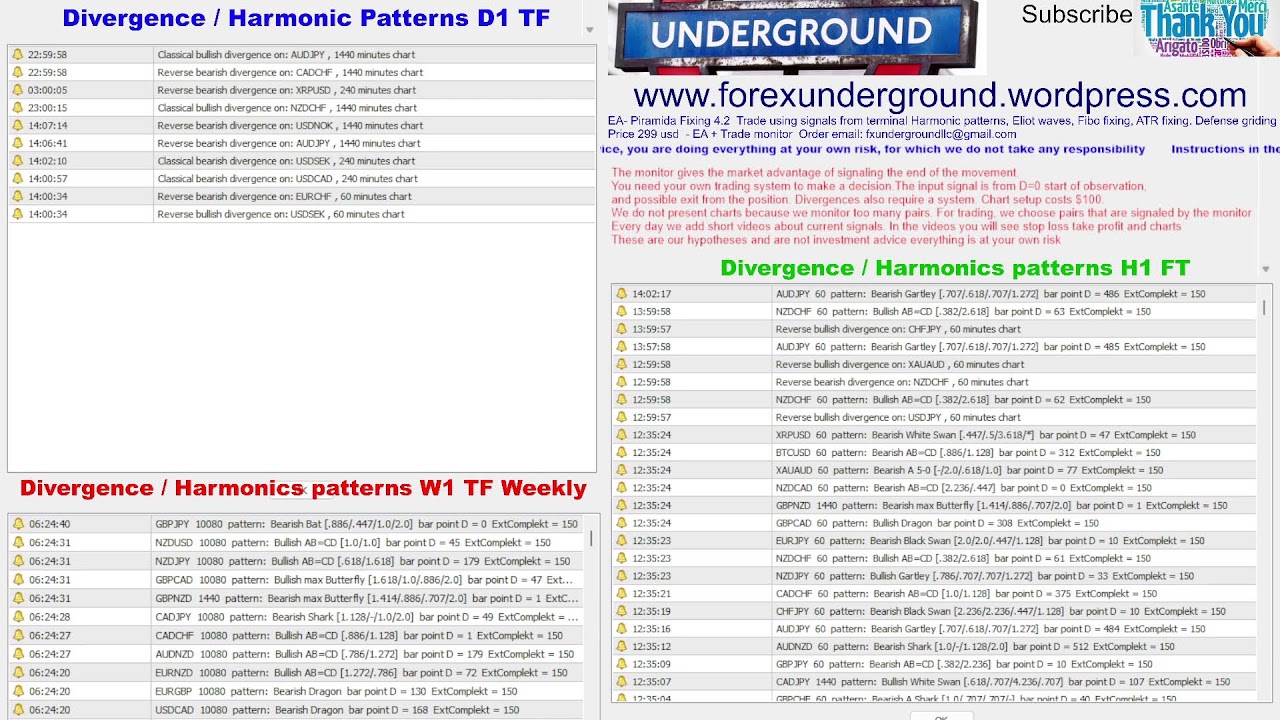

TRADE FOREX PRO Forex Divergence + Harmonic Patterns Scanner 200 charts live FX Underground LLC

Popular YouTube videos highly rated Effectively Trade Forex, Simple Forex Trading Strategy, Unpredictable Market, and What Is Stochastic Divergence, TRADE FOREX PRO Forex Divergence + Harmonic Patterns Scanner 200 charts live FX Underground LLC.

Harmonic trading is a methodology that uses specific price patterns to identify potential reversal points in the financial markets. One of the patterns used in harmonic trading is the “ABCD” pattern, which consists of four price swings and is often referred to as the “ABCD pattern” or the “ABCD harmonic pattern.”

In the context of harmonic trading, “bar point D” refers to the fourth and final price swing of the ABCD pattern. The pattern typically unfolds as follows:

“A” represents the initial price swing in a given direction.

“B” represents a retracement of the initial swing.

“C” represents a corrective move that follows the retracement.

“D” represents the completion of the pattern, where price reaches a specific level that indicates a potential reversal.

The completion point “D” is crucial in harmonic trading as it serves as a potential area where traders anticipate the price to reverse and initiate a new trend. Traders often use Fibonacci ratios and other technical analysis tools to identify and confirm the completion point “D” of the harmonic pattern.

It’s worth noting that harmonic trading is a complex and subjective trading methodology that requires careful analysis and interpretation. It’s always recommended to thoroughly study and practice with harmonic patterns before applying them in real trading scenarios.

