The Reasons Why Swing Trading Is Best For You | What Investing Style?

Interesting replays top searched Learn Forex Trading, Mini Trading Course, Currency Trading Education, and What’s Swing Trading, The Reasons Why Swing Trading Is Best For You | What Investing Style?.

Hey team so i wanted to make a video that talks about swing trading and why i think its great for people who have a busy schedule. 1. Course & Mentorship: …

What’s Swing Trading, The Reasons Why Swing Trading Is Best For You | What Investing Style?.

Four Rules For Success In Swing Trading

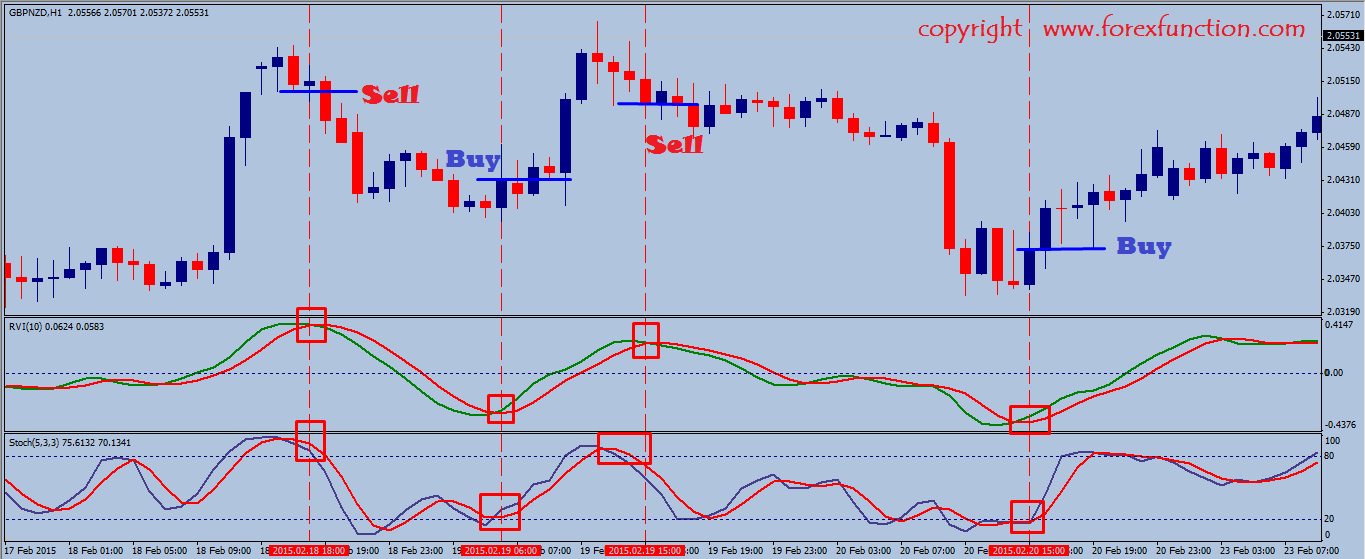

The ones you pick are a matter of personal choice but I like the ADX, RSI and stochastic. This is a basic Forex trading method which is sensible, east to discover and is a timeless method to make money.

The Reasons Why Swing Trading Is Best For You | What Investing Style?, Enjoy trending reviews about What’s Swing Trading.

Now That Forex Trading Is Made Easy

You might take one look at it and think it is rubbish. What were these fundamental analysts missing out on? More typical signs consist of: stochastic, r.s.i, r.v.i, moving averages, candle sticks, etc.

In these rather unsure financial times, and with the unpredictable nature of the stock market today, you might be wondering whether or not you ought to take out and head towards some other kind of financial investment, or you may be looking for a much better, more trustworthy stock trading indicator. Moving your cash to FOREX is not the answer; it is time to hang in there and get your hands on a terrific stock trading indicator. Try this now: Invest in Stock Attack 2.0 stock market software.

The trader can keep track of at which pivot level the rate has actually reached. if it addresses higher level, this can be presumed as extreme point for the cost, the trader then must inspect the Stochastic Trading worth. This will be sign that the currency is overbought and the trader can go short if it is higher than 80 percent for long time. the currency will go short to much at this case.

The second significant point is the trading time. Typically, there are particular time durations that are best to go into a trade and period that are hard to be really dangerous or successful. The dangerous period are the times at which the price is varying and difficult to anticipate. The most risky period are the periods at which economy new are arisen. The trader can go into a trade at this time due to the fact that the rate can not be predicted. Likewise at the end day, the trader must not enter a trade. In the Forex market, completion day is on Friday.

Just as essential as you will comprehend the logic that this forex Stochastic Trading strategy is based upon, you will have the discipline to trade it, even when you take a couple of losses as you know your trade will come.

The difficult part about forex Stochastic Trading is not so much getting a method – but believing in it and trading it with discipline. , if you do not trade with discipline you will lose and you need to have confidence to obtain discipline..

Technical Analysis is based upon the Dow Theory. Dow theory in nutshell states that you can use the past price action to anticipate the future rate action. These rates are supposed to include all the publicly readily available info about that market.

In this post is a trading strategy revealed that is based upon the Bolling Bands and the stochastic signs. The method is easy to utilize and could be utilized by day traders that wish to trade brief trades like 10 or thirty minutes trades.

The more flat these 2 levels are, chances of a rewarding range trading will be greater. Path your block slowly and outside of typical volatility, so you don’t get bumped out of the pattern to soon.

If you are searching updated and exciting videos relevant with What’s Swing Trading, and Win Forex, Forex Trading Method, Stochastic System, Stochastic Line dont forget to list your email address for newsletter for free.