The Zig Zag Indicator

Interesting full length videos relevant with Stock Trading Strategy, Automatic Forex, Currency Trading Training, Trading Currencies, and Stochastic Crossover Alert, The Zig Zag Indicator.

The Zig Zag Indicator explained further.

Welcome everyone to the Stock Planner Channel. If you enjoy this video feel free to SUBSCRIBE! Make sure to follow me on social media for even more coverage of the stock market.

Follow Me:

Facebook: https://www.facebook.com/stockplanner

Twitter: https://twitter.com/StockPlanner

Subscribe:

https://www.youtube.com/channel/UC-hq…

Investing is risky and you need to develop your own ideas. I am not a financial planner or licensed stockbroker so any buy or sell signals on this channel are for educational and critical comments only. Happy Trading

Stochastic Crossover Alert, The Zig Zag Indicator.

Basic Systems For Trading Forex

In an uptrend each new peak that is formed is greater than the previous ones. But how to predict that the existing trend is ending or is about to end? You stand there with 15 pips and now the marketplace is up 60.

The Zig Zag Indicator, Find latest full length videos related to Stochastic Crossover Alert.

Forex Trading System Building In Five Steps

It is one of the most traded market worldwide with about $3 trillion being traded every day. Dow theory in nutshell says that you can utilize the previous rate action to forecast the future price action.

There is a distinction between trading and investing. Trading is always short-term while investing is long term. The time horizon in trading can be as brief as a few minutes to a few days to a few weeks. Whereas in investing, the time horizon can be months to years. Many people day trade or swing trade stocks, currencies, futures, alternatives, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the same day making a quick revenue. In swing trading, a trader tries to ride a pattern in the market as long as it lasts. On the other hand, a financier is least pressed about the brief term swings in the market. She or he has a long term time horizon like a few months to even a couple of years. This long time horizon matches their investment and financial objectives!

You’ll notice that when a stock price strikes the lower Bollinger Band, it usually tends to rise again. Utilizing the SMA line in the middle of the Bollinger Bands offers Stochastic Trading us an even better photo. Keep in mind, whatever stock symbol you choose from on the NASDAQ 100, you ought to look for any news on it before you trade it as any negative news might impact the stock no matter what the Nasdaq efficiency resembles.

You require less discipline than pattern following, because you don’t need to hold positions for weeks on end which can be tough. Instead, your losses and revenues come rapidly and you get lots of action.

No problem you say. Next time when you see the earnings, you are going to click out which is what you do. You remained in a long position, a red candle light shows up and you click out. Whoops. The market continues in your instructions. You stand there with 15 pips and now the market is up 60. Disappointed, you choose you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get activated. You do your research. You enter the trade. Boom. Stopped out. Bruised, damaged and deflated.

Throughout my career in the forex industry, teaching thousands of traders how to benefit, I have actually constantly recommended to begin with a trend following technique to Stochastic Trading currencies. I do the same thing with my current customers. Naturally, I’m going to share a trend following approach with you.

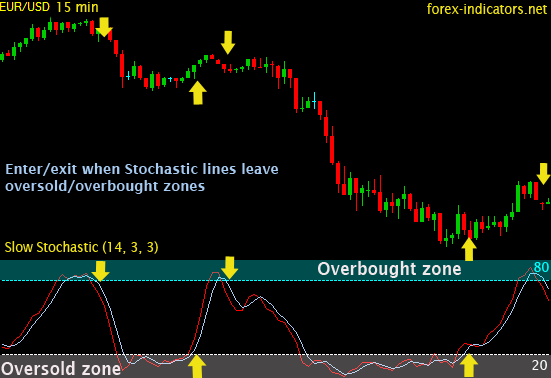

The technical analysis needs to likewise be determined by the Forex trader. This is to forecast the future trend of the cost. Typical indications utilized are the moving averages, MACD, stochastic, RSI, and pivot points. Note that the previous indicators can be utilized in mix and not only one. This is to verify that the cost trend holds true.

Wait for the indications to indicate the bears are taking control, by means of the stochastic and RSI and remember the bulls only take charge above January’s highs.

But do not believe it’s going to be a breeze either. It is appropriately one of the reasons that the interest in trading Forex online has actually been increasing. Then I started attempting to trade all these easy patterns with real cash.

If you are looking unique and exciting reviews relevant with Stochastic Crossover Alert, and Trading Forex, Trading Support and Resistance you are requested to join in newsletter for free.