Ultimate Guide to Technical Indicators with EXAMPLES !! Technical Analysis 1 Hour Course

New un-edited videos relevant with Automatic Trading System, Trade Without Indicators, Stock Market Trend, and Stochastic Day Trading Strategy, Ultimate Guide to Technical Indicators with EXAMPLES !! Technical Analysis 1 Hour Course.

Ultimate Guide to Technical Indicators with EXAMPLES !! Technical Analysis 1 Hour Course

About This video

Hi everyone, in this video i’ve given all the necessary information about technical indicators which are used in trading in cryptocurrency, forex, stock market Dow Jones Nasdaq with proper examples. I have explained Momentum Indicators, Volume indicators, RSI, MACD, Stochastic Oscillator, Moving Average, MA, SMA, EMA. And i have explained them in such a simple way that even a 6 year old kid will be able to understand. So watch my video and then you will be able to predict the market more accurately

Subscribe to my channel INheritecH :– https://www.youtube.com/channel/UC1XavbVv7i1QuDtuKD0uSZg

Channel topics

technical analysis

forex trading

stock market

tradingview

day trading

tradingview best indicators

trading strategy

best tradingview indicator

scalping trading strategy

stocks

tradingview tutorial

double top pattern

trading

tradingview indicator

best buy sell indicator tradingview

best tradingview indicators

forex

technical analysis for beginners

stock market live

trading view

intraday trading live

day intraday trading live

trading bot

poweroftrading

usa

price action

crypto

how to trade forex

buy sell indicator tradingview

tradingview strategy

tradingview indicators

investment

power of trading

stock trading

technical analysis course

investing

technical analysis of stocks

chart pattern

supply demand trading strategy

support and resistance indicator tradingview

technical analysis cryptocurrency

indicator tradingview

forex trading for beginners

indicators

technical analysis secrets

chart analysis

market analysis

tradingview usa

uk

euro

trading indicators

financial education

cryptocurrency

financial markets

online trading

technical analysis forex

best trading platform

best trading indicator

best forex indicator

intraday trading

Query Solved

#technicalanalysis

#forextrading

#stockmarket

#tradingview

#daytrading

#tradingviewbestindicators

#tradingstrategy

#besttradingviewindicator

#scalpingtradingstrategy

#stocks

#tradingviewtutorial

#doubletoppattern

#trading

#tradingviewindicator

#bestbuysellindicatortradingview

#besttradingviewindicators

#forex

#technicalanalysisforbeginners

#stockmarketlive

#tradingview

#intradaytradinglive

#dayintradaytradinglive

#tradingbot

#poweroftrading

#usa

#priceaction

#crypto

#howtotradeforex

#buysellindicatortradingview

#tradingviewstrategy

#tradingviewindicators

#investment

#poweroftrading

#stocktrading

#technicalanalysiscourse

#investing

#technicalanalysisofstocks

#chartpattern

#supplydemandtradingstrategy

#supportandresistanceindicatortradingview

#technicalanalysiscryptocurrency

#indicatortradingview

#forextradingforbeginners

#indicators

#technicalanalysissecrets

#chartanalysis

#marketanalysis

#tradingviewusa

#uk

#euro

#tradingindicators

#financialeducation

#cryptocurrency

#financialmarkets

#onlinetrading

#technicalanalysisforex

#besttradingplatform

#besttradingindicator

#bestforexindicator

#intradaytrading

Subscribe to my channel and hit the like button

Stochastic Day Trading Strategy, Ultimate Guide to Technical Indicators with EXAMPLES !! Technical Analysis 1 Hour Course.

