Trading forex, Trading divergence strategy with the RSI

New overview about Online Currency Trading, Range Trading, Short Swing Trading, and How To Trade Divergence, Trading forex, Trading divergence strategy with the RSI.

This is how I trade divergence it is a very powerful trend reversal strategy hope you can benefit from it like I have done

How To Trade Divergence, Trading forex, Trading divergence strategy with the RSI.

Trading Stochastics – It’s Not All That It’s Broken Up To Be

Emotions are like springs, they extend and contract, both for just so long. Forex swing trading is among the very best methods for novices to look for huge gains. The outer bands can be used for contrary positions or to bank profits.

Trading forex, Trading divergence strategy with the RSI, Watch top full videos related to How To Trade Divergence.

Forex Pattern Following – 2 Ideas To Milk The Huge Patterns For Larger Profits

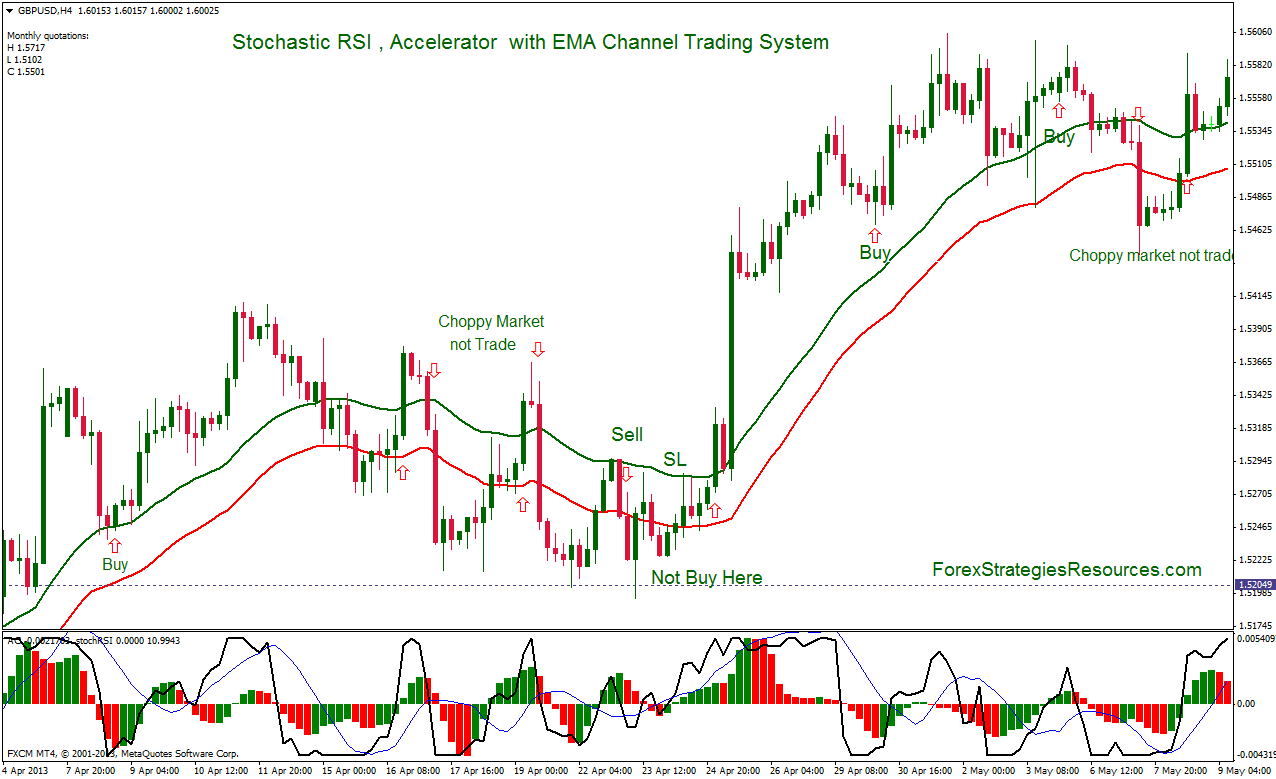

It reveals you the crossovers of bullish and bearish divergence of oversold and overbought levels. The beauty of cycle analysis is that we can typically identify possible tops and bottoms well ahead of time.

, if you want to win at forex trading and enjoy currency trading success possibly one of the simplest methods to achieve it is to trade high odds breakouts.. Here we will look at how you can do this and make big earnings.

As soon as the move is well in progress, start to trail your stop however hold it beyond day-to-day volatility (if you do not understand Stochastic Trading standard deviation of price make it part of your forex education now), this indicates trailing right back – when the move turns, you are going to return some earnings, that’s ok., if you caught simply 60% of every significant trending move you would be extremely rich!! , if it’s a big relocation you will have plenty in the bank and you can’t anticipate where prices go so do not attempt..

The 2nd indication is the pivot point analysis. This analysis strategy depends upon recognizing various levels on the chart. There are three levels that serve as resistance levels and other 3 that function as assistance levels. The resistance level is a level the cost can not go above it for a large period. The assistance level is a level the cost can not go below it for a big duration.

Now I’m not going to get into the details as to why cycles exist and how they belong to cost action. There is much written on this to fill all your peaceful nights in checking out for years. If you invest just a bit of time seeing a MACD or Stochastic Trading indication on a cost chart, you should already be convinced that cycles are at work behind the scenes. Just watch as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ebb and flow of rate action.

If you captured just 50% of every major trend, you would be very rich; accept brief term dips versus Stochastic Trading you and keep your eyes on the bigger long term reward.

This has absolutely been the case for my own trading. Once I concerned realize the power of trading based on cycles, my trading successes leapt leaps and bounds. In any provided month I average a high percentage of winning trades against losing trades, with the couple of losing trades leading to extremely little capital loss. Timing trades with pinpoint accuracy is empowering, only leaving ones internal psychological and psychological baggage to be the only thing that can undermine success. The technique itself is pure.

It takes persistence and discipline to wait on the right breakouts and then even more discipline to follow them – you need confidence and iron discipline – however you can have these if you want to and soon be stacking up triple digit earnings.

This identifies whether the time frame required is hourly, everyday or annual. The more flat these 2 levels are, possibilities of a rewarding variety trading will be higher. This is to forecast the future pattern of the cost.

If you are searching best ever engaging reviews about How To Trade Divergence, and Stock Prices, Thinslice Trading dont forget to subscribe for subscribers database totally free.