Ultimate MACD Indicator Trading Course (EXPERT INSTANTLY)

Popular high defination online streaming highly rated Online Forex Trading, Best Trading System, and What Is Stochastic Divergence, Ultimate MACD Indicator Trading Course (EXPERT INSTANTLY).

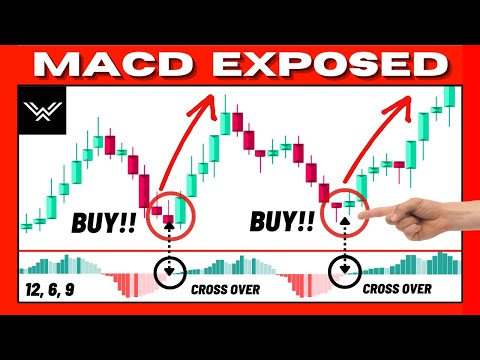

In this video we show you the Wysetrade advanced MACD indicator trading strategy. MACD is used by many traders but is often used incorrectly. We combine all concepts from our past videos SO MAKE SURE YOU WATCH ALL OUR PAST VIDEOS TO GET CAUGHT UP!

⚡️🔴 MORE CONTENT: https://www.wysetrade.com

⚡️🔴 INSTAGRAM: https://www.instagram.com/wysetrade

What Is Stochastic Divergence, Ultimate MACD Indicator Trading Course (EXPERT INSTANTLY).

Day Forex Signal Strategy Trading

The more flat these 2 levels are, opportunities of a rewarding range trading will be higher. This is something that you are not visiting on an easy backtest. This is where the false marketing is available in.

Ultimate MACD Indicator Trading Course (EXPERT INSTANTLY), Search popular explained videos related to What Is Stochastic Divergence.

Variety Trading Winning Strategies

Forex swing trading is among the best ways for newbies to seek big gains. Unfortunately, that’s what a great deal of traders believe technical analysis is. Keep your stop well back until the pattern remains in movement.

There is a difference between trading and investing. Trading is always brief term while investing is long term. The time horizon in trading can be as brief as a few minutes to a few days to a couple of weeks. Whereas in investing, the time horizon can be months to years. Many individuals day trade or swing trade stocks, currencies, futures, alternatives, ETFs, commodities or other markets. In day trading, a trader opens a position and closes it in the very same day making a quick revenue. In swing trading, a trader attempts to ride a trend in the market as long as it lasts. On the other hand, a financier is least pushed about the brief term swings in the market. He or she has a long term time horizon like a couple of months to even a few years. This long period of time horizon matches their financial investment and monetary goals!

Trade the odds and this indicates cost momentum should support your view and validate the trade prior to you get in. Two great momentum indicators are – the Stochastic Trading and the Relative Strength Index – look them up and utilize them.

Due to the fact that simple systems are more robust than complex ones in the brutal world of trading and have less aspects to break. All the top traders utilize basically basic currency trading systems and you should to.

Stochastic Trading The swing trader buys into worry and sells into greed, so lets look at how the successful swing trader does this and take a look at a bullish pattern as an example.

MACD Crossover. After you have investigated a stocks chart to see if the stock is trending, you need to now examine out its MACD graph. MACD-stands for Moving Typical Convergence-Divergence. This graph has 2 lines, the crossing of the two lines is a signal of a brand-new trend. The 2 lines include a fast line and a slow line. If there is a trend Stochastic Trading , where the crossover occurs tells you. The fast line needs to cross above the slow line, or above the 0 line. The greater it ascends above the 0 line the more powerful the uptrend. The lower it comes down below the 0 line the stronger the sag. A trader or financier wishes to capture stocks that are trending huge time, that is how it is possible to make great cash!

When a cost is increasing highly. momentum will be increasing. What you need to look for is a divergence of momentum from rate i.e. rates continue to increase while momentum is refusing. This is known as divergence and trading it, is one of the very best currency trading strategies of all, as it’s warning you the trend will reverse and costs will fall.

It takes perseverance and discipline to wait for the right breakouts and then a lot more discipline to follow them – you need self-confidence and iron discipline – however you can have these if you desire to and soon be accumulating triple digit profits.

Doing this suggests you know what your maximum loss on any trade will be rather than losing whatever. Trading is constantly short-term while investing is long term. The 2 charts being the 5 minute and 60 minute EUR/USD.

If you are searching more entertaining reviews relevant with What Is Stochastic Divergence, and Stochastic System, Forex System, Determining Market Cycles, Forex Swing dont forget to signup our email subscription DB for free.