Best Divergence Trading Strategy

Trending clips related to Swing Trading Stocks, Learn How to Trade Options, Forex Trend Following, and Best Stochastic Setting For Divergence, Best Divergence Trading Strategy.

The best divergence trading strategy is one that uses trend continuation divergences. In this video I will show you how to identify hidden divergences and how to use them to trade with the trend. Using a divergence trading strategy will help you have a higher win rate overall.

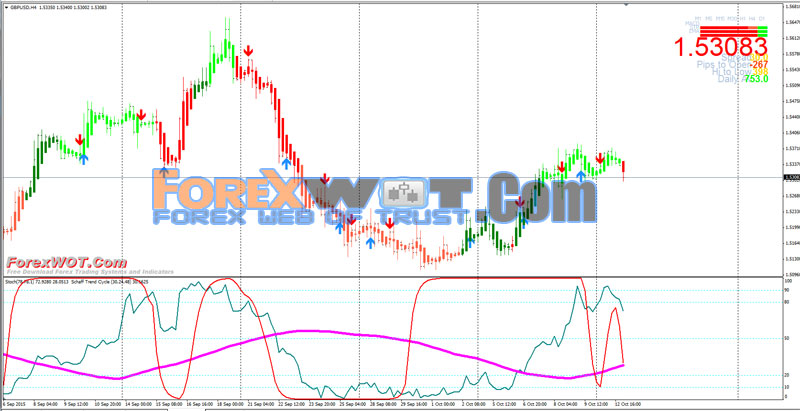

**this divergence indicator is not to be used for live trading because the signal shows up late. this divergence indicator is to be used for back testing to learn how to identify hidden divergences and regular divergences. please for the love of God do not use this indicator for live trading because your entry will be wrong.

use this as a tool to learn how to spot them live.**

The trading floor is a new project that I just launched.

World class day trading education and tools

https://www.trdfloor.com/welcome

FunderPro

Start your funded account challenge HERE (20% discount with link)

https://funderpro.com/get-funded-with-tma-and-funderpro

my twitter https://twitter.com/artybryja

For charts Use Trading View

https://www.tradingview.com/?aff_id=113274

New Official Telegram Group

TMA OFFICIAL®

https://t.me/TMAbyArty

Looking for a forex broker?

I use Osprey

https://ospreyfx.com/tradewithtma

regulated broker i recommend is Blueberry markets

https://bit.ly/blueberrytma

Try a $100,000 funded account from OspreyFX

https://ospreyfx.com/tradewithtma

Use coupon code

movingaverage50

To get $50 off

or try FTMO

https://ftmo.com/en/?affiliates=2677

Get a free audio book from audible

https://tmafocus.com/2WyXSqa

Links to the indicators

TMA Overlay

https://www.tradingview.com/script/zX3fvduH-TMA-Overlay/

TMA Divergence indicator

https://tmafocus.com/3nfcEfd

TMA shop

https://shop.spreadshirt.com/themovingaverage/

Get some free stocks from WEBULL

https://tmafocus.com/3p0vatP

also

Get some free stocks from Public

https://tmafocus.com/3GUUojh

Trading Platform

META TRADER 4

Divergences are used by traders in an attempt to determine if a trend is getting weaker, which may lead to a trend reversal or continuation.

Before you head out there and start looking for potential divergences, here are nine cool rules for trading divergences.

In order for a divergence to exist, the price must have either formed one of the following:

If not, you ain’t trading a divergence, buddy.

You’re just imagining things. Immediately go see your optometrist and get some new glasses.

Divergence Trading Rule #1: YesThere must be extreme highs and lows

Divergence Trading Rule #1: NoDivergences do not work in ranging markets

2. Draw lines on successive tops and bottoms

Okay now that you got some action (recent price action that is), look at it.

Now draw a line backward from that high or low to the previous high or low. It HAS to be on successive major tops/bottom.

3. Connect TOPS and BOTTOMS only

Once you see two swing highs are established, you connect the TOPS.

