Will the EUR/USD trend change from bullish to bearish? Jan 15th 2013/MBCFX

Top reviews relevant with Forex Trading Ideas, Forex Trading Advice, Line D Stock, and Bearish Divergence Stochastic, Will the EUR/USD trend change from bullish to bearish? Jan 15th 2013/MBCFX.

http://www.mbcfx.com/news/news_en.html

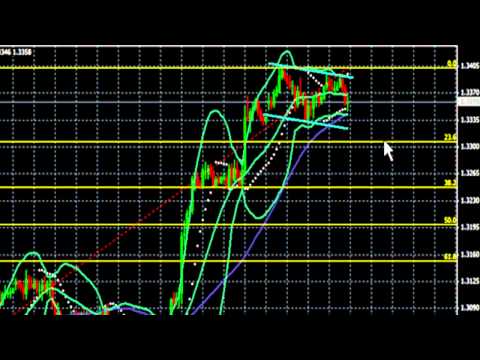

The Euro rose significantly against the US dollar in a short period of time reaching the 1.3404 level.

However, as we notice on the 1 hour chart , the forming of the Double Top, and this gives us a signal that trend of the prices may change from bullish to bearish trend.

So today we expect that the EUR/US would retreat towards the 1.3340-1.3323 area, and if it breaches down this level, this would represent a downward signal and the prices will decrease to the 1.3250 level.

http://www.mbcfx.com/news/news_en.html

The Euro USD has reached a great rise towards the 1.3379 level during the last week, and it started the trading of this week positively, and has reached the 1.3404 level, which is the resistance level that we have mentioned in our analysis of the last week.

We are expecting further increase towards the 1.3420 level before Ben Bernake’s speech concerning the program of the quantitative easing.

The 1.3420 level would represent an important point of shift of the trend from bullish to bearish, and this is confirmed by the Stochastic indicator on the daily chart , as this indicator starts giving us overbought signals and changing its direction.

We also notice that FX5 indicator is showing multiple levels of divergence and convergence, and this reflects the possibly that the Euro USD may change its general bullish direction to bearish trend.

Find more information about Forex News , feel free to visit on our website :

http://www.mbcfx.com/index.html

If you would like to receive our professional Daily Newsletters and Forex signals by Email , please register on :

http://www.mbcfx.com/SM/demo_en.html

Bearish Divergence Stochastic, Will the EUR/USD trend change from bullish to bearish? Jan 15th 2013/MBCFX.

Forex Charts – Standard Earnings Tips For Beginners

This is to anticipate the future trend of the price. The wider the bands are apart the greater the volatility of the currency studied. When they do concentrate on the long term and don’t snatch early.

Will the EUR/USD trend change from bullish to bearish? Jan 15th 2013/MBCFX, Enjoy most shared complete videos relevant with Bearish Divergence Stochastic.

Forex Trading Technique – Based On This Approach Accumulate Huge Profits

Doing this suggests you understand what your optimum loss on any trade will be rather than losing everything. Bollinger bands are based upon standard variance. Basic discrepancy is the procedure of the spread of a set of number.

There is a distinction in between trading and investing. Trading is constantly short-term while investing is long term. The time horizon in trading can be as short as a few minutes to a couple of days to a few weeks. Whereas in investing, the time horizon can be months to years. Many people day trade or swing trade stocks, currencies, futures, options, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the exact same day making a fast revenue. In swing trading, a trader attempts to ride a pattern in the market as long as it lasts. On the other hand, an investor is least pushed about the short-term swings in the market. He or she has a long term time horizon like a couple of months to even a few years. This very long time horizon matches their investment and financial goals!

The trader can keep an eye on at which pivot level the cost has actually reached. if it goes at higher level, this can be presumed as severe point for the rate, the trader then needs to check the Stochastic Trading value. This will be indication that the currency is overbought and the trader can go short if it is greater than 80 percent for long time. the currency will go short to much at this case.

Do not anticipate – you should only act upon confirmation of rate modifications and this always indicates trading with rate momentum on your side – when using your forex trading method.

Lots of indications are available in order to identify Stochastic Trading the trends of the market. The most efficient indicator is the ‘moving average’. Two moving typical indicators ought to be made use of one quick and another slow. Traders wait up until the fast one crosses over or listed below the slower one. This system is also referred to as the “moving typical crossover” system.

Technical analysts attempt to spot a trend, and flight that pattern till the pattern has actually verified a reversal. If a great company’s stock remains in a drop according to its chart, a trader or investor utilizing Technical Analysis will not Stochastic Trading purchase the stock up until its pattern has actually reversed and it has actually been verified according to other important technical indicators.

The technical analysis should likewise be identified by the Forex trader. This is to anticipate the future pattern of the cost. Typical signs used are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indicators can be utilized in combination and not just one. This is to validate that the price pattern is true.

Energy markets are volatile and can make any trader appearance silly however they provide some wonderful profit chances at present which traders can benefit from.

In an uptrend each brand-new peak that is formed is higher than the previous ones. The Stochastic – is a very powerful trade sign. His work and research are first class and parallel his character as a person.

If you are searching instant engaging videos about Bearish Divergence Stochastic, and Online Trading, Quote Currency please list your email address our email subscription DB totally free.