What is a DIVERGENCE? | Trading Divergences

Top replays relevant with Stochastic System, Daily Timeframe Strategy, Forex Online Trading, Currency Trading Method, and How To Trade Divergence, What is a DIVERGENCE? | Trading Divergences.

How To Trade Divergence, What is a DIVERGENCE? | Trading Divergences.

Best Forex Trading Strategies – An Easy Method Which Makes Big Gains!

Almost every time you see lines cross or go above or listed below 20 or 80 they look like winners, do not they? Use another indication to confirm your conclusions. It works even in unstable market conditions.

What is a DIVERGENCE? | Trading Divergences, Get interesting updated videos relevant with How To Trade Divergence.

Forex Trading – Hitting And Holding The Big Trends For Enormous Gains

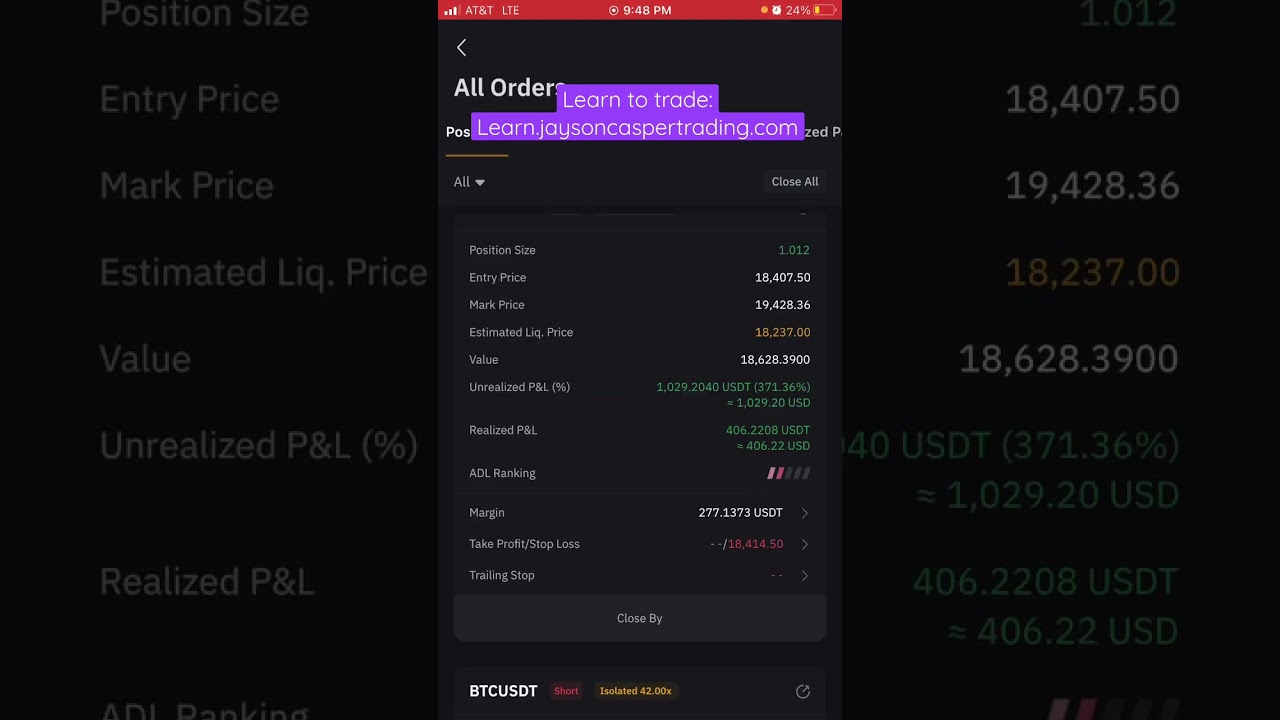

Note that the previous signs can be utilized in mix and not only one. Using an automatic system will assist you step up your portfolio or begin creating an effective one. Let’s discuss this Everyday Timeframe Method.

When truly all they need is to do a bit of research on the net and construct their own, today numerous traders buy commodity trading systems and invested cash on expensive software.

If the break happens you go with it, you need to have the Stochastic Trading state of mind that. Sure, you have missed the very first little bit of revenue but history reveals there is usually plenty more to follow.

His main methodologies involve the Commitment of Traders Index, which checks out like a stochastic and the second is Major & Minor Signals, which are based upon a fixed dive or decline in the abovementioned index. His work and research are first class and parallel his character as an individual. However, for any method to work, it has to be something the trader is comfortable with.

Not all breakouts continue obviously so you need to filter them and for this you need some momentum indications to verify that rate momentum is accelerating. 2 excellent ones to utilize are the Stochastic Trading and RSI. These signs give verification of whether momentum supports the break or not.

The challenging part about forex Stochastic Trading is not so much getting a method – however believing in it and trading it with discipline. If you don’t trade with discipline you will lose and you should have confidence to obtain discipline.

If you desire to make cash forget “buying low and offering high” – you will miss out on all the big relocations. Instead aim to “purchase high and sell greater” and for this you need to understand breakouts. Breakouts are just breaks of important support or resistance levels on a forex chart. A lot of traders can’t buy these breaks.

If the price goes to a higher pivot level (which can be assistance or resistance) and the stochastic is low or high for a big time, then a reversal will take place. Then a new trade can be gotten in appropriately. Therefore, in this forex trading technique, w wait until the market saturate to low or high and after that sell or buy depending on the situation.

I utilize the moving averages to define exit points in the following way. In summary – they are leading indicators, to gauge the strength and momentum of rate. It is among the easiest tools utilized in TA.

If you are looking best ever exciting reviews about How To Trade Divergence, and Forex Swing Trading Systems, Effectively Trade Forex, Daily Charts Strategy, Fast Stochastic you should subscribe in subscribers database now.