The TRUTH about TRIPLE EMA you should know (TEMA) – Day Trading Strategies

New updated videos highly rated Automatic Trading System, Trade Without Indicators, Stock Market Trend, and Best Stochastic For Day Trading, The TRUTH about TRIPLE EMA you should know (TEMA) – Day Trading Strategies.

Triple EMA Trading Strategies or TEMA Indicator things you should know before using it in the Stock Market and Forex Day Trading

Official Trading Rush Website: https://tradingrush.net

Download Official Trading Rush APP (Thanks): https://bit.ly/tradingrushapp

Support the Channel on Patreon (Thanks): https://www.patreon.com/tradingrush

Trading Merch for Best Traders: https://teespring.com/stores/trading-rush

Watch More Videos:

Trading Rush All Uploads : https://youtube.com/playlist?list=PLuBdu9GKAoP6nIjNTJGQgWEay_AeJlmeQ

Trading Strategies Tested 100 Times : https://www.youtube.com/playlist?list=PLuBdu9GKAoP4shAZd6QnM5BJUy1-IcnyD

Trading Strategies : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6MEtX7stfzTGx62M5r3F4Z

Trading Tips and Mistakes : https://www.youtube.com/playlist?list=PLuBdu9GKAoP6lPl2txSXE8AlkhiwgWU2O

MACD Trading Strategy tested 100 times : https://youtu.be/nmffSjdZbWQ

Download Excel Sheet for Day Trading : https://youtu.be/fLKd7uKZOvA

Read Trading Rush Disclaimer: https://tradingrush.net/disclaimer/

Subscribe For More Videos.

Is the Triple EMA really better than the normal Exponential Moving Average? The Triple EMA is very similar to the Double Exponential Moving Average, but as the name says, in the double exponential moving average, you use two Exponential Moving Averages, and in the Triple EMA, you use three Exponential Moving Averages to calculate the values. This results in a faster EMA with less lag.

If you plot a normal 200 Exponential Moving Average, a DEMA, and a Triple Exponential Moving Average at the same time. You can obviously guess that the Triple EMA will be the fastest. However, the fastest Exponential Moving Average doesn’t always have to mean better.

For example, when we talked about the Double Exponential Moving Average, we saw that DEMA was actually better when used as an exit indicator because it reacted to the price faster. But compared to DEMA, the Triple EMA sticks way too close to the price, and when used as an exit indicator, the price will cross it multiple times leading to false early exits. In other words, the DEMA is still the sweet spot between not too fast and not too slow.

But then what’s the point of using a Triple Moving Average? If you look at this chart, you will notice that even though Triple EMA was sticking very close to the price in the trend, when the trend was over, or when the price started to reverse, the Triple EMA was far away from the price. Because of this, the main purpose of the Triple Exponential Moving Average is to smooth out the noise like most moving averages, while reacting to price movements with reduced lag. Remember, just because Triple EMA stays near the price, it is not the same as the faster period normal moving average. However, if you remember, in the Double Exponential Moving Average Video I said, that in a trend, you can achieve the same result as DEMA, by simply using a faster period exponential moving average. With the Triple EMA, that’s not the case. However, a shorter period Double Exponential Moving Average looks very similar to a Triple Exponential Moving Average in a trend.

