An introduction to Policy Gradient methods – Deep Reinforcement Learning

Latest videos related to Trading Rules, Daily Charts Forex Strategy, and Best Stochastic Setting For Divergence, An introduction to Policy Gradient methods – Deep Reinforcement Learning.

In this episode I introduce Policy Gradient methods for Deep Reinforcement Learning.

After a general overview, I dive into Proximal Policy Optimization: an algorithm designed at OpenAI that tries to find a balance between sample efficiency and code complexity. PPO is the algorithm used to train the OpenAI Five system and is also used in a wide range of other challenges like Atari and robotic control tasks.

If you want to support this channel, here is my patreon link:

https://patreon.com/ArxivInsights — You are amazing!! 😉

If you have questions you would like to discuss with me personally, you can book a 1-on-1 video call through Pensight: https://pensight.com/x/xander-steenbrugge

Links mentioned in the video:

⦁ PPO paper: https://arxiv.org/abs/1707.06347

⦁ TRPO paper: https://arxiv.org/abs/1502.05477

⦁ OpenAI PPO blogpost: https://blog.openai.com/openai-baselines-ppo/

⦁ Aurelien Geron: KL divergence and entropy in ML: https://youtu.be/ErfnhcEV1O8

⦁ Deep RL Bootcamp – Lecture 5: https://youtu.be/xvRrgxcpaHY

⦁ RL-adventure PyTorch implementation: https://github.com/higgsfield/RL-Adventure-2

⦁ OpenAI Baselines TensorFlow implementation: https://github.com/openai/baselines

Best Stochastic Setting For Divergence, An introduction to Policy Gradient methods – Deep Reinforcement Learning.

Win Forex Trading – If You Desire To Win Trade The Big Breakouts

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the stochastic. It is among the most convenient tools used in TA. Likewise trade on the duration where major markets are open.

An introduction to Policy Gradient methods – Deep Reinforcement Learning, Play more reviews related to Best Stochastic Setting For Divergence.

Earn Money Quick – Easy Trading Ideas To Build Real Wealth

Dow theory in nutshell says that you can use the past cost action to predict the future price action. Use these with a breakout approach and they offer you an effective combination for seeking big gains.

Among the things a brand-new trader discovers within a couple of weeks or two of beginning his new adventure into the world of day trading is the distinction in between three sign stocks and four sign stocks.

Forex is an acronym of foreign exchange and it is a 24hr market that opens from Sunday evening to Friday evening. It is the a lot of traded market on the planet with about $3 trillion being traded every day. With this arrangement, you can trade on your own schedule and exploit price Stochastic Trading fluctuations in the market.

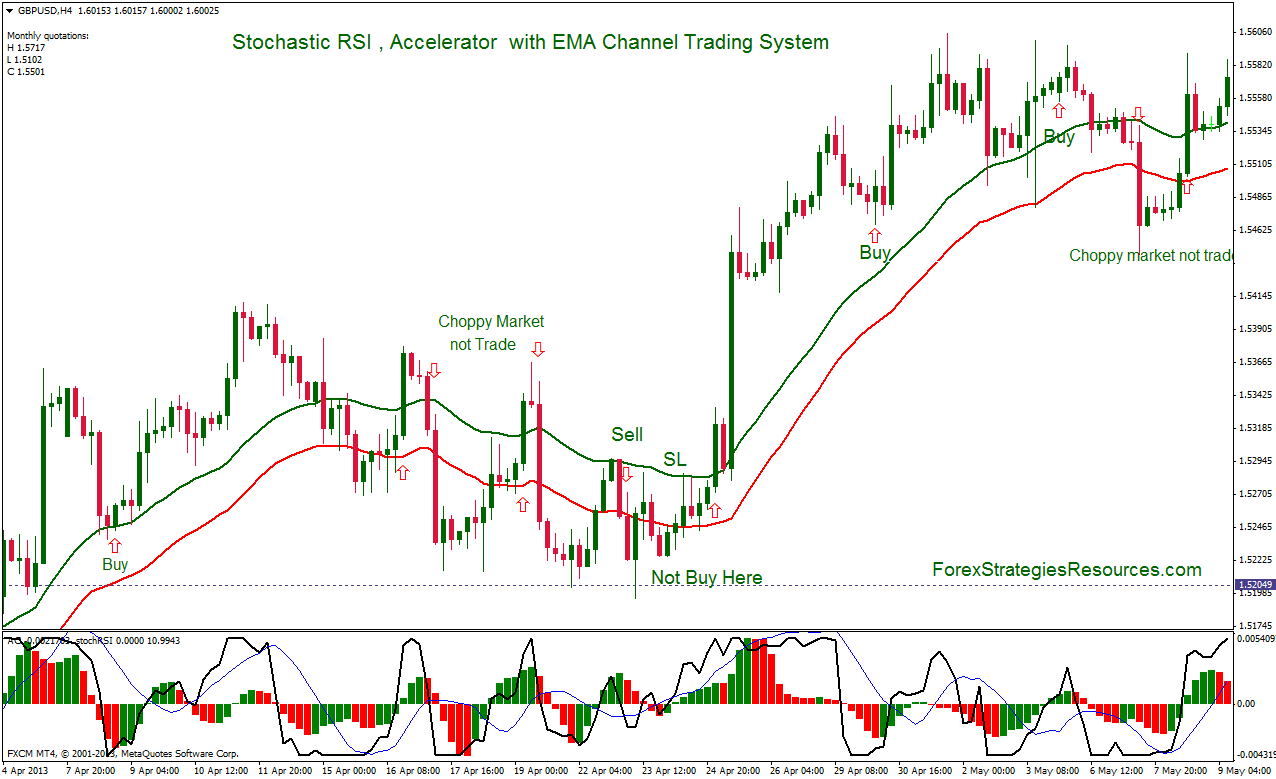

Try to find divergences, it informs you that the rate is going to reverse. If rate makes a new high and at the very same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the cost makes a new low while the stochastic makes higher low.

It needs to go up the revenues and cut the losses: when you see a pattern and utilize the system you developed Stochastic Trading , it needs to continue opening the offer if the revenues going high and close the deal if the losses going on.

A few of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise must search for floors and ceilings in a stock chart. This can show a trader about where to get in and about where to get out. I say “about” because it is pretty difficult to guess an “specific” bottom or an “exact” top. That is why locking in earnings is so so important. If you don’t lock in revenues you are actually risking of making an useless trade. Some traders end up being truly greedy and it only hurts them.

When a cost is increasing strongly. momentum will be rising. What you require to look for is a divergence of momentum from price i.e. costs continue to rise while momentum is rejecting. This is referred to as divergence and trading it, is one of the very best currency trading strategies of all, as it’s warning you the trend is about to reverse and rates will fall.

So get learn Forex swing trading systems and select one you like and you could soon be making big regular revenues and enjoying currency trading success.

In fact that’s why on a monthly basis you can see new plans being used online to brand-new traders. Try this now: Buy Stock Assault 2.0 stock exchange software application.

If you are finding most entertaining comparisons related to Best Stochastic Setting For Divergence, and Forex Charts, Forex Trading Strategy you should join for email subscription DB totally free.

![Bitcoin No One Is Watching This [the week ahead for price] Bitcoin No One Is Watching This [the week ahead for price]](https://Stochastictrader.com/wp-content/uploads/Bitcoin-No-One-Is-Watching-This-the-week-ahead-for-200x137.jpg)