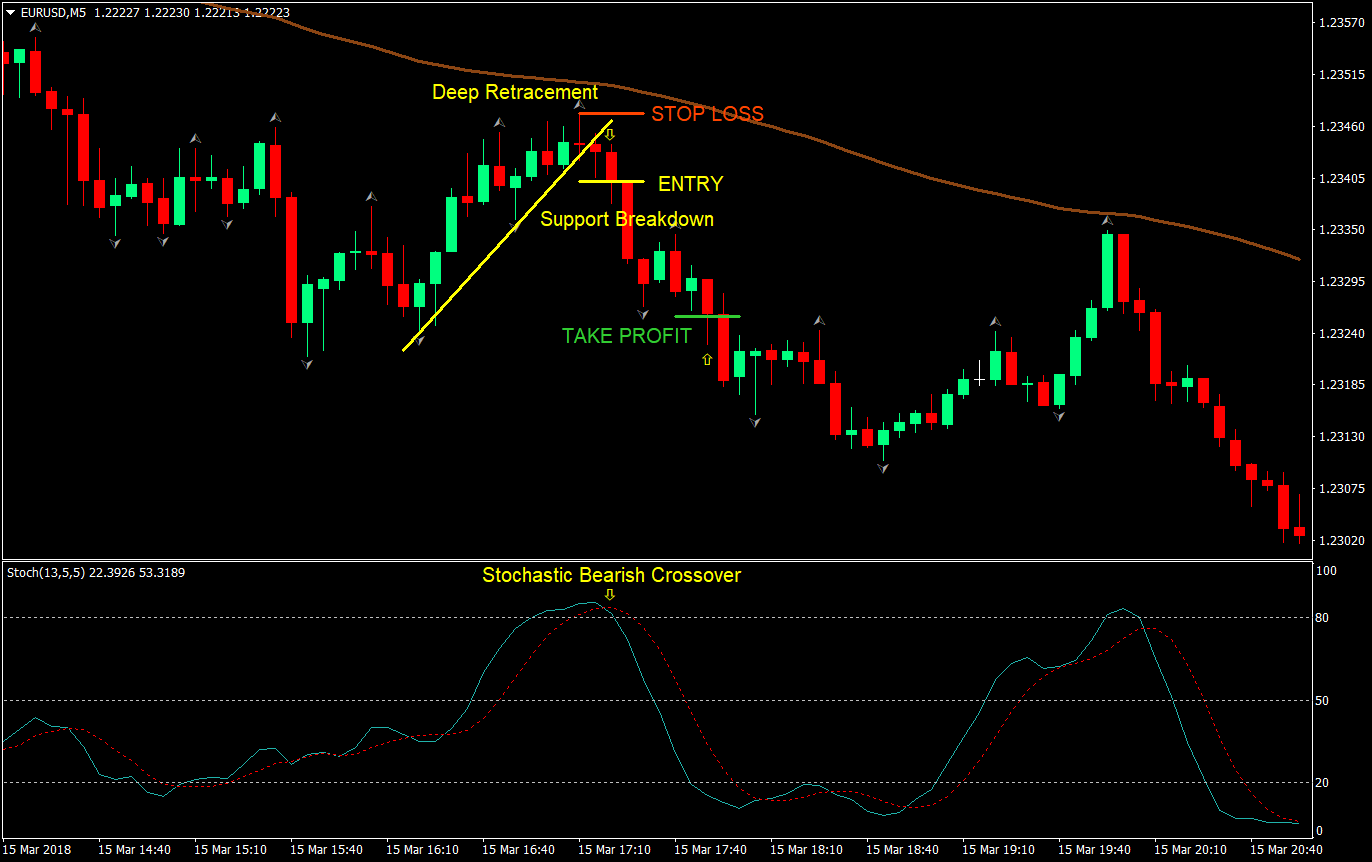

Divergence trading is a popular strategy used in technical analysis to identify potential trend reversals in the financial markets. It is based on the concept that when the price of an asset moves in one direction, while a related indicator or oscillator moves in the opposite direction, it can signal a shift in the underlying momentum and potential trend reversal.

There are two main types of divergences: bullish divergence and bearish divergence.