Forex Trading – My Day Trading Thoughts

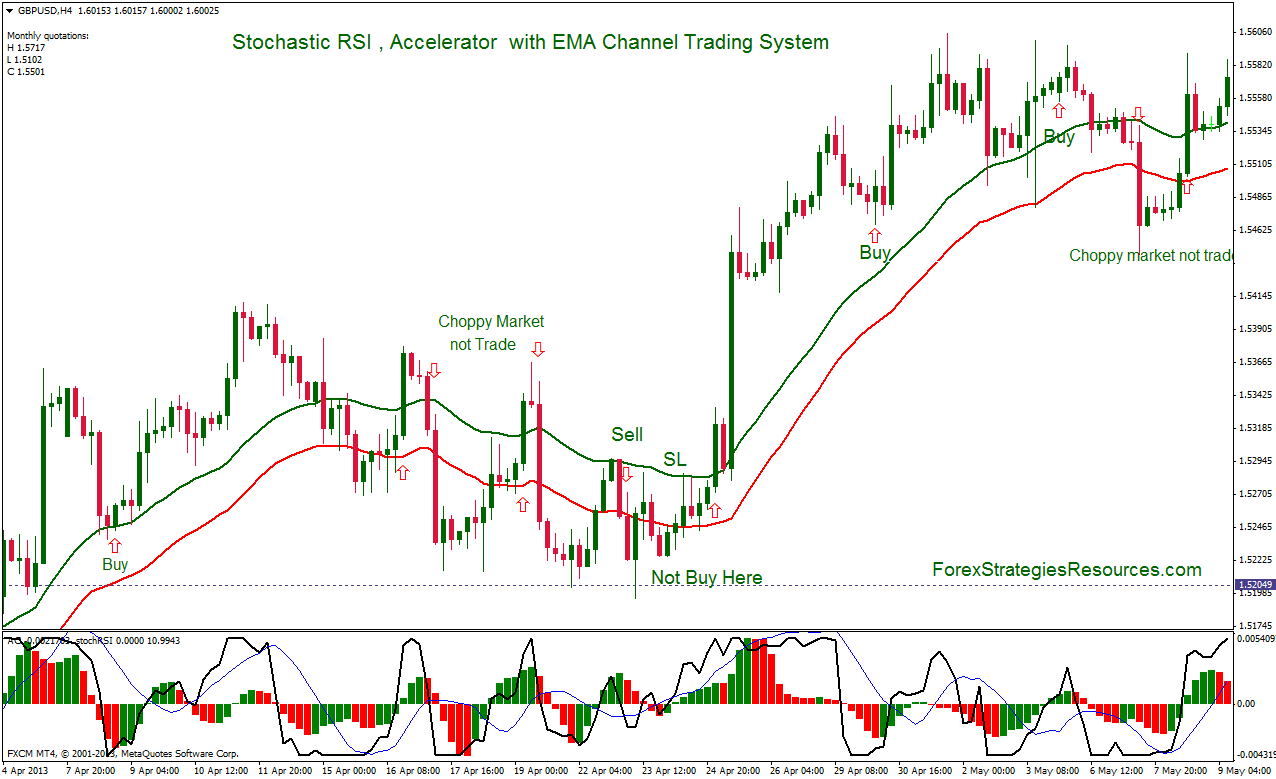

This chart has 2 lines, the crossing of the 2 lines is a signal of a brand-new trend. You then need to see if the chances are on your side with the breakout so you inspect price momentum. So how do we respect the pattern when day trading?

Ultimate Guide to Technical Indicators with EXAMPLES !! Technical Analysis 1 Hour Course, Enjoy new updated videos related to Stochastic Day Trading Strategy.

How To Earn Money In Your Home – The Forex Trading Solution

Many indicators are offered in order to determine the trends of the marketplace. Bollinger bands are based on standard variance. Let’s take a look at the technique and how it works.

The Stochastic Oscillator is an overbought/oversold indicator developed by Dr. George Lane. The stochastic is a common indication that is incorporated into every charting software application including MetaStock.

These are the long term financial investments that you do not rush Stochastic Trading into. This is where you take your time analyzing a good spot with resistance and support to make a huge slide in earnings.

Tonight we are trading around 1.7330, our first region of resistance is in the 1,7380 variety, and a second area around 1.7420. Strong support exits From 1.7310 to 1.7280 levels.

No problem you say. Next time when you see the earnings, you are going to click out and that is what you do. You were in a long position, a red candle shows up and you click out. Whoops. The market continues in your direction. You stand there with 15 pips and now the marketplace is up 60. Disappointed, you decide you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get set off. You do your homework. You go into the trade. Boom. Stopped out. Bruised, damaged and deflated.

MACD Crossover. After you have actually investigated a stocks chart to see if the stock is trending, you should now have a look at its MACD chart. MACD-stands for Moving Typical Convergence-Divergence. This graph has 2 lines, the crossing of the two lines is a signal of a brand-new trend. The 2 lines include a quick line and a slow line. Where the crossover takes place informs you if there is Stochastic Trading a trend. The fast line has to cross above the sluggish line, or above the 0 line. The higher it ascends above the 0 line the more powerful the uptrend. The lower it descends listed below the 0 line the stronger the sag. A trader or financier desires to catch stocks that are trending big time, that is how it is possible to make good money!

When the break takes place, put your stop behind the breakout point and wait up until the relocation is well in progress, before tracking your stop. Do not put your stop to close, or within typical volatility – you will get bumped out the trade.

If the price goes to a higher pivot level (which can be support or resistance) and the stochastic is low or high for a large time, then a turnaround will take place. Then a brand-new trade can be entered appropriately. Therefore, in this forex trading strategy, w wait till the marketplace saturate to high or low and then sell or buy depending on the situation.

The relocation after such inactive durations will often be in the instructions of the general trend. These are the long term investments that you do not rush into. Let’s discuss this Daily Timeframe Technique.

If you are searching instant engaging reviews about Stochastic Day Trading Strategy, and Currency Trading Charts, Effectively Trade dont forget to list your email address our email list for free.