertheless, for any method to work, it needs to be something the trader is comfy with.

No issue you say. Next time when you see the profits, you are going to click out and that is what you do. You remained in a long position, a red candle appears and you click out. Whoops. The marketplace continues in your instructions. You stand there with 15 pips and now the marketplace is up 60. Frustrated, you choose you are going to either let the trade play out to your Stochastic Trading profit target or let your stop get triggered. You do your research. You enter the trade. Boom. Stopped out. Bruised, damaged and deflated.

Lots of traders make the error of believing they can use the swing trade strategy daily, however this is not a good concept and you can lose equity quickly. When the market is just right for swing trading, instead reserve forex swing trading for days. So, how do you understand when the marketplace is right? When the chart is low or high, view for resistance or support that has actually been held numerous times like. Look and see the momentum for when rates swing strongly toward either the assistance or the resistance, while this is taking place look for confirmation that the momentum will turn. This confirmation is important and if the momentum of the price is beginning to subside and a turn is likely, then the odds are in fantastic favor of a swing Stochastic Trading environment.

If you desire to earn money forget “purchasing low and offering high” – you will miss out on all the big moves. Rather seek to “buy high and sell greater” and for this you require to understand breakouts. Breakouts are simply breaks of essential assistance or resistance levels on a forex chart. Most traders can’t purchase these breaks.

Position the trade at a stop loss of approximately 35 pips and you must use any of these 2 methods for the function of making revenue. The very first is use an excellent threat to a rewarding ratio of 1:2 while the next is to make use of support and resistance.

Yet again, check your evaluations versus at least 1 extra indication. In common with practically all elements of life practice is the crucial to getting all 4 aspects collaborating.

If you are finding best ever engaging reviews relevant with Divergence In Stochastic, and Stochastic System, Forex System, Determining Market Cycles, Forex Swing please signup for subscribers database for free.