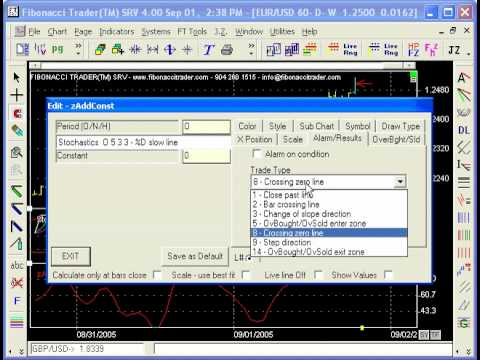

Adding different alarm on the stochastic Indicator

Top full videos top searched Stock Investing, Simple System, and Stochastic Crossover Alert, Adding different alarm on the stochastic Indicator.

Adding different alarm on the stochastic Indicator

Stochastic Crossover Alert, Adding different alarm on the stochastic Indicator.

Why Forex Trading With Stochastics Is A Lot Tougher Than It Looks

The support and resistance levels in the variety should form a horizontal line. Common signs used are the moving averages, MACD, stochastic, RSI, and pivot points. What is does is connect a series of points together forming a line.

Adding different alarm on the stochastic Indicator, Explore latest high definition online streaming videos related to Stochastic Crossover Alert.

Financiers Check Out Technical Analysis

You remained in a long position, a red candle light appears and you click out. It is also important that the trade is as detailed as possible. The 2nd half of this summer season saw index readings of 100 in falling markets.

Forex swing trading is easy to understand, just needs a basic system, its likewise exciting and fun to do. Here we will look at how you can end up being an effective swing trader from house and accumulate big revenues in around thirty minutes a day.

It is this if one must know anything about the stock market. It is ruled by emotions. Feelings resemble springs, they stretch and agreement, both for only so long. BB’s procedure this like no other sign. A stock, especially commonly traded large caps, with all the essential research study worldwide currently done, will only lie inactive for so long, and after that they will move. The relocation after such inactive durations will usually be in the instructions of the overall trend. And the next Stochastic Trading relocation will likely be up as well if a stock is above it’s 200 day moving typical then it is in an uptrend.

Since easy systems are more robust than complex ones in the ruthless world of trading and have fewer components to break. All the leading traders use basically basic currency trading systems and you must to.

If you Stochastic Trading look at the weekly chart you can plainly see resistance to the dollar at 114. We also have a yen trade that is up with lower highs from the July in a strong pattern the mid Bollinger band will function as resistance or support, in this case it serves as resistance and is simply above the 114.00 level. Momentum is up at present – will the resistance hold its time to take a look at the day-to-day chart.

In summary – they are leading indications, to determine the strength and momentum of rate. You want momentum to support any break before executing your Stochastic Trading signal as the chances of extension of the pattern are greater.

If you desire to generate income forget “purchasing low and selling high” – you will miss out on all the huge moves. Rather aim to “purchase high and offer higher” and for this you require to understand breakouts. Breakouts are just breaks of essential support or resistance levels on a forex chart. Most traders can’t purchase these breaks.

In typical with practically all elements of life practice is the key to getting all 4 components interacting. This is now easier to accomplish as many Forex websites have demonstration accounts so you can practice without risking any actual money. They are the nearest you can get to trading in real time with all the pressure of potential losses. But keep in mind – practice makes ideal.

The move after such inactive periods will generally be in the instructions of the general pattern. These are the long term financial investments that you do not rush into. Let’s discuss this Day-to-day Timeframe Technique.

If you are searching more exciting reviews relevant with Stochastic Crossover Alert, and Forex Trading, Currency Trading Charts, Stock Prices dont forget to list your email address our newsletter for free.