What is divergence? Divergence the most profitable strategy in stock market that you should know

Popular YouTube videos related to Commitment of Traders, Forex Techncial Analysis, Stock Market Trend, Daily Timeframe Strategy, and Divergence In Stochastic, What is divergence? Divergence the most profitable strategy in stock market that you should know.

In this video, we are going to about divergence. If you are a trader, then it is very important to understand the divergence. Because the setup of divergence will give you very good results in both trading, swing trading, or intraday trading. And divergence is one of the most important factors in the stock market.

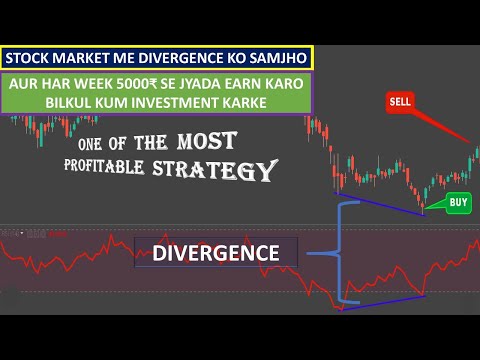

# What is divergence?

A divergence is formed when the price of a stock or an index and one technical indicator(RSI, MACD, ROC, CCI) are moving in opposite directions to each other.

# Types of divergence

There are two types of divergences

1) Regular divergence( Regular bullish divergence and Regular bearish divergence)

2) Hidden divergence( Hidden bullish divergence and Hidden bearish divergence)

# Stochastic RSI and heikin ashi chart best profitable intraday trading strategy for beginners 2021

DISCLAIMERS: This video is only for learning and information purpose. All the suggestions and recommendations given in the video are also for information and learning purposes. Before doing any investment in any stocks take advice from your financial advisors.

#Intradaytradingstrategies #Swingtradingstrategies #Intradaystocksfortomorrow #Stockmarket

Divergence In Stochastic, What is divergence? Divergence the most profitable strategy in stock market that you should know.

5 Ideas To Trade Forex Effectively

When the rate reaches the upper band, the marketplace is thought about to be overbought. Is this indicator being applied to an appropriate timeframe and prices variety? 2 main points need to be thought about for successful trading.

What is divergence? Divergence the most profitable strategy in stock market that you should know, Watch most searched updated videos relevant with Divergence In Stochastic.

3 Most Convenient Methods To Become An Effective Forex Swing Trader Fast

Do not put your stop to close, or within normal volatility – you will get bumped out the trade. You are looking levels which the marketplace thinks about essential. When prices hit target take your profit in and wait for the next established.

The foreign currency trading market, better known as the Forex, is by far the biggest market in the world. In excess of 2 trillion dollars are traded on it each and every day, while ‘only’ 50 billion dollars are traded on the world’s most significant stock exchange, the New York Stock Exchange, every day. This in fact makes Forex larger than all the world’s stock exchanges combined!

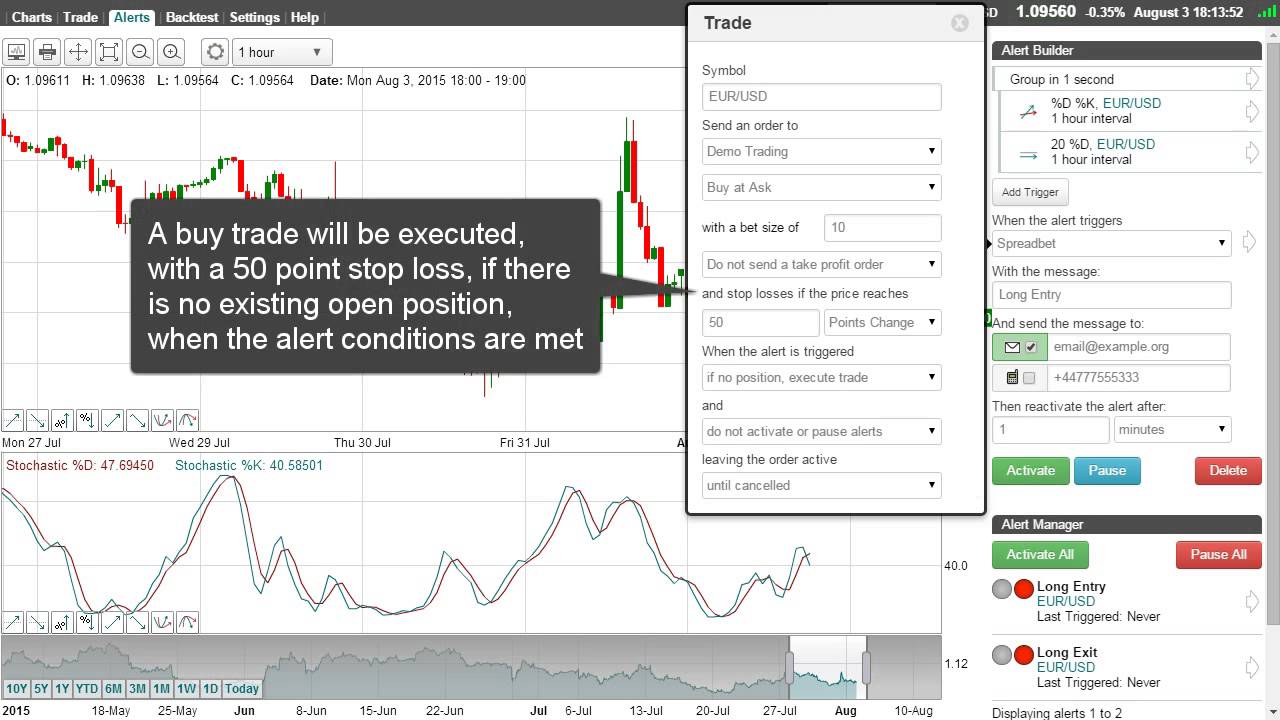

When swing Stochastic Trading, try to find very overbought or really oversold conditions to increase the odds of success and don’t trade unless the cost is at an extreme.

Two of the best are the stochastic indication and Bollinger band. Utilize these with a breakout technique and they offer you a powerful mix for looking for huge gains.

No issue you say. Next time when you see the earnings, you are going to click out and that is what you do. You remained in a long position, a red candle reveals up and you click out. Whoops. The market continues in your direction. You stand there with 15 pips and now the market is up 60. Frustrated, you choose you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get triggered. You do your research. You get in the trade. Boom. Stopped out. Bruised, battered and deflated.

Do you have a stop loss or target to exit a trade? One of the biggest errors that forex traders made is trading without a stop loss. I have worried many times that every position need to have a stop loss however till now, there are a number of my members still Stochastic Trading without setting a stop. Are you one of them?

Breakouts are probable if the resistance and assistance lines converge. In this circumstances, you might not presume that costs will return always. You may have a choice for orders outside the assembling line range to acquire a breakout as it happens. Yet once again, examine your examinations against at least 1 additional indication.

Keep in mind you will constantly give bit back at the end of a pattern however the big patterns can last many weeks or months and if you get simply 70% of these trends, you will make a lot of money.

With this arrangement, you can trade on your own schedule and make use of rate changes in the market. In typical with virtually all elements of life practice is the crucial to getting all 4 aspects collaborating.

If you are finding rare and engaging reviews relevant with Divergence In Stochastic, and Trading 4x Online, E Mini Trading please list your email address our subscribers database now.