Top breakout stocks for SWING TRADING✅✅🎉🎉

Trending clips top searched Technical Indicators, Forex Effectively, Trade Forex, and What’s Swing Trading, Top breakout stocks for SWING TRADING✅✅🎉🎉.

Top breakout stocks for tomorrow SWING TRADING ✅

✅Join telegram channel link-

https://t.me/swingandpositionalideas

✅Swing To Success Course Join:

https://vncvvs.courses.store/?utm_source=whatsapp&utm_medium=tutor-website-share&utm_campaign=app-home-banner

✅Download FREE STOCK MARKET EBOOK IN MY Android App:

https://play.google.com/store/apps/details?id=co.george.vztvw

weekly breakout stocks with high volume breakout. It also cover wide range of t opics.

trading,Breakout stocks for next week,Breakiut stocks for today Breakout stocks for tomorrow swing trading .

#swingtradingstrategies

#swingtrade

#Weekly breakout stocks

Breakout stocks to buy now

Poditive breakiut stocks

Share markets

Stocks to buy now

Monthly breakiut stocks

Poditive breakout stocks to buy Tomorrow

Breakout stocks refer to stocks that have experienced a significant price movement or “breakout” from a previous trading range or pattern. This movement is often characterized by the stock’s price breaking through a key resistance level, which suggests increased investor interest and potential for further price gains. Breakouts can occur in various timeframes, from short-term intraday moves to longer-term trends.

Traders and investors often look for breakout stocks as they may represent opportunities for profit. However, breakouts can be volatile, and not all breakouts lead to sustained upward trends. It’s important for individuals involved in stock trading to conduct thorough research, use technical analysis, and consider their risk tolerance when identifying and trading breakout stocks.

Some important topics covered under breakout:

Breakout stocks”

Weekly breakouts Stocks

Monthly breakout’s

Yearly breakout

“Stock market breakout strategies”

“Best breakout stocks to buy”

“Technical analysis for breakout stocks”

“Intraday breakout stocks”

“Swing trading breakout stocks”

“Penny stocks breakout”

“Nifty breakout stocks”

“Bank Nifty breakout stocks”

“Top breakout stocks this week”

“2021 breakout stocks”

“Indian stock market breakout”

“Candlestick patterns for breakout stocks”

“RSI breakout stocks”

“MACD breakout stocks”

“Moving average breakout stocks”

High volume breakout stocks are stocks that experience a significant price movement accompanied by unusually high trading volume. These stocks typically attract the attention of traders and investors because the combination of a breakout and high volume suggests strong buying or selling interest. Here’s a breakdown:

Breakout: A breakout occurs when a stock’s price moves above a key resistance level (in the case of a breakout to the upside) or below a key support level (in the case of a breakout to the downside). This signifies a potential change in the trend.

High Volume: High volume means that a large number of shares are being traded compared to the stock’s average daily trading volume. It indicates strong participation from traders and investors.

High volume breakout stocks can be of interest for traders and investors for several reasons:

Confirmation: High volume can confirm the validity of a breakout, making it more likely to be sustained.

Liquidity: High volume ensures that there are enough buyers and sellers in the market, reducing the risk of price manipulation and allowing for smoother trade execution.

Opportunity: Traders often seek high volume breakouts as potential trading opportunities to profit from short-term price movements.

However, it’s important to exercise caution when trading or investing in high volume breakout stocks. Not all breakouts lead to sustained trends, and sometimes, high volume can also be the result of speculative or short-term trading, which may not reflect the stock’s long-term fundamentals. It’s essential to conduct thorough research, use risk management strategies, and consider your investment goals and risk tolerance.

Disclaimer।।।

The Site publishes information relating to financial and investment issues from time to time. All information published and disseminated on the Site including the blogs, contents of our newsletters, calculators, other tools and features provided on the Site are for information and educational purposes to enable the User(s) to make prudent financial decisions.

In case the User(s) avail the various paid membership services offered on the Site by Richtradingmind, various opinions, may be made available to such User(s) to enable them in taking relevant decisions.

All such information is for assistance only and shall not be taken as the sole basis for making any investment decisions.

The User(s) assume/s the entire risk that may be associated from the use of the information. The information, content posted, discussed, reviewed on the Site and other tools offered may not be suitable for all investors. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose.

What’s Swing Trading, Top breakout stocks for SWING TRADING✅✅🎉🎉.

Currency Trading Fundamentals – A Basic, Ageless Method For Huge Gains

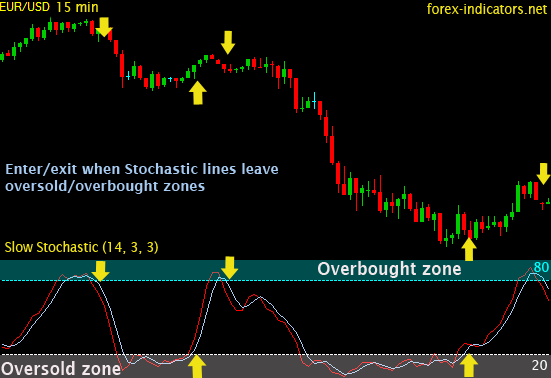

The support and resistance levels in the range need to form a horizontal line. Common indicators utilized are the moving averages, MACD, stochastic, RSI, and pivot points. What is does is connect a series of points together forming a line.

Top breakout stocks for SWING TRADING✅✅🎉🎉, Explore trending reviews about What’s Swing Trading.

5 Actions To Trading Success Utilizing Technical Analysis

That is, of course, till I got so stressed out trying to catch the reversal and I would quit. They await a certain cost target that they believe to be a good buy. The application is, as always, cost and time.

You can so this by utilizing the stochastic momentum sign (we have actually written frequently on this and it’s the very best indication to time any trade and if you are not farmiliar with it find out about it now) expect the stochastic lines to deny and cross with bearish divergence and go short.

Some these “high flyers” come out the high tech sector, that includes the Web stocks and semiconductors. Other “high leaflets” originated from the biotech stocks, which have actually increased volatility from such news as FDA approvals. Due to the fact that Stochastic Trading there are less of them than on the NASDAQ that trade like a home on fire on the right news, after a while you will recognize the signs.

The second sign is the pivot point analysis. This analysis strategy depends upon determining different levels on the chart. There are 3 levels that function as resistance levels and other 3 that act as assistance levels. The resistance level is a level the price can not exceed it for a large duration. The assistance level is a level the cost can not go below it for a big duration.

Numerous indicators are available in order to recognize Stochastic Trading the trends of the marketplace. The most effective indication is the ‘moving average’. 2 moving typical indicators ought to be used one fast and another slow. Traders wait until the fast one crosses over or below the slower one. This system is also understood as the “moving average crossover” system.

If you caught just 50% of every major pattern, you would be really abundant; accept short term dips versus Stochastic Trading you and keep your eyes on the bigger long term prize.

If the resistance and support lines converge, breakouts are possible. In this circumstances, you may not assume that costs will return always. You might like orders outside the converging line range to get a breakout as it happens. Yet again, examine your examinations against at least 1 extra indicator.

I call swing trading “hit and run trading” and that’s what your doing – getting high chances set ups, hitting them and after that banking earnings, before the position can turn back on you. If you discover and practice the above strategy for a week approximately, you will soon be positive adequate to applly it for long term currency trading success.

You can use the method to create your own signal to trade FX from day to day. As a market moves upward towards a resistance, stochastic lines need to generally punctuate. By waiting on a better price they miss the move.

If you are finding best ever exciting reviews about What’s Swing Trading, and Trading 4x Online, Forex Market, Unpredictable Market dont forget to subscribe our email alerts service totally free.