Bullish Divergence: Bullish divergence occurs when the price of an asset forms a lower low, but the indicator or oscillator forms a higher low. This suggests that although the price is showing weakness, the momentum is shifting upwards, indicating a potential trend reversal to the upside. It may signal an opportunity to go long or buy the asset.

Bearish Divergence: Bearish divergence occurs when the price of an asset forms a higher high, but the indicator or oscillator forms a lower high. This indicates that despite the price showing strength, the momentum is weakening, suggesting a potential trend reversal to the downside. It may signal an opportunity to go short or sell the asset.

Traders often use various indicators and oscillators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator to identify and confirm divergences. These indicators help compare the price action with the underlying momentum and provide signals for potential trend reversals.

It’s important to note that while divergences can be useful in identifying potential reversals, they should not be considered as standalone signals. Traders often combine divergence analysis with other technical indicators, chart patterns, and fundamental analysis to make well-informed trading decisions.

LINKS TO PARTNERS

Best Broker for Divergence Trading – Laverage 500 its important

Cashback up to 10 usd from standard lot Gold and Pairs up to 1:1 like eurusd

https://www.vantagemarkets.com/?affid=NTMzOA==

Live Steram Divergence monitor H1 / H4 / D1 – Need trading system? Write ot US

https://forexunderground.wordpress.com/

Cashback up to 10 usd

After registration from link send account number using form from site

For 10 usd form standard lot write “Divergence monitor”

https://forexunderground.wordpress.com/trader-to-trader-free-system/

What Is Stochastic Divergence, TRADE FOREX PRO Forex Divergence + Harmonic Patterns Scanner 200 charts live FX Underground LLC.

Who Desires To Be A Forex Trading Millionaire?

The more flat these two levels are, chances of a profitable range trading will be higher. This is something that you are not visiting on a simple backtest. This is where the incorrect marketing is available in.

TRADE FOREX PRO Forex Divergence + Harmonic Patterns Scanner 200 charts live FX Underground LLC, Watch trending explained videos related to What Is Stochastic Divergence.

Forex Trading Technique – A Basic System For Triple Digit Gains

And if this is the scenario, you will not be able to presume that the price will turn when more. Trail your stop up gradually and outside of typical volatility, so you do not get bumped out of the pattern to soon.

Trading on the day-to-day charts is a much simpler method as compared to trading intraday. This day-to-day charts method can make you 100-500 pips per trade. You don’t need to being in front of your computer system for hours when trading with this everyday charts method.

The trader can monitor at which pivot level the price has actually reached. if it goes at higher level, this can be presumed as extreme point for the rate, the trader then must inspect the Stochastic Trading value. if it is greater than 80 percent for long period of time, this will be indication that the currency is overbought and the trader can go short. the currency will go short to much at this case.

Lots of people do not realize that the forex trading robotic software application will help handle charting. It is of the up the majority of value that you get a forex robotic that has basic trading tools such as Fibonacci levels, RSI, stochastic, in addition to moving average. This is just a minimum list of tools that you will require to be successful.

An essential starting point suffices cash to make it through the initial stages. , if you have adequate cash you have the time to find out and enhance your Stochastic Trading until you are making money.. How much cash is needed depends on how many contracts you want to trade. For example to trade 1 $100,000 dollar contract you require between $1000 and $1500 as margin.

Throughout my career in the forex market, mentor thousands of traders how to benefit, I have actually constantly suggested to begin with a pattern following method to Stochastic Trading currencies. I do the exact same thing with my current customers. Naturally, I’m going to share a pattern following technique with you.

This has certainly held true for my own trading. My trading successes jumped bounds and leaps as soon as I came to realize the power of trading based on cycles. In any given month I average a high portion of winning trades against losing trades, with the couple of losing trades leading to unbelievably little capital loss. Timing trades with pinpoint precision is empowering, just leaving ones internal psychological and emotional baggage to be the only thing that can undermine success. The method itself is pure.

I call swing trading “hit and run trading” which’s what your doing – getting high odds set ups, hitting them and after that banking profits, before the position can turn back on you. If you discover and practice the above strategy for a week or two, you will soon be positive enough to applly it for long term currency trading success.

Do not anticipate t be a millionaire overnight, since that’s just not practical. No one can predict where the market will go. You can use the mid band to purchase or sell back to in strong patterns as it represents worth.

If you are searching rare and exciting videos about What Is Stochastic Divergence, and Stock Market Trend, Currency Swing Trading dont forget to signup for a valuable complementary news alert service now.