What Is Stochastic Oscillator Indicator In Stock Market ? | Hold Stock Longer Using This Indicator

Top reviews about Trading With Stochastics, Currency Trading Education, Range Trading Winning, Effectively Trade Forex, and Stochastic Scalping Strategy, What Is Stochastic Oscillator Indicator In Stock Market ? | Hold Stock Longer Using This Indicator.

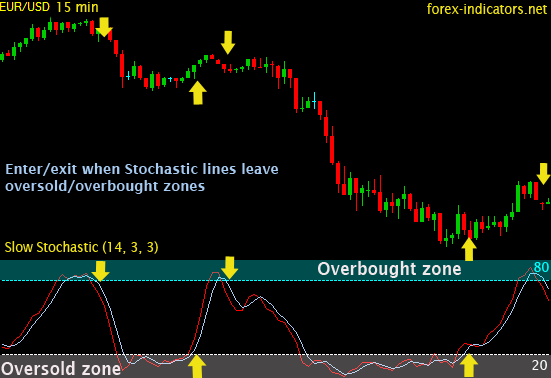

The Stochastic Oscillator is a popular technical analysis tool used in the stock market to assess the momentum of a financial …

Stochastic Scalping Strategy, What Is Stochastic Oscillator Indicator In Stock Market ? | Hold Stock Longer Using This Indicator.

Who Wishes To Be A Forex Trading Millionaire?

These are the long term financial investments that you do not rush into. For that reason if there is a possibility for you to do a counter trend trade remember DO NOT take that trade. They will “bring the stocks in” to adjust their position.

What Is Stochastic Oscillator Indicator In Stock Market ? | Hold Stock Longer Using This Indicator, Find more explained videos relevant with Stochastic Scalping Strategy.

6 Tested Winning Tips To Build Your Forex Trading System

Here we wish to look at developing a sample trading system for huge earnings. These trendlines are considered to be extremely essential TA tool. A trader ought to develop guidelines for their own selves and STICK to them.

There is a difference in between trading and investing. Trading is always brief term while investing is long term. The time horizon in trading can be as brief as a few minutes to a couple of days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Many people day trade or swing trade stocks, currencies, futures, choices, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the very same day making a fast profit. In swing trading, a trader attempts to ride a trend in the market as long as it lasts. On the other hand, an investor is least pushed about the short term swings in the market. He or she has a long term time horizon like a couple of months to even a couple of years. This long period of time horizon matches their financial investment and financial goals!

If one need to understand anything about the stock exchange, it is this. It is ruled by feelings. Emotions resemble springs, they extend and contract, both for just so long. BB’s step this like no other indication. A stock, particularly extensively traded big caps, with all the fundamental research study in the world already done, will only lie dormant for so long, and after that they will move. The move after such inactive durations will often be in the instructions of the total pattern. If a stock is above it’s 200 day moving average Stochastic Trading then it remains in an uptrend, and the next move will likely be up also.

A lot of traders like to wait for the pullback however they never get in. By waiting for a better price they miss out on the move. Losers don’t go with breakouts winners do.

OK now, not all breakouts are produced equivalent and you desire the ones where the chances are greatest. You’re looking for Stochastic Trading assistance and resistance which traders find essential and you can typically see these levels in the news.

A breakout is likely Stochastic Trading if the support and resistance lines are assembling. In this case you can not assume that the cost will always turn. You might choose to set orders outside the series of the assembling lines to capture a breakout when it occurs. However again, examine your conclusions against a minimum of another sign.

When a price is increasing strongly. momentum will be increasing. What you need to look for is a divergence of momentum from rate i.e. costs continue to rise while momentum is rejecting. This is referred to as divergence and trading it, is one of the best currency trading strategies of all, as it’s cautioning you the trend will reverse and costs will fall.

Is it truly that simple? We think so. We were right last week on all our trades, (and we did even much better in energies have a look at our reports) obviously we could have been wrong, however our entries were timed well and had close stops for risk control.

There are different sort of currency trading charts that you can use. Here we wish to look at developing a sample trading system for huge earnings. They will “bring the stocks in” to change their position.

If you are searching updated and engaging comparisons about Stochastic Scalping Strategy, and Stock Market, Win Forex, Trade Without Indicators you are requested to signup for subscribers database for free.

![[Best Scalping TF M1 Technique] – Settings Indicators [Best Scalping TF M1 Technique] – Settings Indicators](https://Stochastictrader.com/wp-content/uploads/Best-Scalping-TF-M1-Technique-Settings-Indicators-200x137.jpg)