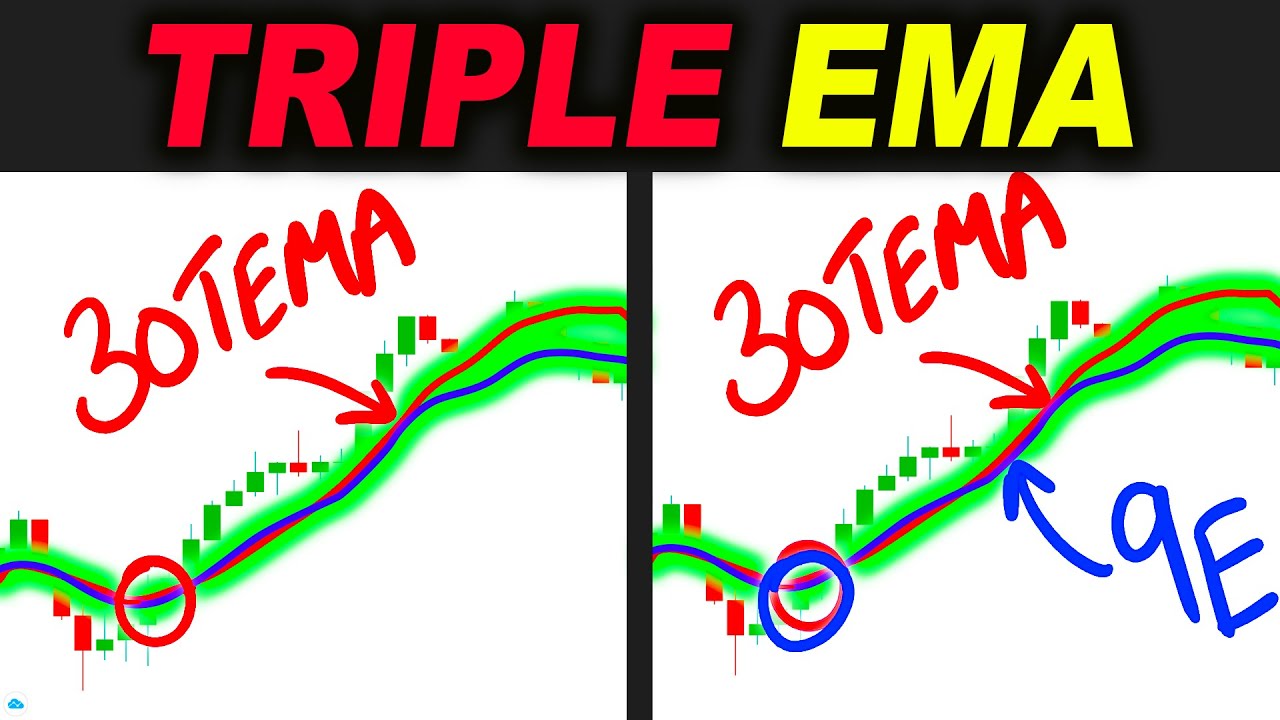

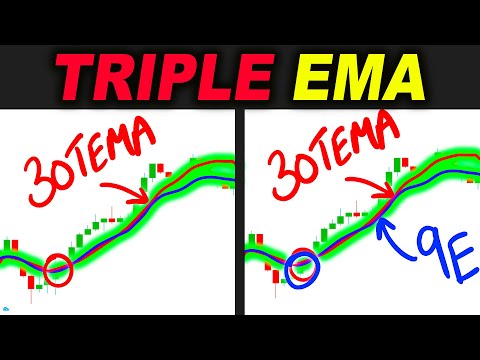

Well, if that’s the case, is Triple EMA special? If you think the normal exponential moving average is special, then yes! But should you use the Triple EMA over a normal Exponential Moving Average? Many traders like to use a 30 period Triple EMA in a strong trend. In an uptrend, they buy when the candle closes above the 30 Triple Exponential Moving Average. But then again, if you add a normal 9-period Exponential Moving Average on the same chart, you will see the normal EMA reacts pretty much the same way in the strong trend, and even gives faster and better entry signals in many cases. The 9 period Exponential Moving Average Strategy is a widely used Trading Strategy, and even I have made money with it in the past. As you can see, in this case, the 9-period normal Exponential Moving Average Strategy gave a way better entry signal than the 30 period Triple EMA Strategy, and many time gives the same or even better exit signals than the 30 period Triple EMA.

Subscribe for more Trading Rush !!

Like and Share the Video to see More Stock Market Intraday Trading Strategy and Forex Day Trading Strategies

NOTE: If your comment magically disappears, it’s because all comments are auto-held for review to avoid imposters who use Trading Rush Logo and Name and reply random links and make people think real Trading Rush is replying. I have a VERIFIED Tick Mark after “Trading Rush”. Use that to differentiate between me and the bots. Happy Trading!

Best Stochastic For Day Trading, The TRUTH about TRIPLE EMA you should know (TEMA) – Day Trading Strategies.

Forex Charts Can Lead To Big Profits

There are many phony breakouts though and therefore you desire to trade breakouts on the present pattern.

In swing trading, a trader attempts to ride a pattern in the market as long as it lasts.

The TRUTH about TRIPLE EMA you should know (TEMA) – Day Trading Strategies, Watch latest high definition online streaming videos about Best Stochastic For Day Trading.

6 Tested Winning Tips To Construct Your Forex Trading System

This is Expense William’s Accelerator Oscillator (Air Conditioning) and the Stochastic Oscillator. Sure enough, you can apply these ideas while utilizing a demo account. It works even in unpredictable market conditions.

One of the important things a new trader learns within a couple of weeks or so of starting his new experience into the world of day trading is the distinction in between 3 sign stocks and four sign stocks.