If two lows are made, you connect the BOTTOMS.

Divergence Trading Rule #3: Connect successive tops or bottoms only

Divergence Trading Rule #3: Divergences do not work in ranging markets

4. Keep Your Eyes on the Price

So you’ve connected either two tops or two bottoms with a trend line. Now look at your preferred technical indicator and compare it to price action.

Whichever indicator you use, remember you are comparing its TOPS or BOTTOMS.

Divergence Trading Rule #4: Focus on tops and bottoms

5. Be Consistent With Your Swing Highs and Lows

If you draw a line connecting two highs on price, you MUST draw a line connecting the two highs on the indicator as well.

If you draw a line connecting two lows on price, you MUST draw a line connecting two lows on the indicator. They have to match!

NOT FINANCIAL ADVICE DISCLAIMER

The information contained here and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor, nor am I holding myself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided here and the resources available for download are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial professional to address your particular information. The Company expressly recommends that you seek advice from a professional.

*None of this is meant to be construed as investment advice, it’s for entertainment purposes only. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

Best Stochastic Setting For Divergence, Best Divergence Trading Strategy.

Swing Trading Forex – A Simple And Simple To Comprehend Technique For Big Gains!

What were these fundamental experts missing out on? The most effective indication is the ‘moving average’. But all is not lost if the traders make rules for themselves and follow them.

Looking for a Forex robot to assist you trade?

Best Divergence Trading Strategy, Watch most shared full videos related to Best Stochastic Setting For Divergence.

Earn Money Fast – Basic Trading Ideas To Build Real Wealth

This is Expense William’s Accelerator Oscillator (Air Conditioning) and the Stochastic Oscillator. Sure enough, you can use these tips while utilizing a demo account. It operates even in unpredictable market conditions.

, if you desire to win at forex trading and take pleasure in currency trading success maybe one of the most convenient ways to accomplish it is to trade high chances breakouts.. Here we will take a look at how you can do this and make big profits.

Forex is an acronym of foreign exchange and it is a 24hr market that opens from Sunday night to Friday night. It is the most traded market on the planet with about $3 trillion being traded every day. With this plan, you can trade on your own schedule and make use of rate Stochastic Trading changes in the market.

Don’t forecast – you ought to only act on verification of price changes and this constantly means trading with cost momentum in your corner – when applying your forex trading method.

No issue you state. Next time when you see the profits, you are going to click out which is what you do. You remained in a long position, a red candle light appears and you click out. Whoops. The market continues in your direction. You stand there with 15 pips and now the market is up 60. Annoyed, you decide you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get set off. You do your homework. You get in the trade. Boom. Stopped out. Bruised, battered and deflated.

Numerous traders make the error of believing they can use the swing trade strategy daily, however this is not an excellent concept and you can lose equity quickly. Rather reserve forex swing trading for days when the market is simply right for swing trading. So, how do you know when the marketplace is right? When the chart is high or low, watch for resistance or support that has actually been held numerous times like. View the momentum and look for when prices swing strongly toward either the assistance or the resistance, while this is happening look for confirmation that the momentum will turn. This verification is critical and if the momentum of the price is starting to wane and a turn is likely, then the odds remain in excellent favor of a swing Stochastic Trading environment.

Breakouts are possible if the resistance and assistance lines assemble. In this instance, you may not presume that expenses will return constantly. You may prefer orders outside the converging line variety to obtain a breakout as it happens. Yet again, check your assessments against a minimum of 1 additional indication.

So get learn Forex swing trading systems and pick one you like and you might quickly be making big regular profits and enjoying currency trading success.

When the rate touches the lower band, the marketplace is thought about to be oversold. 2 of the very best are the stochastic sign and Bollinger band. The broader the bands are apart the greater the volatility of the currency studied.

If you are searching unique and exciting reviews relevant with Best Stochastic Setting For Divergence, and Stock Prices, Thinslice Trading dont forget to subscribe our subscribers database totally free.