5 Minute Forex Scalping Strategy: Trading Stochastic & Moving Averages

Top YouTube videos relevant with Robot Trader, Currency Trading System, Stock Trading Strategy, and Stochastic Settings For Swing Trading, 5 Minute Forex Scalping Strategy: Trading Stochastic & Moving Averages.

5 Minute Forex Scalping Strategy: Trading Stochastic & Moving Averages

5 Minute Forex Scalping Strategy that uses Stochastic & Moving Average indicators. I will show you how you can use this 5-minute forex scalping strategy to trade forex, crypto & stocks. This 5 minute forex scalping strategy works on any currency pair and can be super effective if applied correctly.

⚡️ Join MY DISCORD COMMUNITY: https://discord.gg/tradingmodeofficial

– Forex and Crypto trading ideas 📊

– Education 📚

– Community chat 🗣

– Live streams and much more…

SOCIAL:

📸 Instagram: @kristina.forex

📩 Email: fxtraderkristina@gmail.com

5 Minute Forex Scalping Strategy Using Stochastic & Moving Average Explained:

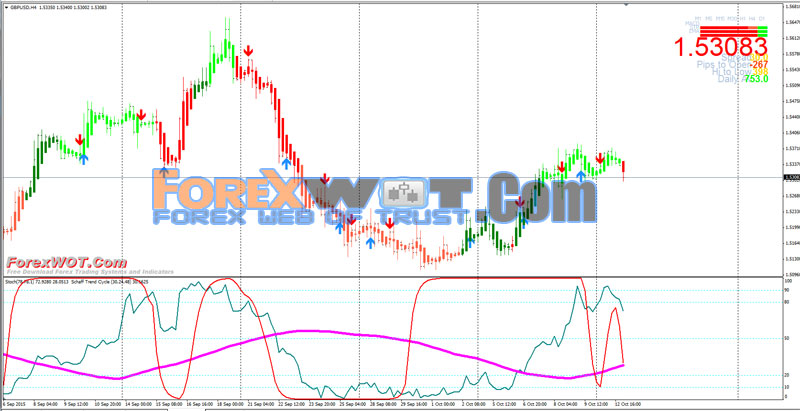

The Stochastic and Moving Averages forex scalping strategy is a simple but effective trading strategy. It works on both medium-term and long-term time frames. The indicators in use in the Stochastics scalping with two moving averages forex trading system are commonly found.

Stochastic and Moving Average 5-minute scalping strategy — is a relatively safe trading system that is based on the standard Stochastic indicator in combination with the standard Moving Averages. You can use the moving averages as the general long-term trend indicator, while the stochastic will show you the short-term overbought/oversold zones, where you can enter a successful trade.

#5minuteforexscalping #5minutescalpingstrategy #trading #stochastic #movingaverage

Stochastic Settings For Swing Trading, 5 Minute Forex Scalping Strategy: Trading Stochastic & Moving Averages.

Forex Charts – Utilizing The Symmetrical Triangle For Larger Profits

Almost whenever you see lines cross or go above or listed below 20 or 80 they look like winners, do not they? Use another sign to verify your conclusions. It operates even in unstable market conditions.

5 Minute Forex Scalping Strategy: Trading Stochastic & Moving Averages, Watch latest explained videos relevant with Stochastic Settings For Swing Trading.

How To Discover A Trending Market When Trading Forex

They do this by getting the ideal answers to these million dollar concerns. We don’t have time to discuss them here however there all easy to discover and use. It is also crucial that the trade is as detailed as possible.

You can so this by utilizing the stochastic momentum sign (we have actually composed often on this and it’s the very best sign to time any trade and if you are not farmiliar with it learn more about it now) watch for the stochastic lines to refuse and cross with bearish divergence and go short.

Well, in this brief article I can’t go into the tactical level – I can’t Stochastic Trading talk about my entry and exit sets off, and trade management techniques.Due to the fact that it’s not just a basic indicator based entry or exit, it would take an entire book. It’s based upon price action – on an understanding of the nature of motion of rate. That takes a long period of time to develop, and it’s something I’ll cover in my website in a lot more information.

Evaluating is a process and it is suggested to check different tools during the years. The goal in testing the tools is to discover the ideal trading tool the trader feels comfortable with in different market scenario however also to improve trading abilities and revenue margin.

You should not let your orders be open for longer duration. Observe the marketplace condition by remaining away from any interruption. The dealings in volatile Stochastic Trading market are always short lived. You must get out moment your target is achieved or your stop-loss order is set off.

Technical experts attempt to identify a pattern, and ride that trend till the pattern has actually confirmed a reversal. If a great company’s stock is in a drop according to its chart, a trader or financier utilizing Technical Analysis will not Stochastic Trading purchase the stock till its pattern has reversed and it has actually been confirmed according to other crucial technical indicators.

While these breaks can in some cases be tough to take, if the support or resistance is valid, the odds favour a big move – however not all breakouts are created equal.

Position the trade at a stop loss of roughly 35 pips and you should apply any of these two methods for the purpose of making revenue. The very first is use a good danger to a gainful ratio of 1:2 while the next is to make use of support and resistance.

Also, examine the copyright at the bottom of the page to see how often the page is updated. I strongly recommend you get at least a megabyte or more of memory. This depends upon how frequently one refers the trade charts.

If you are looking best ever entertaining comparisons related to Stochastic Settings For Swing Trading, and Trending Market, Technical Analysis Tool you should list your email address our subscribers database for free.