Trading Using Oscillators and Indicators

Interesting high defination online streaming about Turtle Trading System, Forex Trading Strategies, Stock Market Trading System, and How To Trade Stochastic Divergence, Trading Using Oscillators and Indicators.

Oscillators are key indicators in technical analysis. They are momentum indicators whose fluctuations are bounded by some upper and lower band. When oscillator values approach these bands, they provide overbought or oversold signals to traders.

Oscillators are typically used in conjunction with other technical analysis indicators to make trading decisions. For instance, they are often combined with moving average indicators to signal trend breakouts or reversals.

To learn more on how to trade using oscillators, join our webinar “Trading Using Oscillators and Indicators”, as we invite a Principal Consultant of MSTA and CFTe Programs to share with you the right usage of oscillators and its trading strategy.

In this 1.5-hr webinar, you’ll learn:

✅ Learn the usage of oscillators

✅ Learn to interpret oscillators

✅ Identify oscillator trading signals

👇🏼More Awesome Content 更多劲爆内容👇🏼

Subscribe to our Youtube Channel to get the alert of our new content 关注我们的Youtube平台:

👉🏼 https://www.youtube.com/lifechamp

Follow us on Facebook to know our upcoming webinars 关注我们的面子书平台:

👉🏼 https://www.facebook.com/mylifechamp

Connect with us on IG for more gossip 关注我们的IG:

👉🏼 https://www.instagram.com/my_lifechamp

Open a Stock / Futures trading account in Malaysia:

👉🏼 https://bit.ly/3dX157y

How To Trade Stochastic Divergence, Trading Using Oscillators and Indicators.

Forex Trading Technique – Based On This Technique Piles Up Substantial Profits

The easier your system is, the more earnings it will produce on a long run. When the fast one crosses the slow one, this will show a trend. A simple commodity trading system like the above, traded with discipline is all you require.

Trading Using Oscillators and Indicators, Get top replays related to How To Trade Stochastic Divergence.

Make Cash Quick – Basic Trading Suggestions To Develop Genuine Wealth

Forex swing trading is among the very best methods for beginners to look for big gains. Regrettably, that’s what a great deal of traders think technical analysis is. Keep your stop well back until the trend is in motion.

In these rather unsure monetary times, and with the unpredictable nature of the stock exchange today, you may be questioning whether or not you need to pull out and head toward some other kind of financial investment, or you might be seeking a better, more reputable stock trading indication. Moving your money to FOREX is not the response; it is time to hang in there and get your hands on a great stock trading sign. Attempt this now: Buy Stock Attack 2.0 stock exchange software.

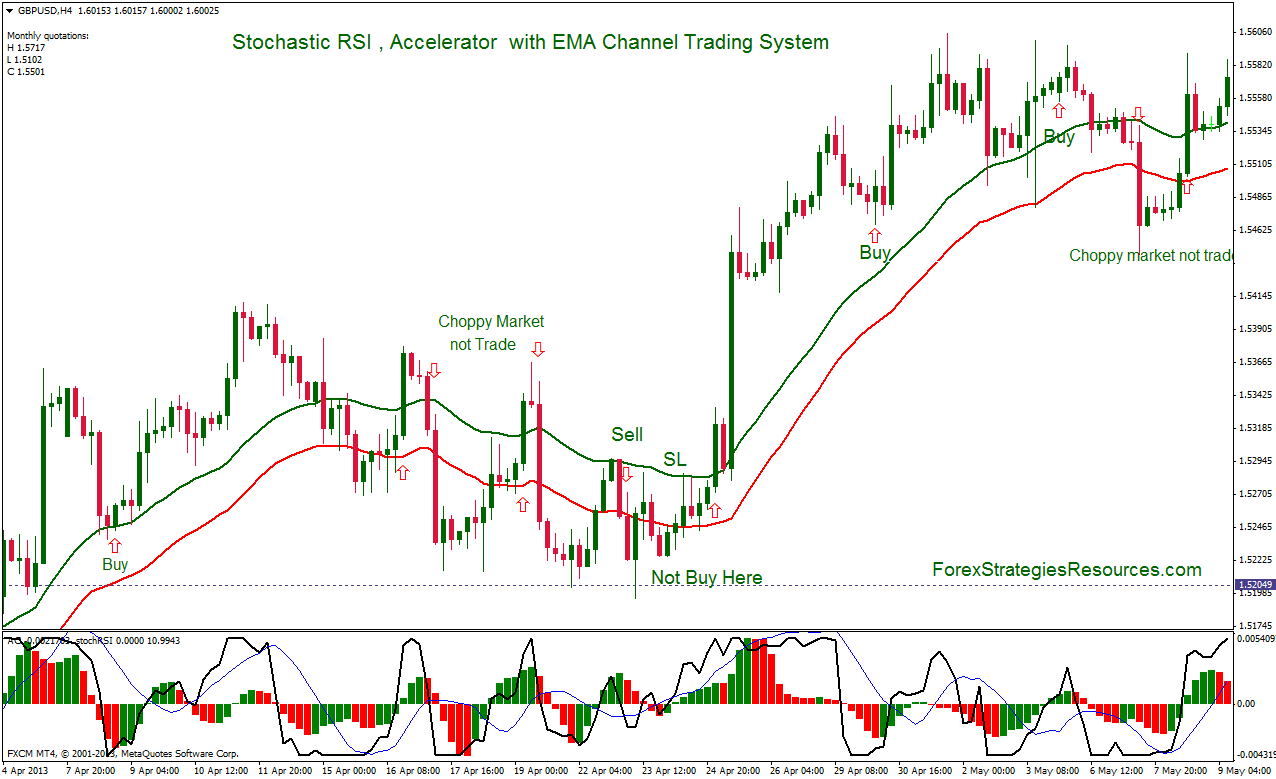

This strategy is easy and it is not made complex in any manner. It functions even in unstable market conditions. Your ability Stochastic Trading to get the very best from this technique depends upon the way you efficaciously apply the technique. There is no magic behind the technique.

Trade the odds and this implies cost momentum should support your view and validate the trade before you enter. 2 excellent momentum indications are – the stochastic and the Relative Strength Index – look them up and utilize them.

No issue you say. Next time when you see the revenues, you are going to click out which is what you do. You remained in a long position, a red candle light shows up and you click out. Whoops. The marketplace continues in your instructions. You stand there with 15 pips and now the market is up 60. Annoyed, you choose you are going to either let the trade play out to your Stochastic Trading profit target or let your stop get set off. You do your research. You go into the trade. Boom. Stopped out. Bruised, damaged and deflated.

In summary – they are leading indications, to assess the strength and momentum of cost. You want momentum to support any break prior to performing your Stochastic Trading signal as the odds of extension of the trend are higher.

The technical analysis should likewise be determined by the Forex trader. This is to forecast the future pattern of the price. Common indicators utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indicators can be used in combination and not just one. This is to verify that the rate pattern is real.

It takes patience and discipline to await the right breakouts and after that much more discipline to follow them – you require self-confidence and iron discipline – but you can have these if you desire to and soon be accumulating triple digit profits.

You’ll discover that when a stock rate strikes the lower Bollinger Band, it usually tends to increase once again. The Stochastic Oscillator is an overbought/oversold indication developed by Dr. Let’s discuss this Day-to-day Timeframe Strategy.

If you are searching best ever exciting reviews related to How To Trade Stochastic Divergence, and Forex Trading Tips, Currency Trading, Online Trading, Thinslice Trading please signup for a valuable complementary news alert service totally free.