The Methodology, Money and Mind for Swing Trading – (Dr. David Paul) | VectorVest

Trending overview about Stock Investing, Simple System, and What’s Swing Trading, The Methodology, Money and Mind for Swing Trading – (Dr. David Paul) | VectorVest.

The Methodology, Money and Mind for Swing Trading – (Dr. David Paul) | VectorVest

Try VectorVest for only $0.99 ➥➥➥ https://www.vectorvest.com/YT

Use this link for a FREE Stock Analysis Report ➥➥➥ http://bit.ly/2KsZlqz

VectorVest mobile app ➥➥➥ http://bit.ly/2UjF6y6

SUBSCRIBE To The VectorVest Channel ➥➥➥ https://www.youtube.com/user/VectorVestMB/?sub_confirmation=1

➥➥➥ FOLLOW VECTORVEST

Twitter ⇢ https://twitter.com/VectorVest

Facebook ⇢ https://www.facebook.com/VectorVest7/

Learn more about VectorVest: https://www.vectorvest.com/

Disclaimer

All investors should be aware of the risks involved in implementing aggressive strategies. They should not assume that future results will be profitable or will equal representations of past performance; real, indicated or implied. VectorVest, Inc., its employees or affiliates are not responsible for any losses you may incur.

For more legal information follow this link: https://www.vectorvest.com/legal-information/

Video Topics: vectorvest, swing trading, swing trading strategies, swing trading for beginners, swing trading stocks, swing trading strategy, swing trading basics, how to swing trade, swing trade, stock market, day trading, stock trading, how to trade, technical analysis, trading strategies, stocks to buy, financial education, what is swing trading, swing trade strategy, swing trading indicators, stock market crash, stock market investing, swing trade stocks, investing, trading, stocks

#swingtrading

#FinancialFreedom

#VVNation

What’s Swing Trading, The Methodology, Money and Mind for Swing Trading – (Dr. David Paul) | VectorVest.

Financiers Explore Technical Analysis

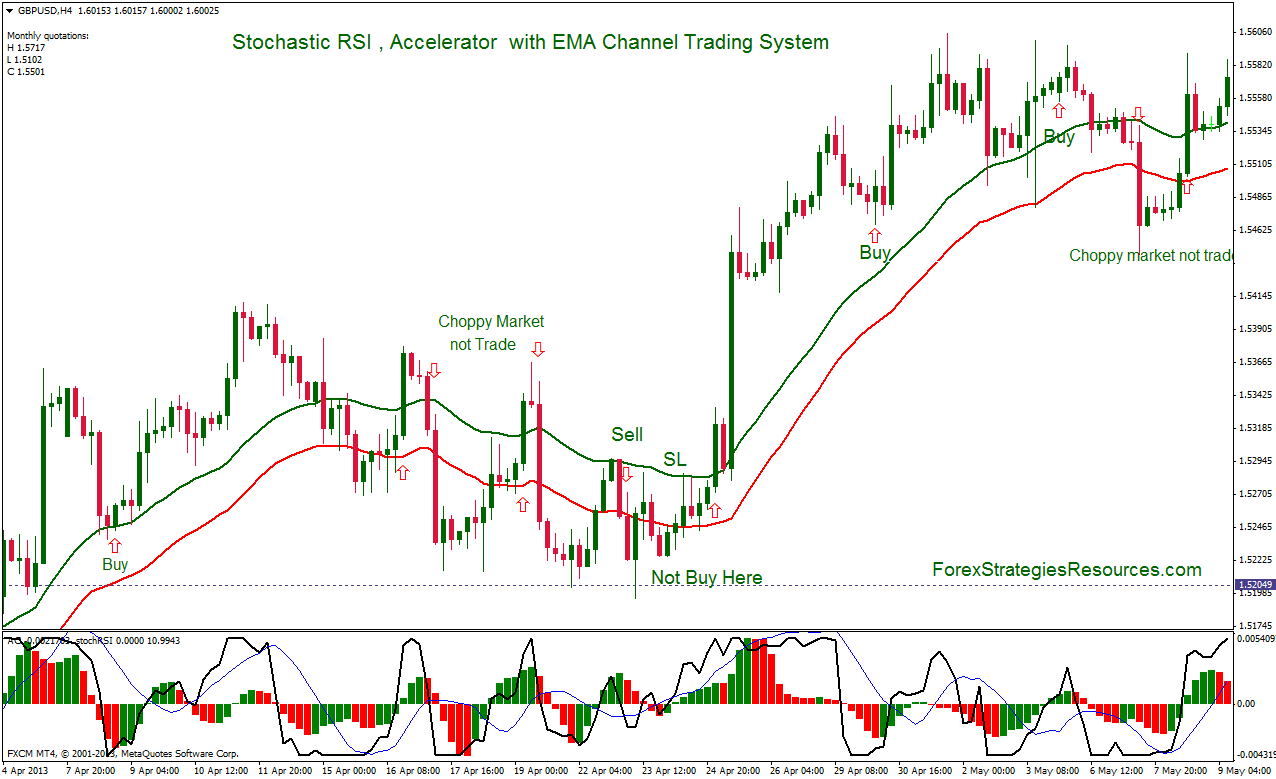

This depends upon how frequently one refers the trade charts. There are different kinds of currency trading charts that you can utilize. All the top traders utilize essentially easy currency trading systems and you should to.

The Methodology, Money and Mind for Swing Trading – (Dr. David Paul) | VectorVest, Play most shared complete videos related to What’s Swing Trading.

Forex Trading System Structure In 5 Steps

Doing this indicates you know what your optimum loss on any trade will be instead of losing everything. Bollinger bands are based on standard discrepancy. Basic variance is the step of the spread of a set of number.

Forex swing trading is easy to understand, only needs a simple system, its also amazing and fun to do. Here we will look at how you can end up being an effective swing trader from home and accumulate big earnings in around thirty minutes a day.

If you buy and sell these breaks, you can get in on and stick with every major trend. Breakout Stochastic Trading is a simple, tested way to earn money – however most traders can’t do it and the factor is easy.

Since basic systems are more robust than complex ones in the brutal world of trading and have fewer components to break. All the top traders use basically simple currency trading systems and you should to.

You should not let your orders be open for longer duration. Observe the marketplace condition by keeping away from any distraction. The dealings in unpredictable Stochastic Trading market are constantly short lived. You need to get out minute your target is attained or your stop-loss order is set off.

Stochastic Trading If the break occurs you go with it, you need to have the state of mind that. Sure, you have missed out on the first little bit of revenue however history reveals there is generally plenty more to follow.

Technical Analysis is based upon the Dow Theory. Dow theory in nutshell says that you can use the previous cost action to anticipate the future rate action. These rates are supposed to integrate all the openly readily available info about that market.

This forex trading method highlights how concentrating on a bearish market can benefit a currency that is overbought. Whether this method is wrong or right, it provides a good risk-reward trade off and is well established on its short position in forex trading.

The trade sold on a slowdown in momentum after the first high at the 80.0 level. It is insufficient just to know the rate has actually hit the line of resistance and got better though.

If you are looking more exciting comparisons related to What’s Swing Trading, and Forex Signals, Free Forex Buy and Sell Signals, Forex Robots, How to Trade Support and Resistance you are requested to subscribe in a valuable complementary news alert service for free.