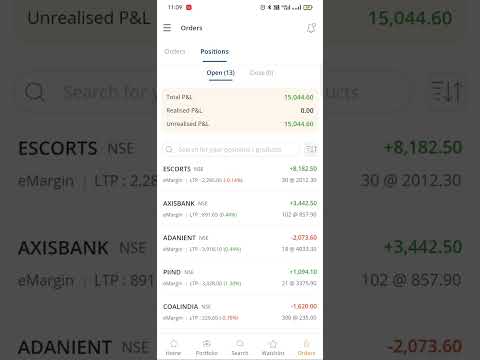

Today's profit and profit || Nifty|| Equity|| Swing Trading|| Portfolio

New vids related to Stock Investing, Simple System, and What’s Swing Trading, Today's profit and profit || Nifty|| Equity|| Swing Trading|| Portfolio.

Nifty||Banknifty||Equity||Tips||Recommended Stock ||Recommendation stock ||Banknifty option||Buying||Selling||stoploss|| How to recover||Today’s profit and Loss||how i Recover||Swing Trading Strategy|| Intraday Trading|| daily 5000 earning from stock|| 150000/- per month earnings||| My portfolio|| My portfolio Stock|| my investment and earning|| Stock market Knowledge||Share market||Share market ka gyan||Trend following strategy|||

Tips|| Share market kaise shikhe|| Basic Knowledge of share market||candle chart|| How to find out fundamental stock|| Trends Following indicator||

Please Like and subscribe My channel 😊

Billion Dollar Mission Start

What’s Swing Trading, Today's profit and profit || Nifty|| Equity|| Swing Trading|| Portfolio.

Forex Charts – Standard Earnings Tips For Beginners

The buzzword today in trading is “signs, indicators, signs”. This is to verify that the price pattern holds true. The final band in the Forex trading technique is the entry and exit points.

Today's profit and profit || Nifty|| Equity|| Swing Trading|| Portfolio, Explore latest full videos about What’s Swing Trading.

What’s Your Trading Plan?

Numerous individuals have actually considered purchasing a forex robot too assist them begin trading forex. Today we are going to take a look at the US Dollar V British Pound and Japanese Yen.

You can so this by utilizing the stochastic momentum indicator (we have composed regularly on this and it’s the finest indication to time any trade and if you are not farmiliar with it find out about it now) look for the stochastic lines to decline and cross with bearish divergence and go short.

You’ll notice that when a stock rate hits the lower Bollinger Band, it typically tends to increase once again. Using the SMA line in the middle of the Bollinger Bands gives Stochastic Trading us an even much better photo. Remember, whatever stock sign you choose from on the NASDAQ 100, you must inspect for any news on it prior to you trade it as any unfavorable news might impact the stock no matter what the Nasdaq performance is like.

The 2nd major point is the trading time. Generally, there are certain time periods that are perfect to get in a trade and time periods that are hard to be very dangerous or rewarding. The dangerous time durations are the times at which the price is fluctuating and tough to anticipate. The most dangerous time periods are the periods at which economy new are arisen. The trader can go into a trade at this time due to the fact that the rate can not be predicted. Likewise at the end day, the trader should not get in a trade. In the Forex market, completion day is on Friday.

Now I’m not going to get into the information as to why cycles exist and how they belong to cost action. There is much written on this to fill all your peaceful nights in reading for years. If you invest just a little bit of time viewing a MACD or Stochastic Trading indication on a cost chart, you should currently be encouraged that cycles are at work behind the scenes. Simply watch as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of price action.

If you captured just 50% of every major pattern, you would be really rich; accept brief term dips against Stochastic Trading you and keep your eyes on the larger long term reward.

But don’t think it’s going to be a breeze either. Don’t expect t be a millionaire overnight, since that’s simply not realistic. You do need to put in the time to find out about technical analysis. By technical analysis, I do not indicate tossing a number of stochastic signs on your charts, and have them tell you what to do. Regrettably, that’s what a lot of traders think technical analysis is.

Rule number one: Finance is of utmost value if you remain in for a long period of time of TF. Adapt to the emerging trading trends. A synergy between the systems functions and tools and your understanding of them will insure earnings for you. Using an automatic system will help you step up your portfolio or begin producing an effective one. Thoroughly select the automated trading system that covers your work action by action and not get swindled by a system shown to make the owner cash from selling an inferior product.

It is the most traded market in the world with about $3 trillion being traded every day. You can set your target just above the mid band and take revenue. The traders most favored currency sets are the EURUSD, USDJYP and GPBUSD.

If you are searching most entertaining comparisons relevant with What’s Swing Trading, and Automatic Trading System, Effectively Trade please subscribe for newsletter for free.