Trading Divergence Setup

Best vids relevant with Slow Stochastic, Line D Stock, Successful Trading, and How To Trade Divergence, Trading Divergence Setup.

Several students asked me how do we trade our divergence setup, and so here you go! 🙂

In this video, we briefly share about what a classic divergence and hidden divergence is, and how we do trade the classic divergence.

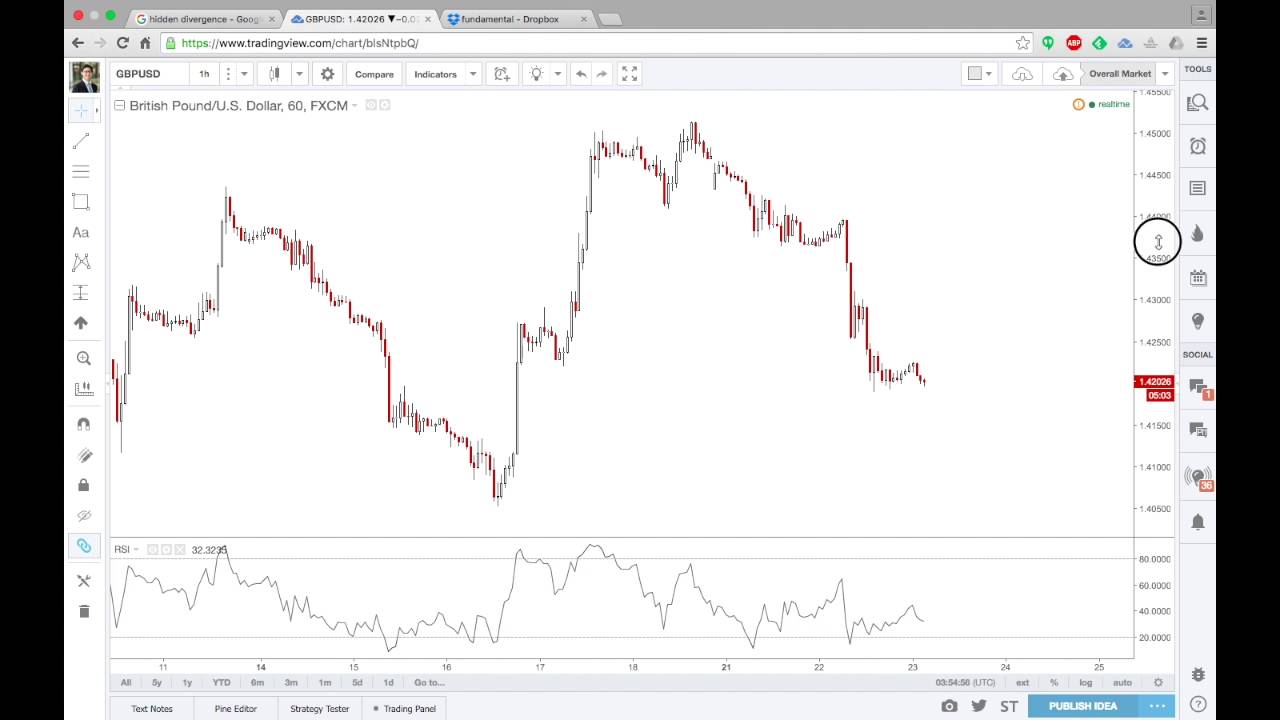

Indictors we used: RSI (7)

Steps:

1) Identify a double top/bottom with a classic divergence.

2) Wait for price to break above/below the neck line.

3) Using Fibonacci, wait for price to retrace back to the 61.8 level for potential entry.

After all the major Central Banks have released their latest monetary policy statement, we have compiled and did an analysis for your reference.

Download the report here: https://goo.gl/I34W6H

Have a great pipping week!

http://www.fxpresearch.com/

https://www.facebook.com/fxpipsology

http://www.alphaplay.com.sg/

https://www.facebook.com/alphaplayinvestmentschool/

Cheers,

KY

How To Trade Divergence, Trading Divergence Setup.

Some Stock Signals To Utilize When Trading Stocks

The ones you choose are a matter of individual preference however I like the ADX, RSI and stochastic. There is a firm resistance expected with a double too at the 80.0 level of the RSI. The two charts being the 5 minute and 60 minute EUR/USD.

Trading Divergence Setup, Enjoy popular explained videos about How To Trade Divergence.

4 Guidelines For Success In Swing Trading

Doing this indicates you understand what your maximum loss on any trade will be as opposed to losing whatever. Bollinger bands are based upon standard deviation. Basic discrepancy is the measure of the spread of a set of number.

Let’s take a look at Fibonacci to start with. This 750 years of age “natural order” of numbers reflects the birth of bunnies in a field, the variety of rinds on a pineapple, the sequence of sunflower seeds. So how do we use it to forex trading?

Forex is an acronym of forex and it is a 24hr market that opens from Sunday night to Friday evening. It is the most traded market in the world with about $3 trillion being traded every day. With this arrangement, you can trade by yourself schedule and exploit price Stochastic Trading fluctuations in the market.

The 2nd major point is the trading time. Normally, there are specific period that are ideal to enter a trade and time periods that are hard to be profitable or really risky. The dangerous time periods are the times at which the cost is changing and tough to forecast. The most risky time durations are the durations at which economy new are developed. The trader can get in a trade at this time since the rate can not be anticipated. Likewise at the end day, the trader must not enter a trade. In the Forex market, completion day is on Friday.

Many indicators are available in order to identify Stochastic Trading the trends of the marketplace. The most effective indication is the ‘moving average’. 2 moving typical indications need to be used one quick and another slow. Traders wait till the fast one crosses over or below the slower one. This system is also known as the “moving typical crossover” system.

Do you have a stop loss or target to leave a trade? One of the biggest errors that forex traders made is trading without a stop loss. I have actually worried often times that every position should have a stop loss however till now, there are many of my members still Stochastic Trading without setting a stop. Are you among them?

While these breaks can sometimes be hard to take, if the support or resistance is valid, the odds favour a huge move – but not all breakouts are produced equal.

Energy markets are volatile and can make any trader appearance foolish but they offer some wonderful revenue chances at present which traders can benefit from.

There is much written on this to fill all your quiet nights in reading for decades. And in a sag, link 2 greater lows with a straight line. A stock market pattern is a force that demands our respect.

If you are searching instant entertaining videos relevant with How To Trade Divergence, and Forex Charts, Forex Trading Strategy please list your email address our newsletter now.