Versions are very important. Before you buy any forex robotic, you need to make sure that it is present. How can you do this? Examine the sellers website Stochastic Trading and check the version number of the software being offered. Also, check the copyright at the bottom of the page to see how frequently the page is upgraded. If not updates are being made, then it’s purchaser beware.

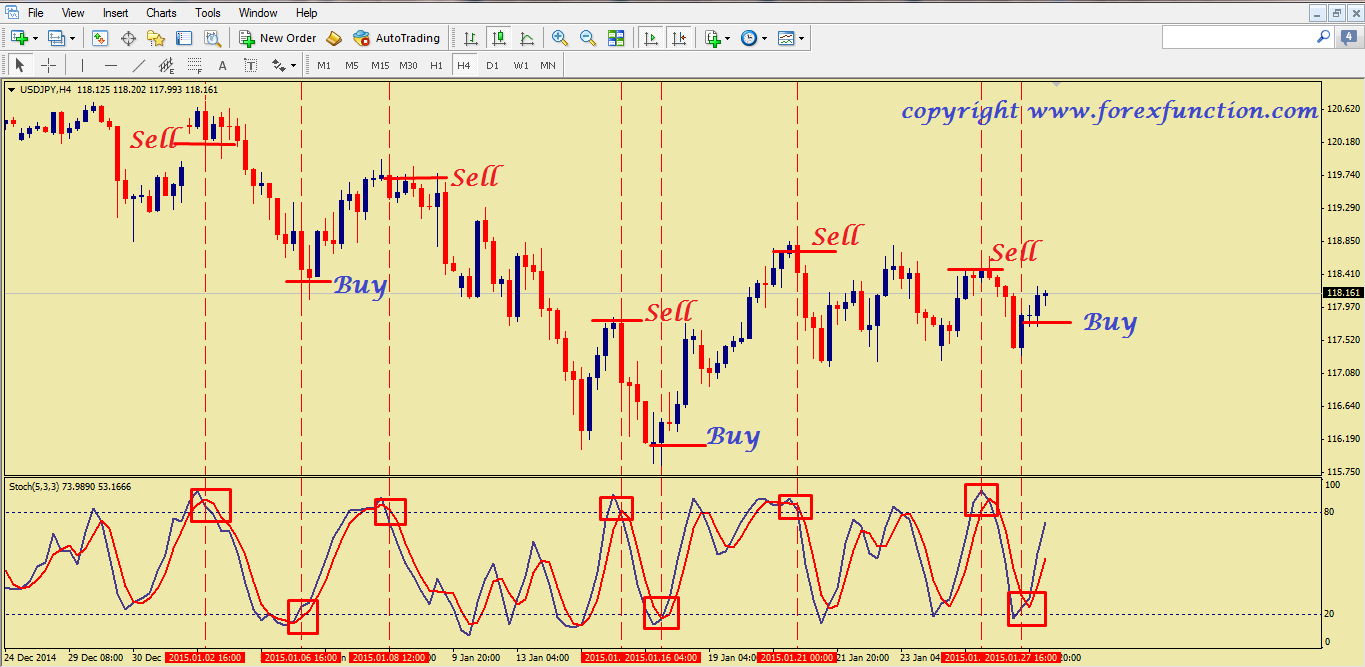

2 of the very best are the stochastic sign and Bollinger band. Use these with a breakout approach and they provide you a powerful combination for seeking big gains.

OK now, not all breakouts are produced equal and you want the ones where the chances are highest. You’re trying to find Stochastic Trading assistance and resistance which traders find crucial and you can typically see these levels in the news.

If you captured just 50% of every significant trend, you would be very rich; accept short-term dips versus Stochastic Trading you and keep your eyes on the larger long term prize.

This has actually absolutely been the case for my own trading. My trading successes leapt bounds and leaps as soon as I came to realize the power of trading based on cycles. In any given month I average a high portion of winning trades versus losing trades, with the couple of losing trades leading to extremely little capital loss. Timing trades with pinpoint precision is empowering, only leaving ones internal psychological and psychological luggage to be the only thing that can undermine success. The approach itself is pure.

Keep in mind, if your trading stocks, do your homework and share a plan and stay with it. Do not forget to lock in revenues. Stock trading can make you a lot of money if done in a disciplined way. So go out there and attempt it out.

In summary – they are leading indicators, to determine the strength and momentum of rate. Currency trading is a method of generating income but it likewise depends on the luck aspect. They are positioned side by side (tiled vertically).

If you are searching most engaging comparisons relevant with Best Stochastic For Day Trading, and Trading Forex, Trading Support and Resistance you are requested to join in email alerts service now.