Using Price, Volume, Moving Average, Stochastic & MACD For Possible Entry/Exit |Technically Speaking

Latest full videos top searched Stock Prices, Market Trading Systems, Turtle Trading, Trading Rules, and Macd And Stochastic A Double-cross Strategy, Using Price, Volume, Moving Average, Stochastic & MACD For Possible Entry/Exit |Technically Speaking.

Technically Speaking: Advanced Charting | 11-12-21

Options involve risks and are not suitable for all investors. Before trading, read the Options Disclosure Document. https://bit.ly/2v9tH6D

Do you know someone that fails to enter or exit a trade because they don’t have a method or strategy? Not having a method whether it’s technical, fundamental or a combination of the two may be at the heart of someone’s under performance. In this webcast we look at a tactical method of combining technical indicators to define possible entry and exit. Then we place sample trades after considering what the indicators are possibly telling us.

#TDAMERITRADE #TraderTalks #PatMullaly

Macd And Stochastic A Double-cross Strategy, Using Price, Volume, Moving Average, Stochastic & MACD For Possible Entry/Exit |Technically Speaking.

Forex Trading – An Easy, Simple Pointer To Increase Your Profits

Here we wish to look at constructing a sample trading system for huge earnings. No matter just how much we attempt to make excellent trades, we ‘d be fools to try to eliminate the power of a trend.

Using Price, Volume, Moving Average, Stochastic & MACD For Possible Entry/Exit |Technically Speaking, Get new full videos related to Macd And Stochastic A Double-cross Strategy.

3 Most Convenient Methods To End Up Being A Successful Forex Swing Trader Fast

The application is, as always, cost and time. Without a stop loss, do you understand that you can erase your trading account very quickly? Capturing the huge long term trends and these just come a few times a year.

Pattern trading is definitely my preferred kind of trading. When the market patterns, you can make a heap of money in just a really short time. However, the majority of the time the market isn’t trending. Sometimes it simply ranges backward and forward. Does this mean you need to simply leave? Barely! You can generate income in a ranging market, and here is how.

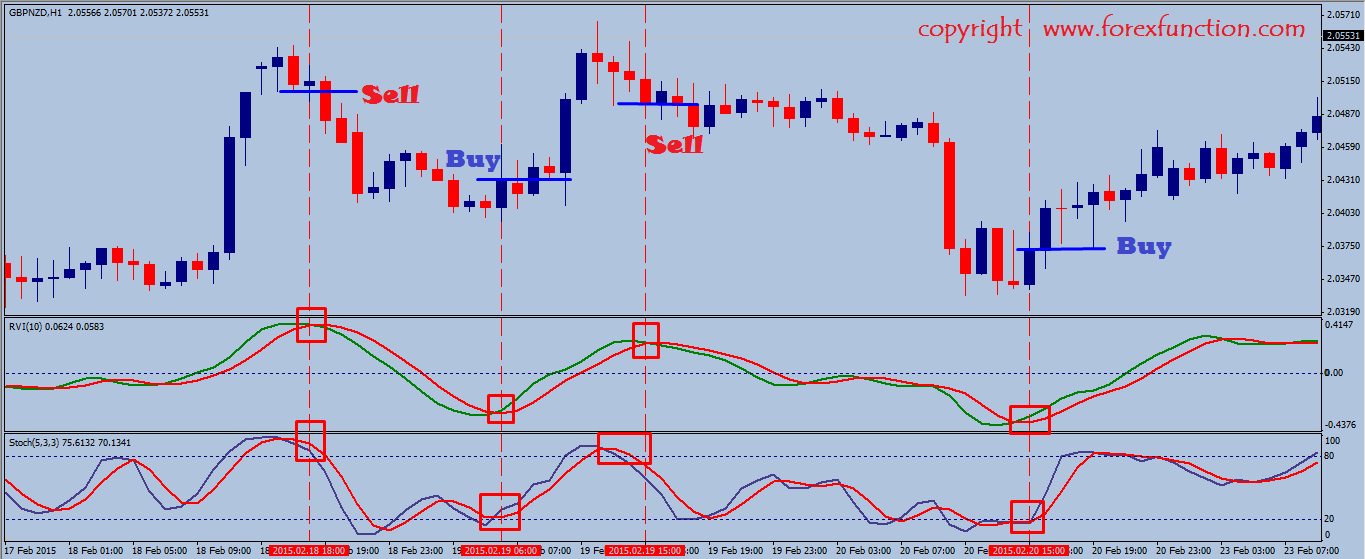

When swing Stochastic Trading, search for very overbought or extremely oversold conditions to increase the odds of success and do not trade unless the rate is at an extreme.

You then need to see if the chances are on your side with the breakout so you check cost momentum. There are lots of momentum signs to assist you time your relocation and get the speed of price in your corner. The ones you select refer personal preference however I like the ADX, RSI and stochastic. If my momentum computation accumulates I choose the break.

These are the long term investments that you do not hurry into. This is where you take your time evaluating Stochastic Trading a good area with resistance and assistance to make a huge slide in earnings.

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise need to search for floorings and ceilings in a stock chart. This can reveal a trader about where to get in and about where to get out. I state “about” since it is quite hard to guess an “exact” bottom or an “exact” top. That is why securing earnings is so so important. If you don’t secure profits you are actually running the danger of making an useless trade. Some traders end up being truly greedy and it just injures them.

Inspect some momentum signs, to see how overbought momentum is and a terrific one is the stochastic. We don’t have time to discuss it in complete information here so look it up, its a visual indicator and will only take 30 minutes approximately to discover. Search for it to end up being overbought and after that. just look for the stochastic lines to cross and turn down and get brief.

Currency trading is a method of making cash however it also depends on the luck factor. But all is not lost if the traders make rules on their own and follow them. This will not just ensure higher profits but also minimize the danger of higher losses in trade.

Don’t anticipate t be a millionaire overnight, because that’s simply not realistic. No one can forecast where the market will go. You can use the mid band to buy or offer back to in strong patterns as it represents value.

If you are looking best ever exciting comparisons relevant with Macd And Stochastic A Double-cross Strategy, and Forex Trading Strategies, Forex Trading Advice, Forex Day Trading Signals you are requested to subscribe our email list for free.