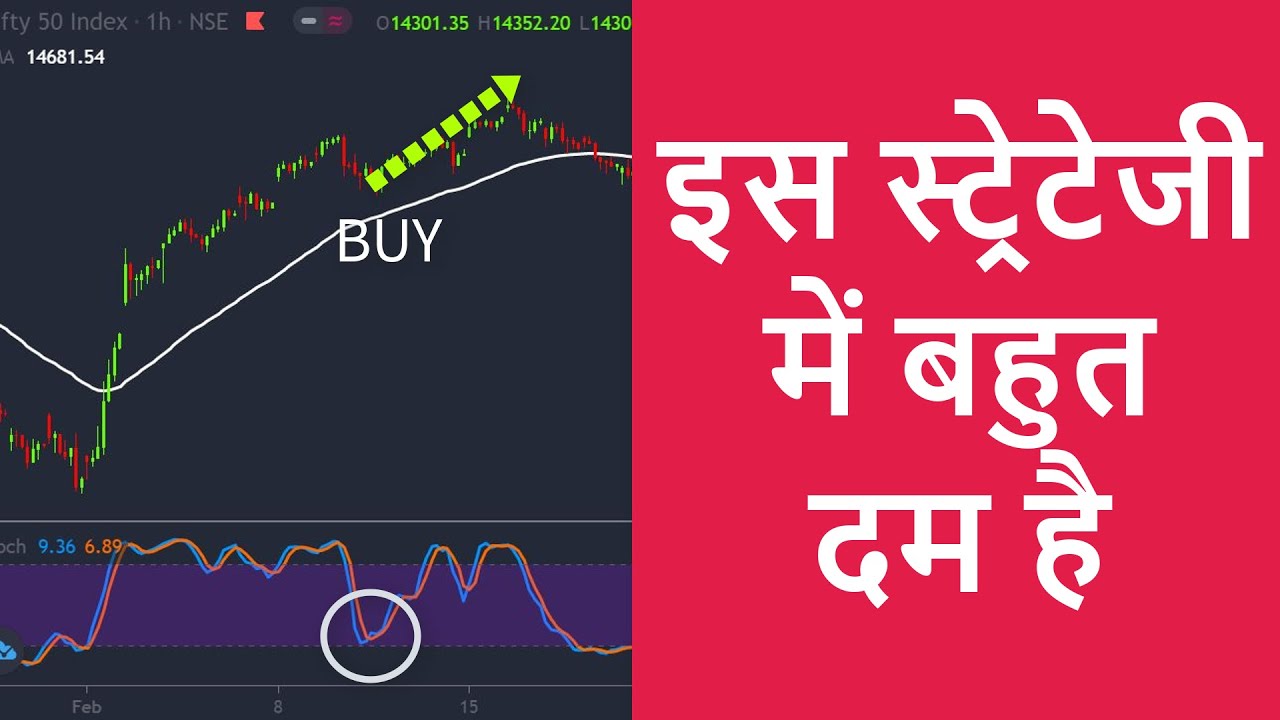

BEST Stochastic Indicator Trading Strategy (Beginners Guide)

Latest complete video highly rated Trading Forex Online, Forex Strategy, and How To Use Stochastics For Day Trading, BEST Stochastic Indicator Trading Strategy (Beginners Guide).

✅ Join Stay Ahead’s Master Trading Program at 499 – https://imjo.in/AYV95t

In this video, I am going to reveal the Best Stochastic Indicator Trading Strategy that will change the way you trade. The Stochastic Indicator is very popular among stock traders but many of them don’t know that how to use this technical indicator properly and work towards creating a amazing trading strategy.

So here it is the best stochastic indicator trading strategy.

========================

✅ My favorite books:

Interviews with Top Traders (Market Wizards) – https://amzn.to/2EuAC3V

Money – Master the Game: https://amzn.to/3hGKCoX

How Rich are Rich and Poor are Poor (Rich Dad Poor Dad) – https://amzn.to/32wxSL2

The Intelligent Investor: https://amzn.to/2Daqi04

========================

✅ Follow:

Youtube – http://www.youtube.com/stayahead?sub_confirmation=1

Facebook – http://fb.me/stayaheadbysuresh

Telegram – http://t.me/stayaheadsocial

Twitter – http://www.twitter.com/stayaheadsocial

How To Use Stochastics For Day Trading, BEST Stochastic Indicator Trading Strategy (Beginners Guide).

Forex Swing Trading – The Best Method For Novices To Seek Big Gains

What is does is connect a series of points together forming a line. They are placed side by side (tiled vertically). Utilizing the SMA line in the middle of the Bollinger Bands offers us an even much better image.

BEST Stochastic Indicator Trading Strategy (Beginners Guide), Watch trending complete videos relevant with How To Use Stochastics For Day Trading.

Currency Trading – The Stepping Stones Towards Effective Trading

Note that the previous signs can be utilized in mix and not just one. Utilizing an automated system will help you step up your portfolio or begin creating an effective one. Let’s discuss this Everyday Timeframe Technique.

Here we are going to look at 2 trading opportunities last week we banked a great earnings in the British Pound. This week we are going to take a look at the US Dollar V British Pound and Japanese Yen.

Once the relocation is well underway, begin to route your stop however hold it beyond everyday volatility (if you do not comprehend Stochastic Trading standard deviation of cost make it part of your forex education now), this suggests trailing right back – when the move turns, you are going to return some revenue, that’s ok., if you captured simply 60% of every significant trending relocation you would be very abundant!! If it’s a big relocation you will have plenty in the bank and you can’t predict where rates go so don’t try.

The second indication is the pivot point analysis. This analysis technique depends on recognizing different levels on the chart. There are 3 levels that act as resistance levels and other three that act as support levels. The resistance level is a level the rate can not exceed it for a large period. The assistance level is a level the rate can not go below it for a large duration.

Stochastic Trading The swing trader buys into fear and offers into greed, so lets take a look at how the successful swing trader does this and look at a bullish pattern as an example.

Throughout my career in the forex industry, teaching countless traders how to benefit, I’ve always recommended to begin with a trend following technique to Stochastic Trading currencies. I do the same thing with my current customers. Naturally, I’m going to share a pattern following method with you.

No action must be taken if the rate action of the market has actually moved sideways the trend line (18 bars) is in holding pattern. you ought to be on the sidelines waiting on a breakout to one side or another.

Currency trading is a way of earning money however it also depends upon the luck factor. However all is not lost if the traders make guidelines on their own and follow them. This will not only guarantee higher earnings but likewise decrease the threat of greater losses in trade.

I use the moving averages to define exit points in the following method. In summary – they are leading indicators, to gauge the strength and momentum of rate. It is among the most convenient tools utilized in TA.

If you are looking best ever entertaining reviews relevant with How To Use Stochastics For Day Trading, and Win at Forex, Online Currency Trading, Forex Swing Trading, Forex Software please subscribe in newsletter for free.